22 Feb Why It Can Pay To Put As Much As Possible Into Super

Why It Can Pay To Put As Much As Possible Into Super

As the retirement day of reckoning looms, it’s common for Australians of a certain age to regret not putting more into their super earlier on.

While recent changes to the super rules make it easier for older Australians to continue contributing to their super account until they turn 75, that doesn’t alter the fact that the sooner you start the better. Why?

Tax efficiency and compound interest, it’s that simple.

The power of compound interest

You have probably heard that Albert Einstein described compound interest as the eighth wonder of the world. Thankfully, you don’t have to be a genius to take advantage of it.

Compound interest means you earn interest on your interest. The longer this compounding continues, the bigger your savings will be.

In the context of super, your money is locked away for upwards of four decades until you retire. During that time, all investment earnings on your savings are reinvested.

And it doesn’t stop there. If you transfer some or all of your retirement savings into a super pension account when you retire, the underlying investments will continue to generate returns even as you withdraw income. What’s more, investment earnings are generally tax free in retirement phase.

Tax-efficient savings vehicle

Concessional (tax-deductible) contributions into super are taxed at just 15% on the way in. That includes your employer’s Super Guarantee (SG) payments, salary-sacrifice arrangements and tax-deductible personal contributions, up to an annual limit of $27,500. If you have unused cap amounts from previous years you may be able to make catch-up contributions under the carry-forward rule.

Because concessional contributions are made before tax (or provide a tax deduction for personal contributions you make from your after-tax earnings), they offer significant tax savings for higher income earners. Instead of paying income tax at a marginal rate of up to 45% you pay contributions tax of just 15%, or 30% if your income and concessional contributions total more than $250,000 a year.

However, making extra super contributions is generally tax effective if you earn more than $45,000 a year, which is when the 32.5% marginal tax rate kicks in.

If you have reached your $27,500 annual concessional contributions limit, you can also make a non-concessional (after-tax) contribution. You won’t pay the 15% contributions tax, but there is an annual concessional contribution limit of $110,000 or up to $330,000 in any three-year period under the bring-forward rule.

Why would you bother adding to your employer’s super guarantee contributions when you could simply invest your surplus cash outside super?

You guessed it, tax and compounding. Once your money is inside your super fund you pay tax on investment earnings at a rate of up to 15%. If you bought the same investments outside super, you would pay tax on investment earnings at your marginal income tax rate. This leaves more money in your super fund to go on compounding.

But wait, there’s more. The biggest tax savings are left till last.

Note: From 1 July 2024 the 32.4% tax rate is scheduled drop to 30% for incomes between $45,000 and $200,000, where the top 45% rate will kick in.

Tax-free retirement income

When you retire and start a super pension, you generally pay no tax on pension income or investment earnings inside your pension account from age 60. If you retire before you turn 60, there may be some tax to pay.

As with everything to do with super, there are rules. To move from the accumulation phase of super to retirement phase, you must retire and satisfy a condition of release or turn 65. And once you start a super pension you must make minimum annual withdrawals.

There are also limits to the government’s generosity.

Keeping a lid on super savings

It’s important to recognise that the sole purpose of super is to provide retirement benefits for members, not to act as a tax-efficient store of intergenerational wealth.

With this purpose in mind, the government conducts a fine balancing act. While encouraging us to save for our retirement with generous tax concessions, it also caps the amount we can have in super and still enjoy those tax benefits.

From 1 July 2023, your total superannuation balance (accumulation and pension accounts combined) must be less than $1.9 million if you want to remain eligible for certain tax concessions.

Just to confuse matters, there is also a $1.9 million transfer balance cap on the amount of money you can shift from accumulation phase to retirement phase.

Good to know: The total super balance and transfer balance cap are indexed periodically in $100,000 increments.

What about lower earners?

While super tax concessions undoubtedly favour wealthier individuals, there are also incentives for lower income earners to add to their retirement savings.

If you earn $43,445 or less in 2023–24, the government will contribute 50c for every dollar of personal contributions you make into your super account, up to a maximum of $500. That’s a return of 50% on your investment, which is close to impossible to match, legally at least.

The government co-contribution phases out once your income reaches the upper threshold of $58,445 in 2023–24.

While an additional super contribution of a thousand or two a year might seem like small beer, it can make an enormous difference to your retirement super balance.

Go early, go super

To paraphrase then treasury secretary Ken Henry’s advice to government during the GFC, to maximise your retirement savings while allowing tax and compound interest to do the heavy lifting, the best approach is to go early, go super.

Not only does adding to your super earlier in your working life make the most of compounding, but it also means you won’t run up against contribution limits later in life as you scramble to give your super a last-minute boost.

