23 Jul Key Opportunities for FY 2018-19

Here are some of the key changes that took effect on 1 July 2018 that could impact your situation or otherwise create opportunities for you and your family.

Buying your first home?

Status: Bill passed

Effective: 1 July 2017 for super contributions and 1 July 2018 for release authorities

From 1 July this year, eligible first home buyers can withdraw voluntary contributions made after 1 July 2017 to their superannuation fund to purchase a first home under the First Home Super Saver Scheme (FHSSS). The FHSSS allows eligible first home buyers to save their deposit in the concessionally taxed super environment.

Voluntary contributions are limited to $15,000 per year, up to a total of $30,000 and count towards the relevant contribution cap. Withdrawals are limited to 100% of non-concessional contributions and 85% of concessional contributions plus associated earnings. See our previous post here.

Selling your home?

Status: Bill passed

Effective: 1 July 2018

Eligible super members can make super contributions of up to $300,000 per person from the sale of their home after 1 July this year, if they are aged 65 or over and meet other conditions. These contributions don’t count towards the concessional and non-concessional contribution caps and can be made even if the member doesn’t meet the usual age, work and other contribution tests.

The ‘downsizer contributions’ must:

- Apply to contracts for sale entered into on or after 1 July 2018

- relate to the sale of a dwelling that was their main residence (wholly or partly) and was owned for at least 10 years before disposal, and

- be made within 90 days of the change of ownership (settlement date), with any extensions to be approved by the Commissioner of Taxation.

Eligible for a tax cut?

Status: Bill passed

Effective: 1 July 2018

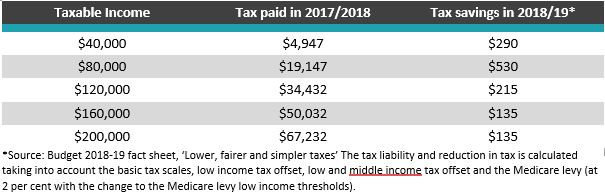

The tax cuts announced in this year’s Federal Budget have been legislated. The first tranche took effect on 1 July this year, providing savings of up to $530 – see table below. There are a number of things that could be done with the extra cash, such as paying off debt and making extra super contributions.

Want a super deduction?

Status: Bill passed

Effective: 1 July 2017

Most people (including employees for the first time) are eligible to claim personal super contributions as a tax deduction. This could reduce taxable income and give super savings a much needed boost. The concessional contribution (CC) cap for 2018/2019 is $25,000.

This is very beneficial for people who:

- Work for an employer who doesn’t permit salary sacrificing

- Works for an employer who does allow salary sacrificing, but it’s disadvantageous due to the reduction in entitlements; and

- Are currently salary sacrificing but want to make a top-up contribution to utilise their full CC cap.

Prior to making a contribution, it’s best to check what has already been contributed and consider any future contributions prior to 30 June.

Not likely to max out your super cap?

Status: Bill passed

Effective: 1 July 2018

If super members make concessional (pre-tax) super contributions (CC) of less than the cap of $25,000 in 2018/19, they may be able to carry forward unused cap amounts, for use in a future financial year. Individuals with super balances less than $500,000 on 30 June of the prior financial year can now carry forward unused CC cap amounts on a rolling basis for a period of five years. 2018/19 is the first financial year unused CC cap amounts can be accrued and these unused amounts can be used from 1 July 2019.

This is worth keeping in mind – particularly for members who take time off work or work part-time. It means members may be able to make ‘catch-up’ concessional contributions from 1 July 2019, if their cashflow allows. Concessional contributions include all employer contributions (super guarantee and salary sacrifice), personal contributions claimed as a tax deduction and certain other amounts.

In addition, an opportunity will exist for those who intend to sell a CGT asset in the future where they can accumulate unused CCs. They can offset CGT on the sale of the asset by making a personal deductible contribution in the relevant income year that uses up the accumulated unused CC cap amounts.

Have a SMSF?

From 1 July this year, if a pension is started or is running in an SMSF, certain events may need to be reported to the ATO using the ‘Transfer Balance Account Reporting’. Also, while not yet in effect, if a new limited recourse borrowing arrangement (LRBA) is started in an SMSF, there is a potential law change that would make the outstanding balance of a relevant LRBA count towards the members’ ‘total super balance’.

The outstanding balance of a Limited Recourse Borrowing Arrangement (LRBA) will be included in an individual’s Total Super Balance (TSB), if the LRBA is entered into on or after 1 July 2018 and a member has either:

- satisfied a condition of release with a nil cashing restriction, or

- arranged the LRBA with a related party.

This will be tested not only at the time the loan is entered into, but on an ongoing basis. This means that if a member has a related party LRBA or will soon meet a full condition of release and wishes to make non-concessional contributions in the future, they may need to take steps to unwind the LRBA.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments