22 Apr Monthly Commentary: April 2024

Market Trends: Fears of a Global Recession Fading Fast

Market fears of a global recession anytime soon are now all but eradicated. Resilient US economic growth, hopes of a broadening in global growth to non-US regions, artificial intelligence euphoria and rate-cut expectations are now the major drivers of the global equity rally. The only near-term debate is how quickly central banks will cut interest rates.

The major risks remaining are sticky inflation and a premature acceleration in global growth, which places renewed upward pressure on bond yields and downward pressure on increasingly stretched equity valuations.

As with global markets, PE valuations are getting a little stretched locally. Sustained further gains seem to require a decent decline in bond yields (without a recession) or further gain in forward earnings.

With a local and global economic soft landing now achievable, the outlook for earnings is encouraging – albeit expected growth over the coming year appears somewhat more subdued than for the global market overall.

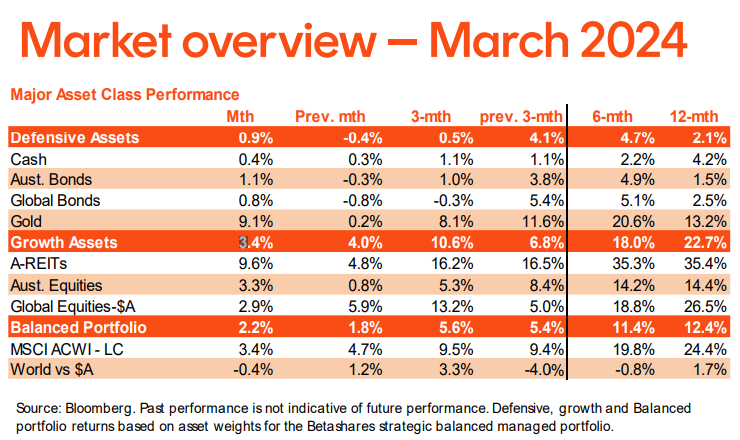

BetaShare’s hypothetical balanced portfolio returned 2.2% in March, reflecting further good gains in growth assets and a positive rebound in defensive asset returns.

Defensive assets returned 0.9%, reflecting firmer fixed-rate bond returns as bond yields eased back modestly. Gold returns remained strong, up 9.1% in March.

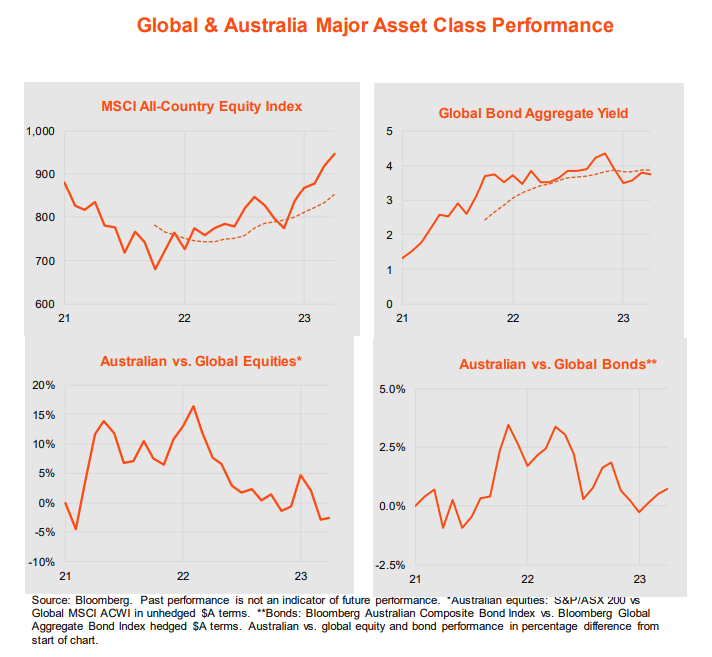

Growth assets returned 3.4%, with global equities in unhedged AUD terms rising 2.9%. The trend in global equities has been upward since bottoming in late 2022.

An easing in bond yields helped produce further strong gains in local listed property, which returned 9.6%, while Australian equities returned 3.3%. The trend in the relative performance of Australian equities remains downward since early 2023. Relative returns for Australian versus global bonds has been choppy over the past year.

Global Bonds

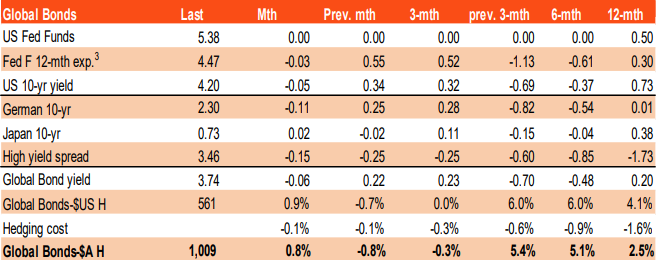

The Bloomberg Global Aggregate Bond Index (AUD hedged) returned 0.8% in March, reflecting a small decline in global bonds yields. Inflation has continued to generally decline globally in line with expectations and more central banks signal the next move in rates is likely down. Over the past year, the index has returned 2.5%

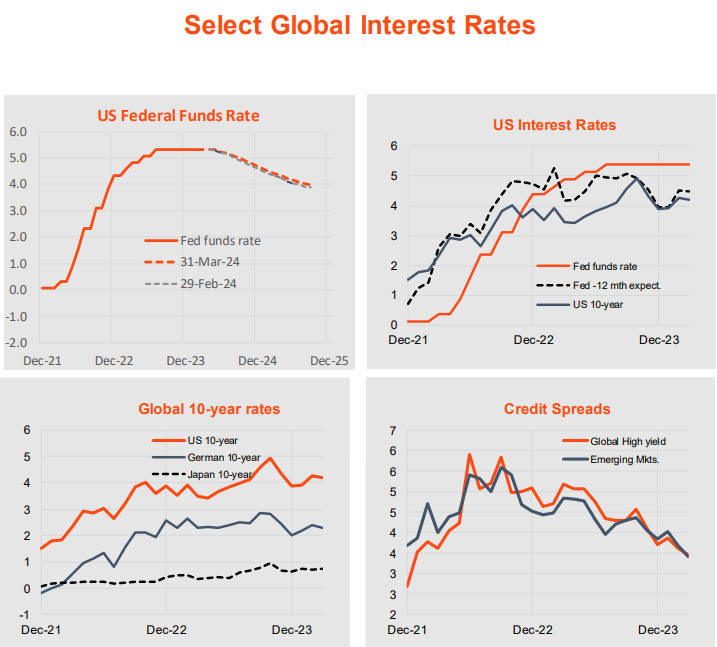

Importantly in the United States, while both the consumer price index (CPI) and producer price index (PPI) produced further solid gains in February, the US Federal Reserve retained its expectation for three rate cuts this year. Fed chair Powell retained his optimism that inflation would keep falling (although the road could be bumpy) and interest rate could likely be cut later this year. The Bank of Switzerland became the first-developed country central bank to cut rates this cycle, while in a widely anticipated move, the Bank of Japan ended its negative interest rate policy.

US 10-year bond yields edged down 0.05% over the month to 4.20% p.a., German 10- year bond yields eased 0.11%, while Japanese yields edged up only 0.02%, despite the BOJ rate hike. High yield bond spreads continued to narrow. All up, the yield-tomaturity on the Bloomberg Global Aggregate Index eased 0.06% to 3.74% p.a.

Source: Bloomberg, Refintiv, Betashares. Past performance is not indicative of future performance.

Global Equities

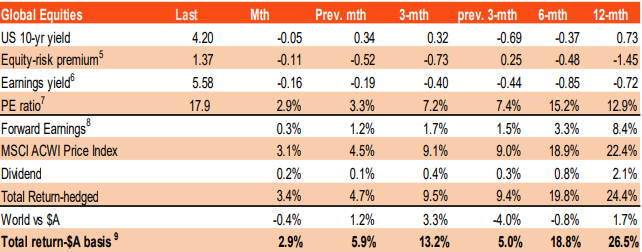

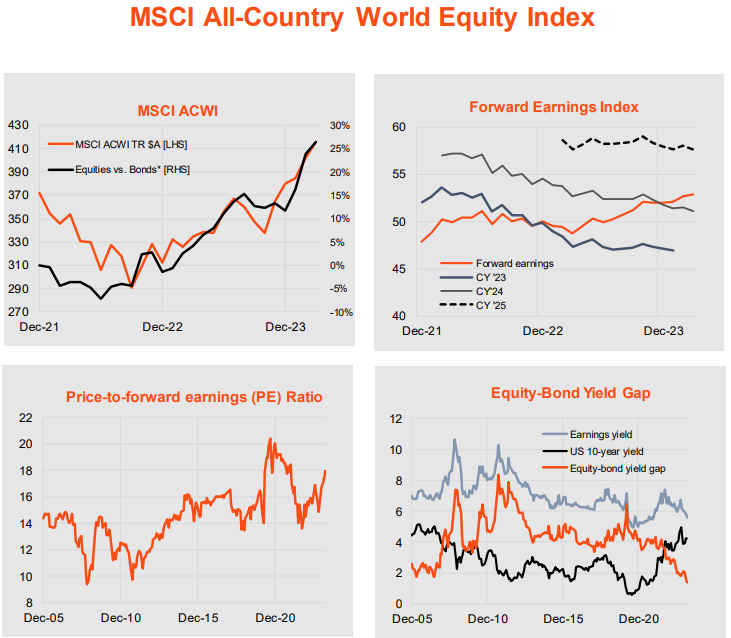

Steadier bond yields helped the MSCI All-Country World Equity Index return a further 3.4% in

March on an unhedged (local currency) basis, following a 4.7% gain in February. Forward

earnings were up only 0.3% in the month, with most of the contribution to returns coming from a

further rise in the forward-PE ratio to 17.9.

Associated with this, there was a further narrowing in the equity risk premium to relatively tight 1.37% – the lowest level since the mid-2000s.

In unhedged AUD terms, global equities returned a softer 3.4%, thanks to modest weakness in global currencies versus the AUD. On an unhedged basis, global equities have returned 26.5%

over the past year.

With market fears of a global recession anytime soon now all but eradicated, resilient US economic growth, hopes of a broadening in global growth to non-US regions, artificial intelligence euphoria and rate-cut expectations are now the major drivers of the global equity rally. The only near-term debate is how quickly central banks will cut interest rates.

The major risks remaining are sticky inflation and a premature acceleration in global growth, which places renewed upward pressure on bond yields and downward pressure on increasingly

stretched equity valuations.

Source: Bloomberg, Refintiv, Betashares. Past performance is not indicative of future performance.

Global Sector/Factor Trends

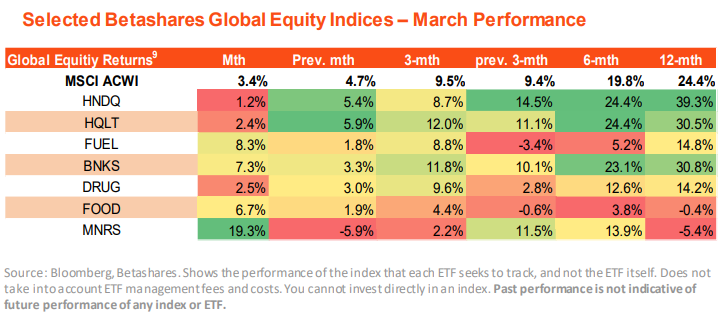

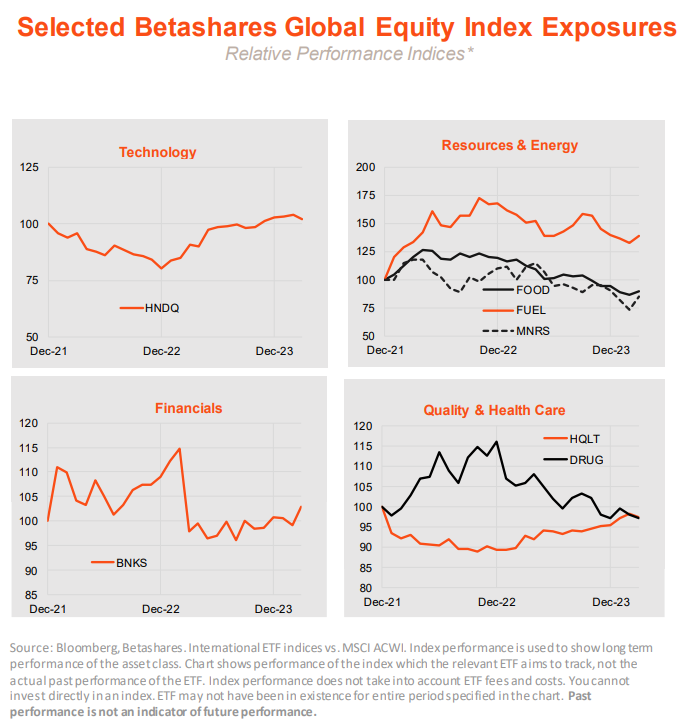

Strength in gold prices contributed to a belated strong gain in global mining stocks in March, with MNRS’ index returning 19.3%! Other value exposures such agriculture (FOOD), energy (FUEL) and financials (BNKS) also performed well compared to the NASDAQ-100 (NDQ) and global quality (HQLT).

Delayed US rate cut hopes and relative value considerations have potentially contributed to the recent new interest in value over growth/quality exposures. Whether this is the start of a new trend remains to be seen, as the US still seems likely to cut interest rates late this year in line with ongoing declines in inflation.

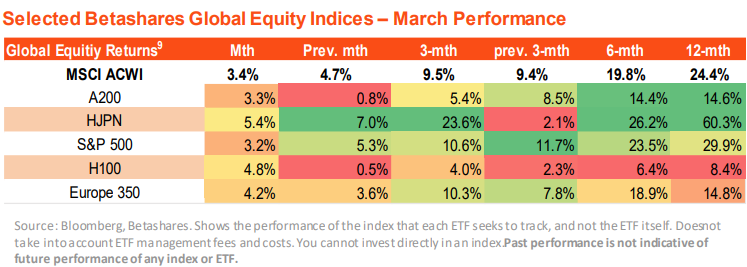

Global Regional Trends

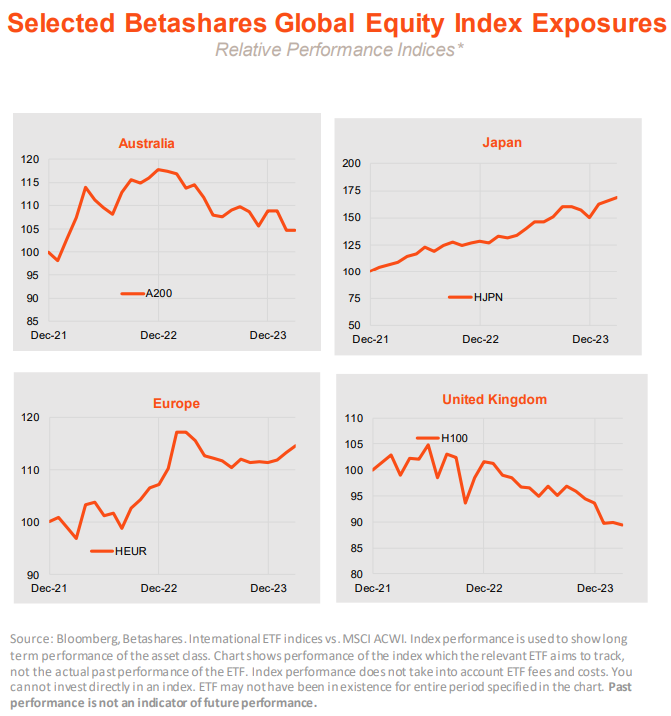

Non-US equity exposures generally outperformed the US in March, with the S&P 500 returning 3.4% – or a little less than the global benchmark. Japanese equities (HJPN) continued to perform exceptionally well despite the BOJ rate hike.

The relative underperformance of European equities (HEUR) also appears to be bottoming out, which bodes well for a broadening in the global equity rally. Australia and UK relative performance, however, remains in a downtrend.

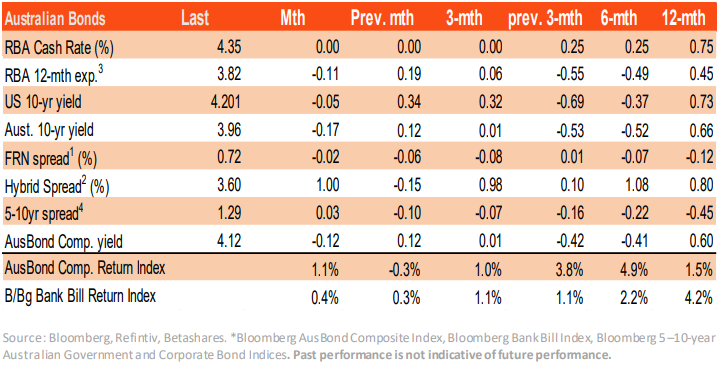

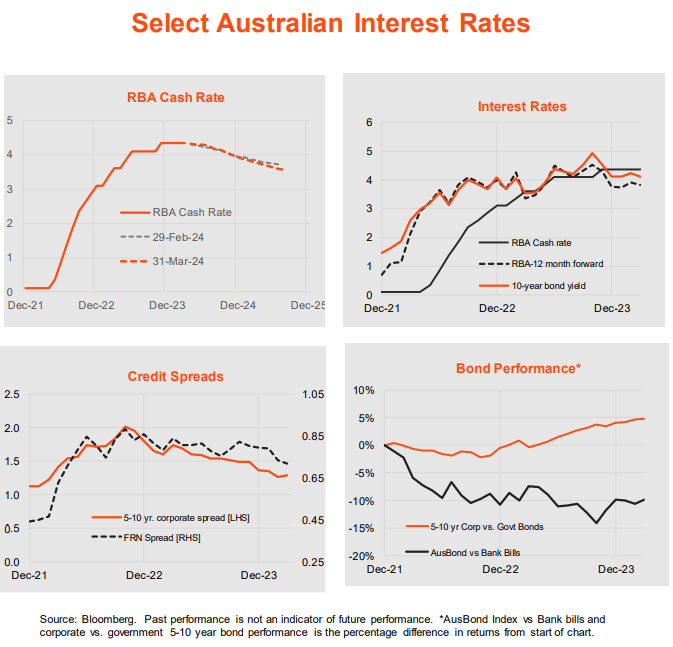

Australian Cash and Bonds

The Bloomberg Australian Bond Composite Index returned 1.1% in February, reflecting a decline in local bonds yields. Cash returns, according to the Bloomberg Bank Bill Index, lifted 0.4%.

The decline in bond yields reflected both lower global rates plus a slightly deeper rate cut expectations in 2025. Key local news was a slightly softer tone in recent RBA commentary, playing down the risk of further rate rises. The market is pricing just under two rate cuts by end2024.

Bond have outperformed cash since the peak in bond yields in October last year, though there has been a modest setback in this trend in the past two months.

Corporate credit spreads, meanwhile, continue to narrow, which is supportive of corporate bond outperformance over government bonds.

Australian Equities

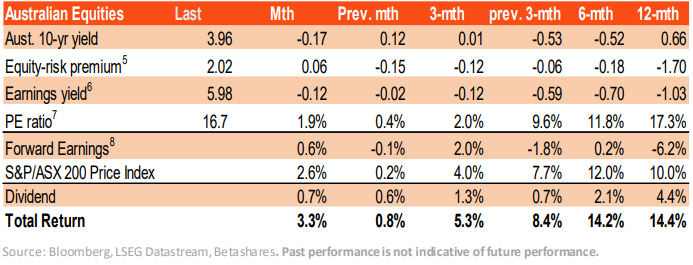

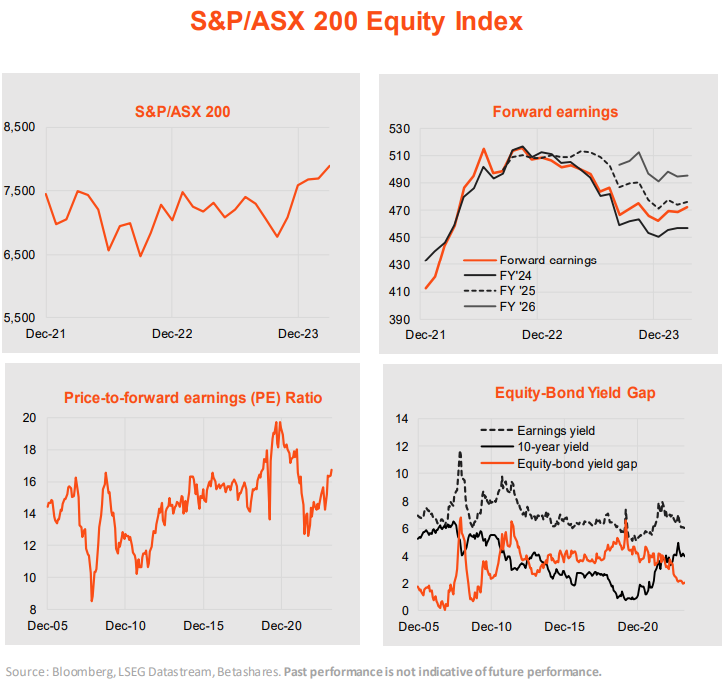

Helped by lower local bond yields, the S&P/ASX 200 Index returned 3.3% in March after a 0.8% gain in February, after breaking out of a multi-year range. Forward earnings ticked up after being flat in February, with a modest upgrade to earnings expectations evident. Most of the market gain, however, come from valuations with the PE ratio rising 1.9% to 16.7.

As with global markets, PE valuations are getting a little stretched and the equity risk premium is low. Sustained further gains seem to require a decent decline in bond yields (without a recession) or further gain in forward earnings. With expected positive earnings growth in FY25 and FY26, the forward earnings outlook is positive after declines through much of 2023.

With a local and global economic soft landing now achievable, the outlook for earnings is encouraging – albeit expected growth over the coming year appears somewhat more subdued than for the global market overall.

Australian Equity Themes

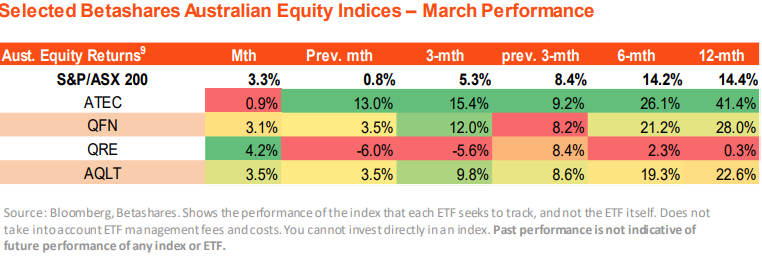

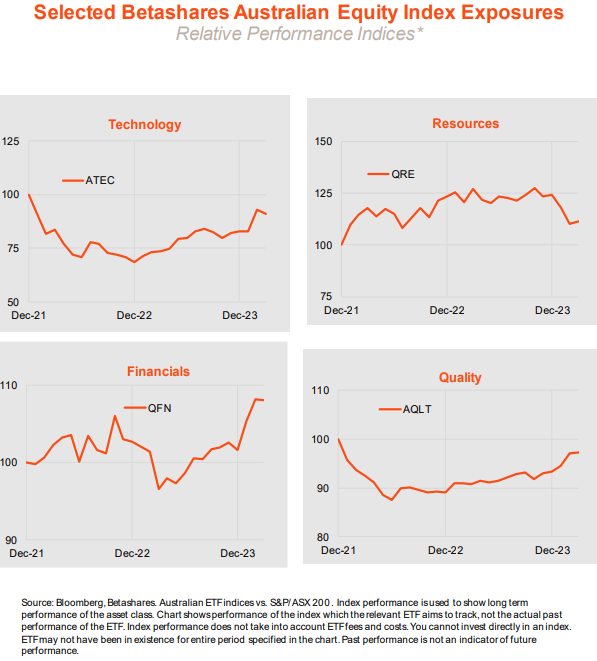

Local technology stocks were the laggards among selected Australian equity ETFs in March, consistent with the global switch to value themes. Resources (QRE), and quality (AQLT) produced above market returns while financials (QFN) were a touch below average.

Over the past six to 12 months, three of the selected Australian equity theme indices – financials, technology and quality – have tended to outperform the broader market. After a very strong 2023, relative performance of the resources sector has since pulled back.

This article was originally produced by David Bassanese from BetaShares. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments