The responsible investment market as of 2018 accounts for 44% of the $2.24 trillion total assets under management in the Australian market and continues to grow.

Download your guide to investing responsibly

Your introduction to investing responsibly and ethically where you will begin to understand how your money can be used to deliver both positive returns and be good for society and the world we all live in.

Q. What is ethical investing?

The term “ethical, responsible and sustainable investing” has such a broad definition and will mean different things to different individuals.

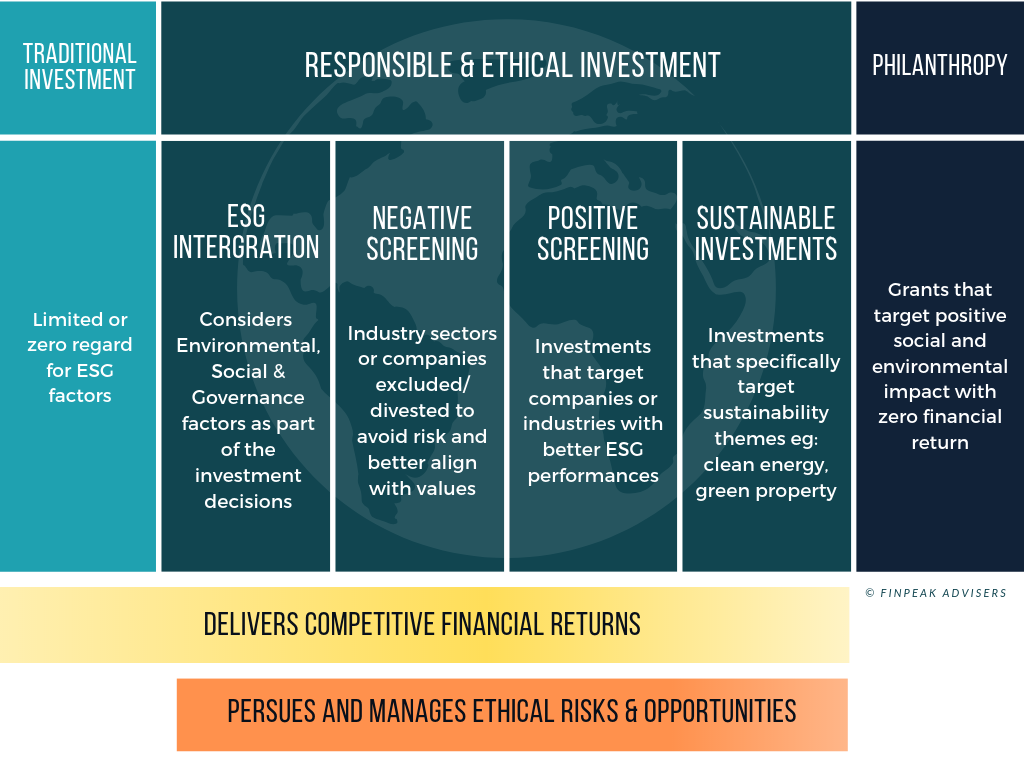

On the left side of the spectrum, we have people who want to invest in companies that consider environmental, social and governance (ESG) factors as part of their investment strategy. Towards the right side, the targets are companies that generate profits from sustainability themes (e.g. clean energy, green property) and also consider environmental impacts (e.g. banks who do not lend to fossil fuel producers).

Most people will sit somewhere in between and want to invest in companies that “do the right thing.”

Q. How does the future of ethical investing look?

According to research released by the Responsible Investment Association Australia (RIAA), 9 out of 10 Australians expect their super and other investments to be invested ethically and responsibly. So it is clear this investment trend is not going away anytime soon.

The industry is only continuing to grow. RIAA’s 2020 Impact report revealed that investors would ideally like to increase their proportional allocation towards impact investments more than five-fold to $100 billion over the next five years.

At Dec 2018, responsible investing constituted $980 billion (44%) of the $2.242 trillion of total assets professionally managed in Australia. This amount is up by 13% from the previous year.

The industry is only continuing to grow. RIAA’s 2020 Impact report revealed that investors would ideally like to increase their proportional allocation towards impact investments more than five-fold to $100 billion over the next five years.

Q. Will it compromise my returns?

At FinPeak’s core level we invest first and foremost. On the second level, we make sure we don’t sacrifice your values in the hunt for performance.

In saying that, one of the biggest misconceptions is that investing responsibly comes at the cost of financial underperformance. We believe that doing the right thing does, in fact, lead to long term sustainable performance.

Why? Because those companies who pollute, who underpay employees, who breach human rights within supply chains, or ignore community concerns, who rip off their customers, make significant damage to their brands and their share price.