01 May What is investment gearing?

Gearing simply means borrowing money to invest. It can be used to enhance the overall returns on your money by allowing you to make a larger investment than would otherwise be possible. The borrowed money can be used to invest in assets such as shares, property and managed funds. Gearing can be an effective strategy if the after-tax capital gain and income return of the geared investment exceeds the after-tax costs of funding the investment. Most people are familiar with obtaining a loan to purchase an investment property and are quite comfortable in borrowing up to 80% of the funds needed to purchase property.

As long as the net gains from your investments over the long term outweigh the costs of borrowing, gearing will magnify those gains. Gearing is considered to be an effective long term strategy because experience has shown over the long term, growth based investments can deliver the higher potential returns required. However, investments suitable for gearing are generally more volatile than others and can also lose value. During a period when investments are losing value, gearing will magnify those losses.

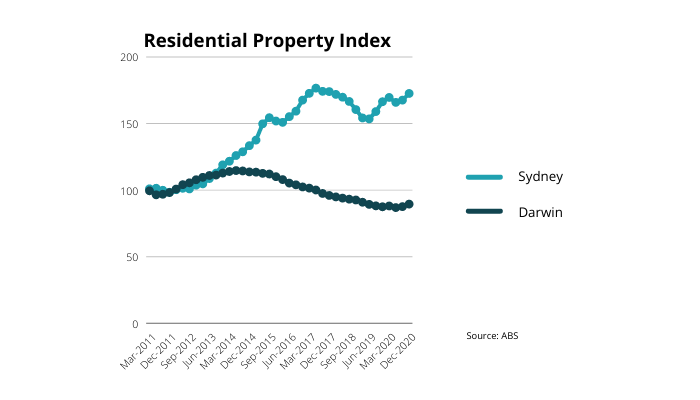

Let’s stick with residential property for now, property is safe right and keeps increasing over time? This is not always the case if we take a good look at two opposing scenarios of the capital cities of Sydney and Darwin over the past 10 years.

Source: ABS

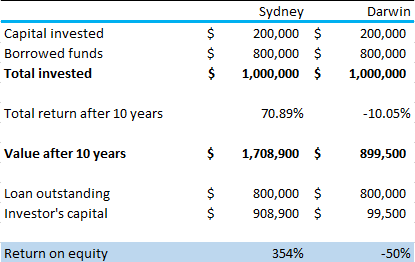

If we ignore the income received, as we want to just look at the impact of gearing on capital returns, we will see that the total capital return over 10 years for Sydney was 70.89% or 5.5% pa and for Darwin -10.05% or -1.05% pa. Let’s now see how gearing impacts the return on your capital if we assume that each property was purchased for $1m and the loan to value ratio (LVR) was 80%, we will ignore stamp duty and other fees for now, then the return on equity would be 354% for Sydney and -50% for Darwin.

Note – this is a hypothetical example and are no way advocating investing in property in either markets.

If you decided to adopt a lesser amount of gearing let’s say a LVR of 50%, this would mean that you would need to invest more capital at the start ($500k as in the above example) and your return on equity would be 142% for Sydney and -20% thus demonstrating the multiplier effect of gearing. Gearing is only appropriate for growth based investments such as shares and property and should be viewed as a long– term strategy, being a seven to ten year timeframe. You need to be able to retain the investment (and maintain the loan repayments) during potential short–term market declines in order to obtain the benefits of long term growth.

Gearing facilities:

Home equity loan or line of credit – A straight forward and perhaps most cost effective way to gear is to borrow against the equity in property you already own (for example, your home) at prevailing mortgage rates. The main benefits of this type of funding include:

- cheaper interest rates compared to other loan types,

- the absence of margin calls and;

- no requirement to contribute funds to the investment.

The lending institution will generally only require the regular payment of interest to fulfil your obligations, in which case, the level of debt remains constant. Mortgage loans such as a home equity loan and line of credit are commonly used for this purpose.

Margin loan – Another way to access funding for investment gearing is via a margin loan facility. You are required to contribute your own equity which will be used as security for the borrowing. The lending institution will lend a portion of the value of specific securities or managed funds, usually between 40 and 80 per cent. If the margin loan outstanding is greater than the lender permits, a margin call will be made. See the Margin calls section further below.

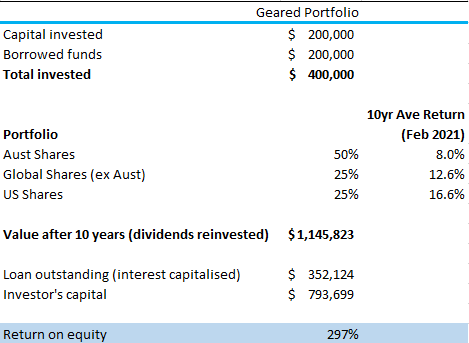

Gearing is not limited to property as stated above, you can also borrow to invest in shares and managed funds as well. If we look at using the same amount of capital in the example above and we assumed that we invested these funds and reinvested the dividends and capitalised the interest expense you would have achieved the following outcomes:

Again this does not take into account any taxes once you sell your investment to cash.

Other things you should know:

Negative gearing – occurs when the interest payable on borrowed funds and any expenses incurred to derive that income exceeds the net income received from the investment. The investor must have surplus income from other sources over and above their day to day living expenses to meet the shortfall.

Example: Negative gearing on a rental property occurs when the interest payable on the loan used to purchase the property plus other expenses (maintenance, etc) exceeds the rental income generated by the property. These expenses can be used to offset tax payable on other income such as dividends from shares or on salary from employment.

Positive Gearing – is when the interest payments and other investment costs are lower than the income you receive from the investment.

Example: Borrowing to invest in shares when the dividend income exceeds the expenses of the loan.

Margin Calls – apply when you borrow via a margin lending arrangement. A margin call is when the market worth of your shares falls. The result is the LVR exceeds the allowance limits. In this situation you will usually have three options:

- lodge additional securities that you have

- pay back part of your loan, and/or

- sell your portfolio and draw on the proceeds to pay back part of the loan.

Your gearing loan provider will generally need the LVR to be returned to the arranged limits within a stated time period, usually within 24 hours. Although, when you borrow less than the maximum loan limit, you can decrease the risk of margin calls.

Double gearing– In some circumstances, it may be appropriate to use double gearing. This strategy involves borrowing funds from a loan such as a home equity loan or line of credit and using those funds to purchase investments. The investments are then used as security for further borrowing via a margin loan. A double gearing strategy increases both the total amount of your debt and the amount you invest. As a result, a double gearing strategy involves more risk as any investment gains and investment losses will be magnified significantly more than a standard gearing strategy. Double gearing is only appropriate for investors who have a strong surplus cash flow, are willing to take on extra risk in pursuit of higher potential returns and are comfortable with significant fluctuations in the value of their portfolio.

With this strategy, it is important to bear in mind any losses within your investment portfolio may affect your ability to repay the original borrowing (via a home loan or line of credit) which is often secured by an existing property or your home.

This is certainly a risky strategy but interestingly enough a not lot of Australians consider it being risky when they use the equity in their home to purchase an investment property which is normally geared at 80%.

Capital Gains Tax – CGT may be payable when you sell your investments. When you use gearing to buy more investments, you may have more tax to pay when you sell them.

Changes in interest rates – If the income from investments does not change but interest rates on borrowed funds increase, you will incur additional costs that will need to be covered from other sources.

Growth–based investments – A gearing strategy must invest a high proportion of an investment portfolio into growth assets such as property and equities to prove successful. These investments can be volatile over short–term periods – that is, in the short–term there may be some years in which the investments do not perform well or even lose value. It is for this reason gearing is a long–term investment strategy.

In conclusion

Gearing is not for everyone, you need to have a high tolerance of risk and be prepared to accept the ups and downs from your investments. You need to have a strong secure cashflow and in most cases have a backup plan like income protection. It works best for people on high marginal tax rates and you need to be patient and have a long investment timeframe. As always, it is best to consult a financial adviser to determine the appropriateness of the strategy.

Sources

https://www.vanguard.com.au/adviser/en/index-chart

https://www.mlc.com.au/understandingseries/understanding_gearing.pdf

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments