22 Feb Equity Markets: What Will Happen When Interest Rates Fall?

Equity Markets: What Will Happen When Interest Rates Fall?

The conclusion of the recent rate hiking cycle ignited a surge in what market analysts are calling an “everything all at once rally”. However, as the focus shifts towards potential rate cuts, investors face a more nuanced landscape where specific assets are expected to outperform.

Kerry Craig, executive director and global market strategist at JPMAM, expressed uncertainty regarding Australia’s trajectory for a soft landing during a media briefing in Sydney last week. Describing the current economic landscape as “foggy”, Craig highlighted potential bumps along the way as visibility improves and the soft landing becomes more apparent.

“It does feel like that’s now very much the case when we think about the consensus view that’s building around a soft landing, but anyone who’s been on an airplane will know that the last little bit as you come into land is often the most nerve-racking and can still be very bumpy,” Mr Craig said.

“We are aware of the risks in the economy, particularly to the downside, and somewhat to the upside, given there are still potential risks around geopolitics, what’s happening in the Middle East, politics in the US and other places, and [are] thinking about the potential for a re-acceleration of inflation and what that will mean.”

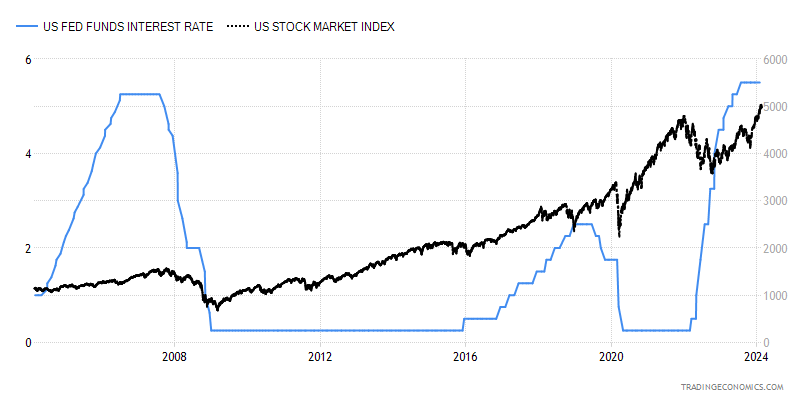

Central banks around the world, including the Reserve Bank, are closely watching economic data as they contemplate rate cuts. Mr Craig explained that while an end to one of the steepest hiking cycles in history has been an “everything all at once rally”, rate cuts would require investors to be more discerning.

Reflecting on historical data from the US on asset class performance following the start of a rate cutting cycle, Mr Craig noted, “When we think about a rate cutting cycle, the asset class performance becomes slightly more nuanced.”

“We can still see opportunities in fixed income, and more importantly, we can see them within equities. As long as we don’t have that recession, we do think of equities as being somewhat overweight in a portfolio rather than being relatively neutral when we’re thinking about a recession.”

Mr Craig highlighted that equities have already experienced a substantial increase in valuations over the past few months.

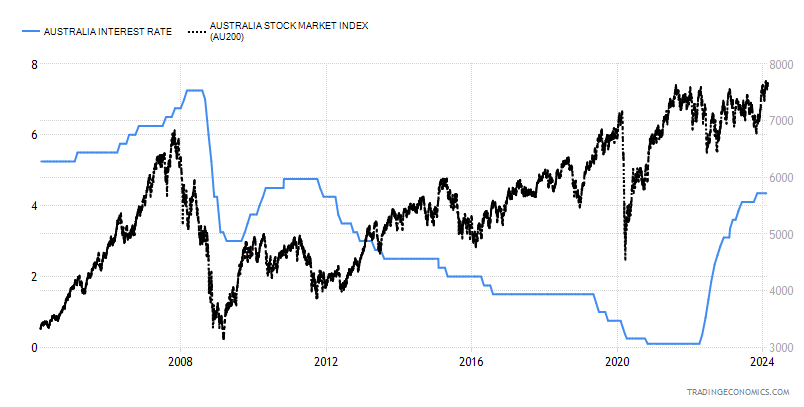

The market strategist indicated that while Australia’s earnings growth expectations are notably modest, hovering around 2 per cent, this subdued outlook is attributed to the country’s current position in its rate cycle and inflationary trends.

“So, we still have that quality bias, which leans us towards US large caps, and we’re still thinking about the opportunities in places like Japan and Europe … and we’re also looking at emerging markets outside of China,” Mr Craig said.

“We still have a preference for equities, we’re still thinking about broadening that exposure in the US and the rest of the world as we see those asynchronous economic cycles come through, but we’re still a little bit cautious.”

On fixed income, he added that the outlook is still positive.

“Even though bond yields have fallen, 4 per cent on the Aussie 10-year Treasury is still very attractive given the historical context,” Mr Craig said.

US S&P hits 5,000

Last week, global share markets rose with the US S&P 500 increasing 1.4 per cent and surpassing 5,000 for the first time.

Commenting on this feat, AMP’s chief economist, Shane Oliver, said its rise was supported by ongoing confidence in a Goldilocks landing for the US economy and strong earnings results.

Eurozone shares rose 0.8 per cent and Japanese shares added 2 per cent, while Chinese shares gained 5.8 per cent on news of more market support measures and stimulus.

But despite the global gains, Australian shares fell 0.7 per cent.

“We remain of the view that shares have run a bit ahead of themselves and are now overbought and at risk of a short-term correction – with risks around central banks and the timing of rate cuts, recession risks and various geopolitical issues (including the escalating Middle East conflict) all providing potential triggers,” Dr Oliver said.

However, AMP, he said, would view any pullback or consolidation as a correction in the context of a continuing bull market.

“Valuation and sentiment measures are a bit stretched but are not at extremes and while central banks are generally cautious and keen to avoid cutting rates too early, they are heading in the direction of lower interest rates this year.

“For now, share markets don’t seem too worried about a possibly later start to rate cuts than expected a few weeks ago because it partly reflects stronger economic conditions, so rate cuts, when they come, may be more likely to be ‘good news cuts’ (with low inflation) rather than ‘bad news cuts’ (reflecting poor economic activity).”

Ultimately, Dr Oliver sees global shares returning a “far more constrained” 7 per cent this year, while Australian shares are expected to “outperform”, if a recession is not had, with the ASX 200 predicted to return 9 per cent in 2024 and rise to around 7,900.

Bonds, Dr Oliver noted, are likely to provide returns around running yield or a bit more, as inflation slows and central banks cut rates.

Fed Funds Rate vs Overall US Stock Market

AU Cash Rate vs ASX 200

‘Multi-pronged fork in the road’

Last month, GSFM market strategist Stephen Miller also cautioned investors that markets face a “multi-pronged fork in the road” in 2024, with a number of structural factors that could still become potential inflection points.

While the prevailing sentiment favours a benign slowdown and disinflation, he cautioned about various other factors that must be considered along the journey towards achieving a Goldilocks scenario, which could significantly impact financial assets.

Alongside risks of sticky inflation and an unexpected recession, he noted other structural factors that are at inflection points – such as higher neutral interest rates because of a big US budget deficit, the need for investment in climate change, emboldened regulators, and growing protectionism, the last of which Mr Miller argued is “one of the few things that Donald Trump and Joe Biden agree on”.

He continued: “There’s these emergent mega forces: there’s obviously climate, there’s cyber security, there’s AI. There’s even mundane ones like a housing shortage in Australia or how health systems cope with an ageing population.

“So, there’s all these things that are out there. Some of them are known unknowns, but there are unknown unknowns.”

This article was originally produced by Rhea Nath of Investor Daily News. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)