22 Feb Monthly Commentary: February 2024

Waiting for a cut

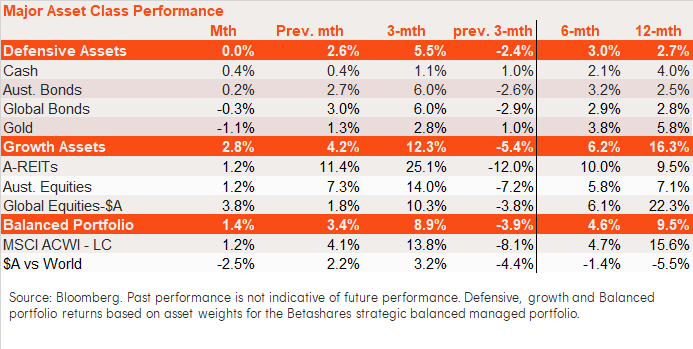

Defensive assets returns were flat in January, reflecting muted cash and Australian bond returns, and a small decline in global bond returns. Gold prices also eased a little. The major theme of the month was solid US economic growth and reduced expectations of near-term US rate cuts. The trend in global bond yields since October last year has been downward.

Growth assets returned 2.8%, with global equities in unhedged AUD terms rising 3.8%, in part due to AUD weakness. The trend in global equities has been upward since bottoming in late 2022.

Australian equities and listed property both returned 1.2% in January. Relatively soft Australian equity returns unwound some of the outperformance versus global equities seen since late last year. That said, the trend in relative Australian equity performance has been downward since early 2023. Relative returns for Australian versus global bonds have been choppy over the past year.

Cash Returns

Cash Returns

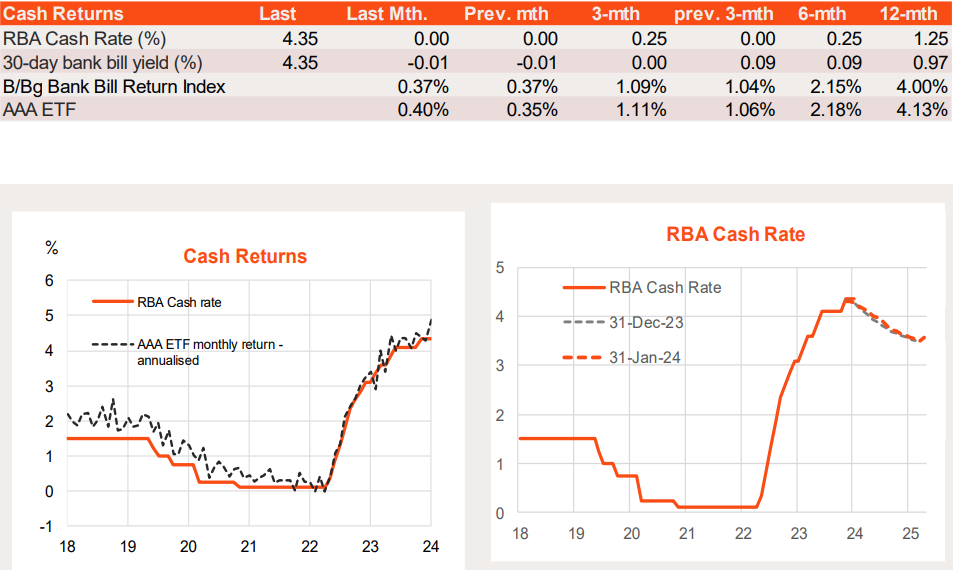

The RBA cash rate and monetary policy expectations have been broadly steady in recent months. The RBA last raised the cash rate to 4.35% in November 2023.

A major local development over the month was the lower-than-expected Q3 CPI in late-January, which heightened talks of RBA rate cuts later this year. That said, rate cut expectations have already been priced into the market in recent months, given an easing in global inflation pressures and rate cut expectations in the US.

Reflecting the 4.35% p.a. official cash rate, the Bloomberg Bank Bill Index returned 0.4% in January (4.3% annualised), as did the AAA cash ETF. AAA’s returns have broadly matched the RBA cash rate since early 2022.

As at end-January, markets were pricing almost three 0.25% p.a RBA rate cuts by end-2024.

My base case is two rates cuts in H2’24.

Source: Bloomberg, Refintiv, Betashares. You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

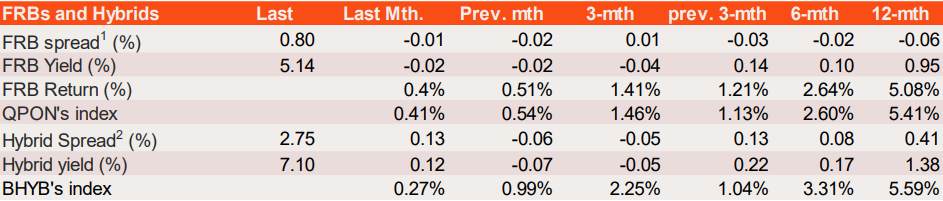

Floating Rate Bonds and Hybrids

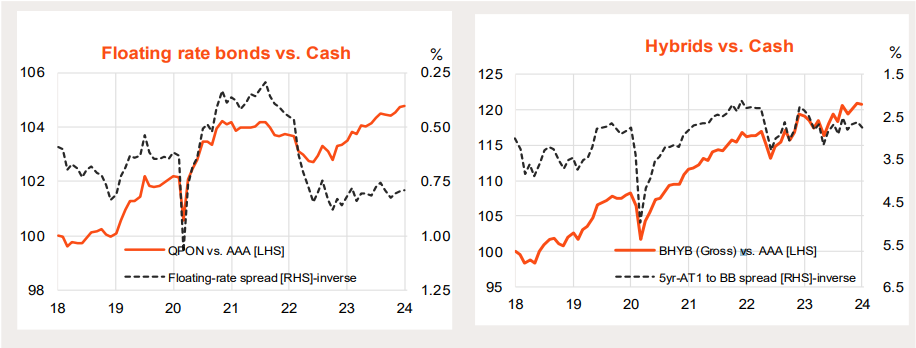

Floating rate bonds (FRBs), as measured by QPON’s index, returned 0.4% in January – close to the AAA cash ETF. The relatively steady FRB spread since mid-2022 has seen QPON broadly outperform AAA over this period (5.4% versus 4.1% over the past 12-months).

The FRB spread has remained broadly in line with its pre-Covid average over the two years.

Bank hybrids, as measured by BHYB’s index, returned 0.27% in November, with the hybrid spread remaining broadly steady over the month. Over the past 12-months, bank hybrid gross returns were 5.6%.

The hybrid spread has also been in a choppy sideways range in recent months, though remains somewhat tighter than the average spread of around 3.5% in the two years prior to the 2020 Covid crisis.

Source: Bloomberg, Refintiv, Betashares. Refer to page 12 for more additional information. Shows the performance of the index that QPON and BHYB seeks to track, and not the ETF itself. Does not take into account ETF management fees and costs (0.22% p.a. for QPON and 0.35% p.a. for BHYB). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

Source: Bloomberg, Refintiv, Betashares. Shows the performance of the index that QPON and BHYB seeks to track compared to the AAA ETF, and not QPON or BHYB itself. Does not take into account QPON or BHYB’s management fees and costs (0.22% p.a. for QPON and 0.35% p.a. for BHYB). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

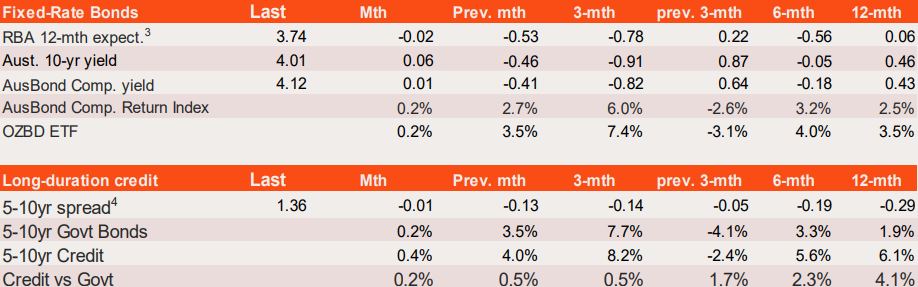

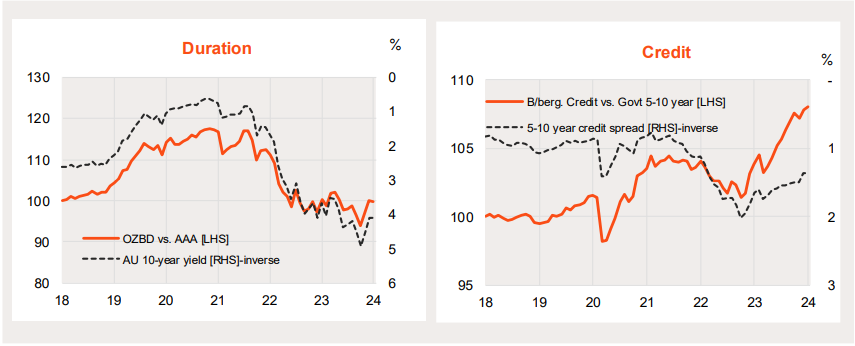

Fixed-rate Australian Bonds

Long-term bond yields were broadly steady over January, with multiple RBA rate cuts still priced into the market.

Australian 10-year bond yields rose 0.06% to 4.01% p.a., while the yield on the Bloomberg AusBond Composite Index rose 0.01% to 4.12% p.a. As a result, the AusBond Composite Index returned 3.0% in the month, while OZBD’s index returned 0.2%.

Bonds have outperformed cash since the peak in bond yields in October 2023.

Corporate fixed-rate credit spreads continue to creep lower, supporting outperformance of corporate bonds over government bonds.

Source: Bloomberg, Refintiv, Betashares. Refer to page 12 for more additional information. Shows the performance of the index that OZBD seeks to track, and not the ETF itself. Does not take into account ETF management fees and costs (0.19% p.a.). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

Source: Bloomberg, Refintiv, Betashares. Shows the performance of the index that OZBD seeks to track compared to the AAA ETF, and not the ETF itself. Does not take into account ETF management fees and costs (0.19% p.a.). You cannot invest directly in an index. Past performance is not indicative of future performance of any index or ETF.

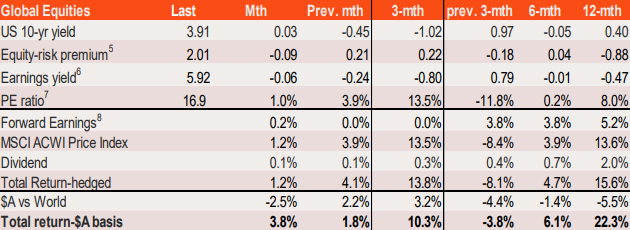

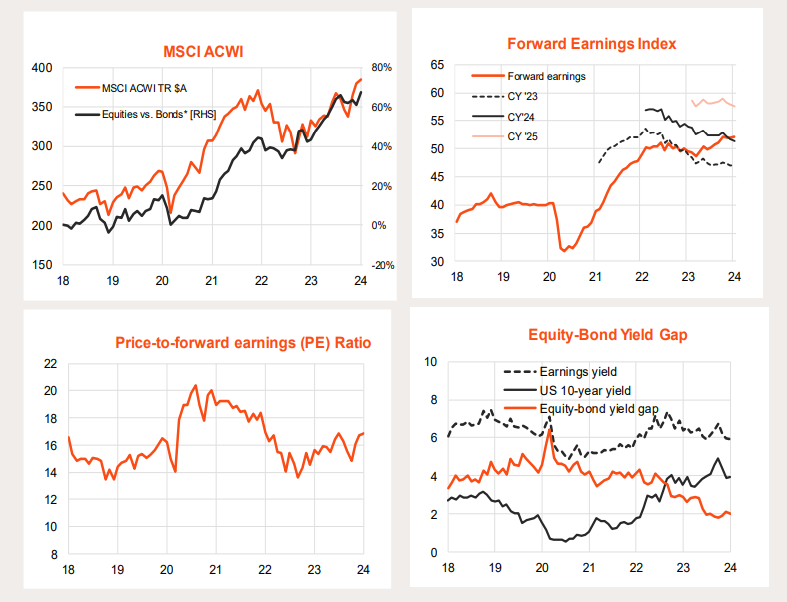

Global Equities

The MSCI All-Country World Index returned 1.2% in January on an unhedged (local currency) basis, following a strong 4.1% gain in December. After a large decline

in December, bond yields were steady in January, with a small decline in the equity risk premium instead modestly boosting the PE ratio to 16.9. Forward earnings remained flat. A weaker AUD boosted returns in unhedged AUD terms to 3.8%.

Easing fears of a global recession remains the major global market theme, with the US Federal Reserve signaling the next move in rates is likely down. The only near-term debate is how quickly the Fed will cut, with markets potentially at risk in the short term if the Fed delays until H2’24.

That said, at 16.9x and 2.0% respectively, the PE ratio and equity risk premium appear a little stretched by recent historic standards, suggesting further equity gains may require a decent further decline in bond yields or a lift in forward earnings. Central bank rate cuts should help push down bond yields, while positive CY’25 earnings expectations also suggest a further lift in forward earnings. The earnings outlook is worth watching, with a modest downgrade to expectations seen over the past two months.

Source: Bloomberg, Refintiv, Betashares. Past performance is not indicative of future performance.

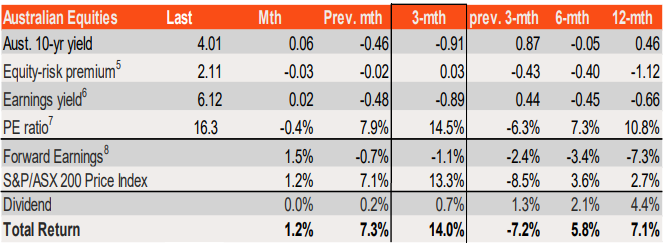

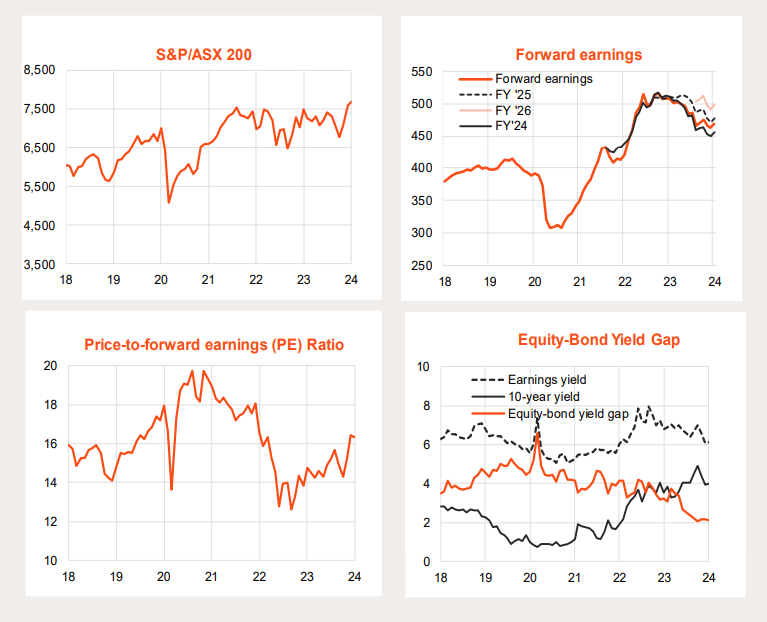

Australian Equities

The S&P/ASX 200 Index returned 1.2% in January. In turn, this reflected a small fall in the PE ratio to 16.3 with steadier bond yields in the month after large falls in December.

Forward earnings rose 1.5% with an encouraging uptick in earnings expectations over the month.

After enduring a choppy sideways range over the past two years (with a recovery in PE valuations offset by declining forward earnings) the market broke through the top of its range in January. As with global markets, PE valuations are getting a little stretched and the equity-risk premium low. Sustained further gains seem to require a decent decline in bond yields (without a recession!) or a further gain in forward earnings.

With a local and global economic soft landing now achievable, the outlook is encouraging.

Source: Bloomberg, Refintiv, Betashares. Past performance is not indicative of future performance.

This article was originally produced by David Bassanese from BetaShares. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments