21 Jun Maximising the First Home Super Saver Scheme (FHSSS)

The maximum value for participants in the First Home Super Saver Scheme (FHSSS) will generally arise from making voluntary concessional contributions (CCs) to their super fund. A large part of the benefit stems from the tax differential between personal marginal tax rates that would otherwise apply and the tax applied to CCs, which in the FHSSS includes both superannuation contributions tax and personal income tax (less a 30 per cent tax offset) paid on withdrawal.

The natural assumption is that those subject to the higher personal marginal tax rates will benefit most from this tax rate differential. However, employees with high levels of employment income will generally have a higher level of Superannuation Guarantee (SG) contributions paid by their employer, reducing their ability to make voluntary concessional contributions (up to the $25,000 CC cap) that may be subsequently withdrawn for a first home deposit.

FHSSS contribution limitations

Contributions eligible for withdrawal from super under the FHSSS are limited to $15,000 per income year, and $30,000 in total. So those who wish to maximise the benefit they received from the FHSSS should plan their CCs over at least two income years. Some people, however, will need to plan over a longer period.

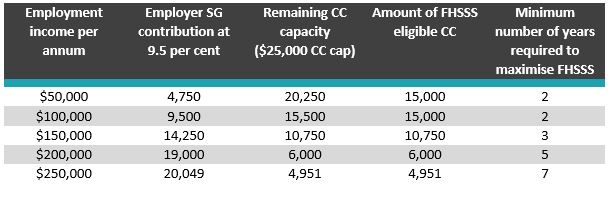

Only voluntary contributions are eligible for withdrawal. SG contributions made by your employer reduce your capacity to make voluntary CCs up to the CC cap. The following table shows the amount of eligible CCs per annum that you can make based on your employment income level, and also shows an indication of the number of years (rounded up) you’ll need to maximise the FHSSS benefit.

Table 1: SG impact on FHSSS per annum (based on 2017-18 thresholds)

So although people with a high level of income (and a high marginal tax rate) may benefit the most from the FHSSS because of the tax rate differential, you will need to plan your contributions over a longer time frame to maximise the FHSSS benefit.

Targeting the CC cap

SG contributions cannot be accessed through the FHSSS. Maximising the benefit of the FHSSS will generally involve you making CCs, targeting their annual CC cap of $25,000.

The capacity of employees to make CCs was broadened recently by the removal the 10 per cent test from the criteria for claiming a deduction in relation to personal super contributions. Prior to this measure becoming effective on 1 July 2017, many clients’ only option to target their CC cap was through a salary sacrifice arrangement entered into with their employer.

But not all employers offer salary sacrifice arrangements to their employees.

Furthermore, certain employers who offer salary sacrifice arrangements use the arrangement to reduce their SG payment liability based on:

- the employee’s lower wages as a result of the salary sacrifice arrangement, and

- the salary sacrificed super contributions the employee elects for being used towards the employer’s SG obligations.

As part of the Government’s Super Guarantee integrity measures package, legislation to amend this anomaly effective from 1 July 2018 is currently in the Parliamentary process, but yet to become law at the time of writing.

The option to make personal contributions and claim a tax deduction from 1 July 2017 is an alternative to salary sacrifice arrangements for employees wanting to target their CC cap of $25,000. Personal contributions can be made throughout the income year, via monthly payments for example, without the need to enter into a salary sacrifice arrangement.

Alternatively, one larger contribution could be made towards the end of the income year, when the level of employer SG payments for the year is known, and hence the amount needed to contribute up to the CC cap. A deduction notice will generally be required by the super fund prior to the earlier of the time you lodge your income tax return or the end of the following income year.

Amount of FHSSS benefit

The benefit of using the FHSSS to supplement a first home deposit savings plan, in comparison to solely accumulating after-tax funds in a standard bank account, broadly derives from two sources:

- The tax rate differential on super CCs compared to personal income taxed at marginal tax rates.

- The effective after-tax accrual rate on funds invested in super, versus the after-tax interest earned in a standard bank account.

1 The tax rate differential

The tax rate differential referred to above is generally the major element of the benefit of the FHSSS over the standard bank account strategy. The level of the tax rate differential benefit is illustrated in the example below.

Example – Jenna:

Jenna’s employment income is $70,000. Her employer pays 9.5% Superannuation Guarantee super contributions in addition to this income.

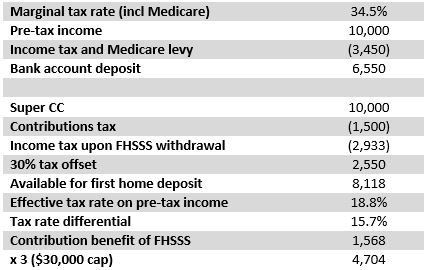

Jenna decides make a personal contribution of $10,000 to her super fund in 2017/18 and will claim a tax deduction in relation to that contribution, as she intends to purchase her first home in a few years. The tax rate differential benefit to Jenna of the FHSSS contributions over the standard bank account option is shown in Table 2.

Table 2: Tax differential for Jenna on $10,000 of pre-tax income

The effective tax rate on $10,000 of Jenna’s employment income is 34.5 per cent, whereas the effective tax rate on the same funds, if contributed to super as a concessional contribution and withdrawn using the FHSSS, is 18.8 per cent, a tax rate differential 15.7%.

If Jenna repeated the strategy over three years, the tax rate differential benefit may be as much as $4,704, assuming the assessable portion of the FHSSS withdrawal is taxed at 34.5 per cent. In today’s dollar terms, this benefit is $4,255.

As Jenna’s current employment income is $70,000, the assessable portion of the FHSSS withdrawal may cause her total assessable income to exceed the 34.5 per cent tax bracket upper threshold in the income year of withdrawal. The upper threshold is currently $87,000, but was proposed to be increased to $90,000 from 1 July 2018 in the 2018 Federal Budget announcement. Any assessable income in excess of the threshold will be taxed at 39 per cent, reducing the benefit shown above ($4,704).

It may be in Jenna’s best interest to time her FHSSS withdrawal so that it occurs in the same year as her last deductible personal super contribution intended to be withdrawn via the FHSSS. If the last contribution is $10,000, the deduction will reduce her taxable income from $70,000 to $60,000, allowing up to $30,000 (assuming the Federal Budget measure becomes law) of further assessable income from the FHSSS withdrawal before the 39 per cent tax rate applies.

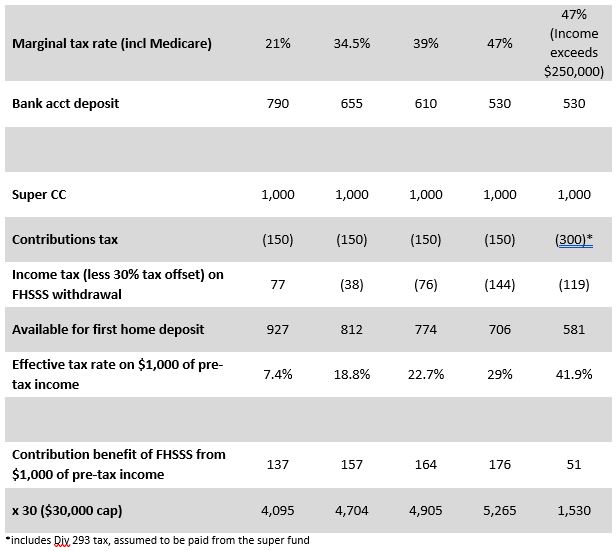

Table 3 shows the tax differential between the standard bank account and the FHSSS for all marginal tax rates, per $1,000 of pre-tax income.

Table 3: Tax differential on $1,000 of pre-tax income

2 Accrual of earnings

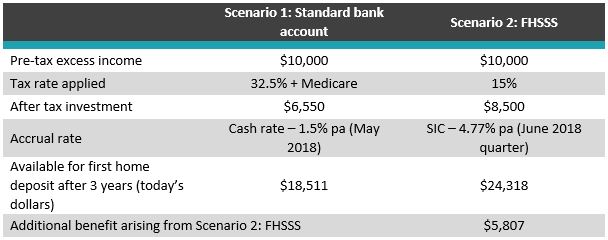

The second source of FHSSS benefit relates to the crediting rate used for calculating the FHSSS withdrawal amount: that is, the Australian Taxation Office (ATO) Shortfall Interest Charge (SIC) rate, currently 4.77 per cent per annum (June 2018 quarter). This compares favourably to the interest rates generally paid in standard bank accounts, which we assume here to be the current RBA cash rate of 1.5 per cent per annum.

Furthermore, the calculated earnings in super are effectively taxed at the your marginal tax rate less the 30 per cent tax offset (maximum of 17 per cent, and only 4.5 per cent in Jenna’s case), whereas the bank account earnings are taxable at the your marginal tax rate without any tax offset applying (maximum of 47 per cent, and 34.5 per cent in Jenna’s case).

Example – Jenna (continued):

Jenna’s first scenario is to continue to receive $10,000 of employment income as wages, taxed at her personal marginal tax rate of 34.5 per cent. As she is paid monthly, she deposits $545.83 into her standard bank account each month for three years.

We assume the bank pays interest on Jenna’s balance at 1.5 per cent per annum. This interest is taxable at Jenna’s marginal tax rate.

After three years Jenna withdraws the funds to use towards a first home deposit.

The second scenario involves Jenna making deductible personal super contributions each month. She may lodge a tax variation request with the ATO to reduce amount of PAYG withheld from your salary that may help to compensate for the increased cash flow of making $833.33 monthly contributions.

After three years Jenna applies to the ATO to have her FHSSS eligible contributions plus associated earnings (calculated using the ATO SIC rate) released so she can use the funds for a first home deposit.

Table 4: Jenna’s scenarios

It was previously identified that the benefit to Jenna of the FHSSS sourced from super contributions rather than receiving employment income as wages is $1,568 per annum, or $4,255 over three years (today’s dollars).

So the additional benefit of the extra earnings calculated and the lower rate of tax on those earnings is $1,552.

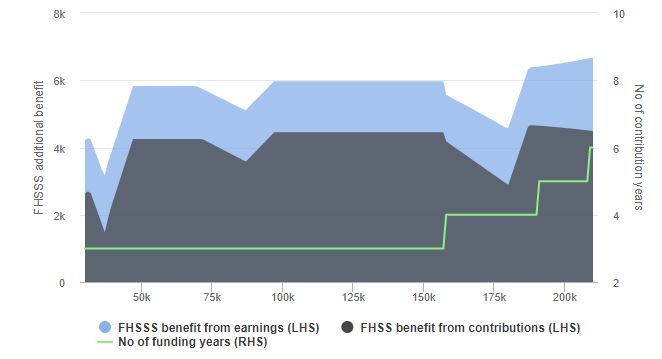

More broadly, the benefit that may arise from the FHSSS at different income levels is illustrated in Chart 1 below. The source of the benefit (contribution or earnings) is represented by the separately shaded areas. Note that it is assumed that the maximum super contribution made is $10,000 in any year, current income tax rates and thresholds continue to apply and all values are in today’s dollars, assuming inflation of 2.5 per cent per annum.

Chart 1: FHSSS benefit compared to Standard bank account option

Conclusion

The FHSSS scheme may provide a benefit to first home deposit savers potentially in the range of $4,000 to $7,000, depending on circumstances and return assumptions.

As a significant portion of this benefit arises from making concessional contributions, which are limited by the level of employer SG contributions made, potential first home buyers should plan early to ensure they have enough time to maximise the benefit available from the FHSSS.

This article was prepared by David Barret from Macquarie Bank on 22 May 2018 the full article can be found by clicking here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

Pingback:FinPeak | Key Opportunities for FY 2018-19

Posted at 07:11h, 23 July[…] Voluntary contributions are limited to $15,000 per year, up to a total of $30,000 and count towards the relevant contribution cap. Withdrawals are limited to 100% of non-concessional contributions and 85% of concessional contributions plus associated earnings. See our previous post here. […]

Pingback:FinPeak | Tech Talk : Property Buying/Investing PART 1

Posted at 10:55h, 26 October[…] If you’re a first home buyer then, using your superfund to tax effectively save, see our article on the First Home Super Saver Scheme (FHSSS) here; […]