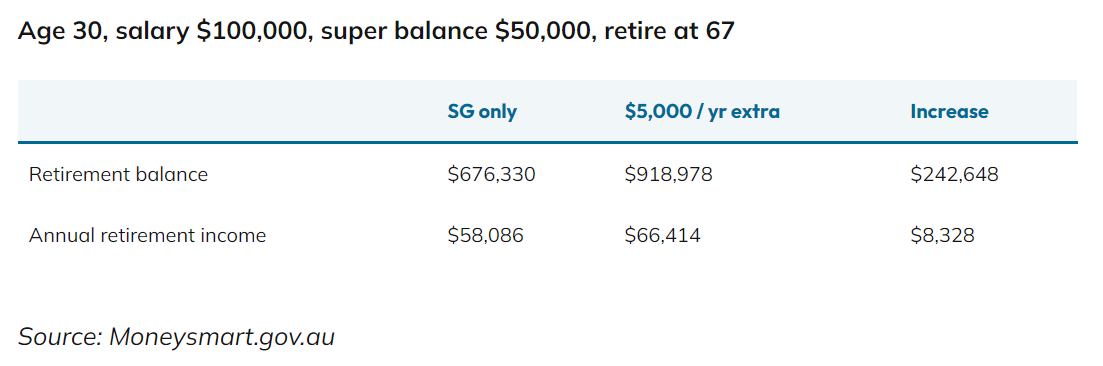

Case study 1: Getting rich slowly

To illustrate a get-rich-slowly approach, take the hypothetical example of a 30-year-old earning $100,000 with a current super balance of $50,000. Let’s call her Jess.

Using the government’s Moneysmart retirement planner calculator, we estimate that if she relies on her employer’s SG payments and makes no additional contributions, she can expect a final retirement balance of $676,330 at age 67. This would provide annual retirement income of $58,086 up to age 92, including a part-Age Pension in later years.

If Jess were to make a personal tax-deductible contribution of $5,000 per year until she retires, she would end up with a final balance of $918,978 ($242,648 extra) and annual retirement income of $66,414 ($8,328 extra). A welcome gain for minimal pain.

To put this in perspective, in June 2023 the ASFA Retirement Standard estimated that to live comfortably in retirement a single person would need annual income of $50,207. To generate this level of income they would need a retirement balance of $595,000.

While Jess just meets ASFA’s comfortable standard on SG payments alone, retirement income of $58,000 might be a lifestyle shock for someone used to earning around $77,000 after tax ($100,000 before tax).

A better guide might be the 70% rule of thumb, which estimates the amount of retirement income you should aim for is around 70% of pre-retirement income (after tax and super). This suggests Jess could continue to enjoy her usual lifestyle on retirement income of $53,900 per year (70% of $77,000). This suggests Jess is on track. However, if she were to take time out of the workforce to care for children or other reasons in future, she might consider making extra contributions while she can.

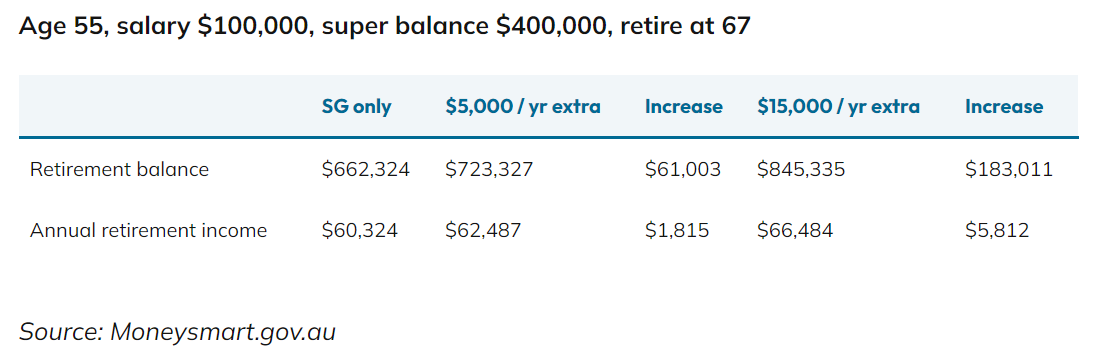

Case study 2: Making up for lost time

It’s often not until you hit your 50s that saving for retirement becomes a priority. By that stage, compounding has less time to weave its magic and there are limits to what you can contribute to super even if you have the cash. Even so, there is still a lot you can do to make up some lost ground.

Take the example of a 55-year-old with $400,000 in super and a salary of $100,00. Let’s call him Dinesh.

If Dinesh does nothing and relies on his employer’s SG payments alone, he stands to have a retirement super balance of $662,324 at age 67 and annual retirement income of $60,672 until age 92. This puts him a bit ahead of ASFA’s definition of comfortable (annual retirement income of $50,207 and a retirement balance of $595,000), but probably short of his own expectations based on his pre-retirement income.

If he contributes an additional $5,000 a year as Jess is doing, he won’t have a great deal more to show for it once he reaches age 67 (retirement income of $62,487 per year vs $60,324 on SG alone).

Instead, he decides he can afford to make an annual tax-deductible contribution of $15,000 which, combined with his employer’s SG payments of $11,000 per year ($11,500 in 2024-25), takes him close to the concessional contributions cap of $27,500 per year. This will make the most of super’s tax concessions and give him a handy tax deduction on his personal contribution.

The upshot is that his retirement balance should increase to $845,335 (up $183,011 compared with doing nothing). This should provide him with annual retirement income of around $66,484 to age 92 (up $5,812), which is comfortably ahead of the $53,900 suggested by the 70% rule of thumb for someone on his level of pre-retirement income.

What’s interesting to note is that even though Dinesh personally contributes three times the amount that Jess does from age 55, he still ends up with less super.

The bottom line

Thanks to the twin benefits of compound interest and tax, even small amounts you contribute to super early in life will make a big difference to your retirement savings. That said, it’s better to start late than never.

To work out the value of different super contribution strategies for your personal circumstances, jump onto the Moneysmart Retirement Planner and SuperGuide’s retirement calculators and reckoners or speak to a qualified financial adviser, you can do so by clicking the link here.

This article was originally produced by Barbara Drury of SuperGuide. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments