26 Oct Tech Talk : Property Buying/Investing PART 1

Investing in property is a huge decision and can be very costly if you get it wrong. The first decision you need to make is: “Are you buying a home to live in or are you buying it as an investment?”

We will be breaking down this strategy into two parts; buying property to live in, and buying property as an investment.

Tips for buying your own home

Unless you plan on flipping properties as a hobby (which some do very well from), most of us will only ever own one or two properties in our lifetime as the costs associated with buying and selling property are quite high and will erode all your savings if you’re not careful.

1. Save for a deposit

It would be nice if we could just turn up at a real estate agent with a cheque and pay for your home outright from your savings but for most of us, we’ll need to come up with a deposit and then borrow the remainder from a bank or financial institution. A good starting point for a deposit is to aim for at least 20% deposit plus costs. Generally, to avoid paying lenders mortgage insurance (LMI)*, it is best to have a deposit of 20% or more. Some lenders may only require a deposit of 5% but a smaller deposit also means a higher cost for LMI and a larger loan to be paid back to the bank with interest over the term of the loan which could be up to 30 years!

*What is lenders mortgage insurance?

Other costs involved will be things such as stamp duty, legal costs, inspection reports, agent fees (if engaging a buyer’s agent) and loan fees. Then there are the other costs they don’t tell you about like moving costs, fit-out costs, renovations and landscaping.

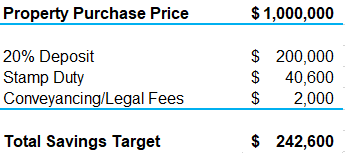

Below is an example of what your basic costs may look like, it may be more or less depending on your circumstances.

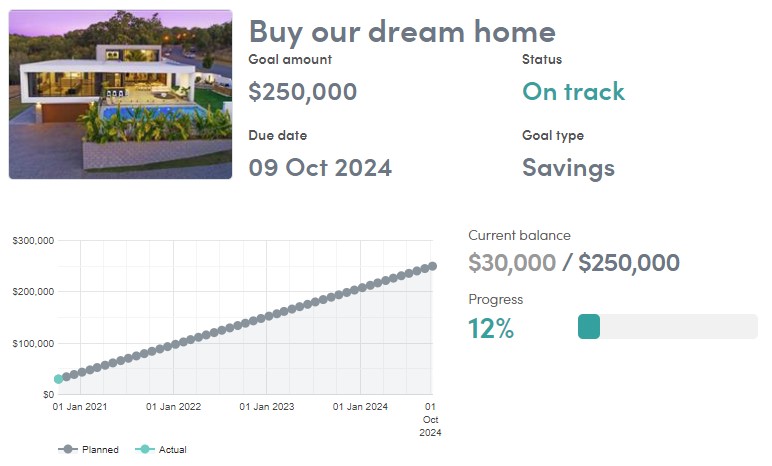

According to moneysmart.gov.au it takes around 4.6 years to save for a 20% deposit. Saving for a deposit starts with a budget. To manage your spending, try setting up a regular savings plan to help with growing your deposit. At FinPeak, we use a wealth platform called MyProsperity which allows you to track all your expenses across all your bank accounts and receive a monthly report so you can stay on target with your goal. MyProsperty allows you to track your spending habits and automatically categorises your expenses and gives you the ability to set a budget so you can see if you are going over or under on those ‘nice to have’ expenses. You can even set a goal that tracks your progress so you can own your home sooner.

Other ways to help you save for a deposit could include:

- If you’re a first home buyer then, using your superfund to tax effectively save, see our article on the First Home Super Saver Scheme (FHSSS) here;

- Or you may be eligible for the First Home Owners Grant (FHOG), to help boost your deposit and even reduce your stamp duty costs. Different rules apply in each state and territory;

- Or you may be eligible to buy your house with as little as 5% deposit and save around $10,000 in LMI through the First Home Loan Deposit Scheme;

- If you have existing investment properties you may be able to use the equity from those assets (note the interest expense associated with the funds drawn for your own home deposit will not be tax-deductible);

- More recently, given high entry prices, many buyers are turning to the Bank of Mum & Dad (BoMD) however this may cause further problems in the future such as a shortfall in their retirement objectives;

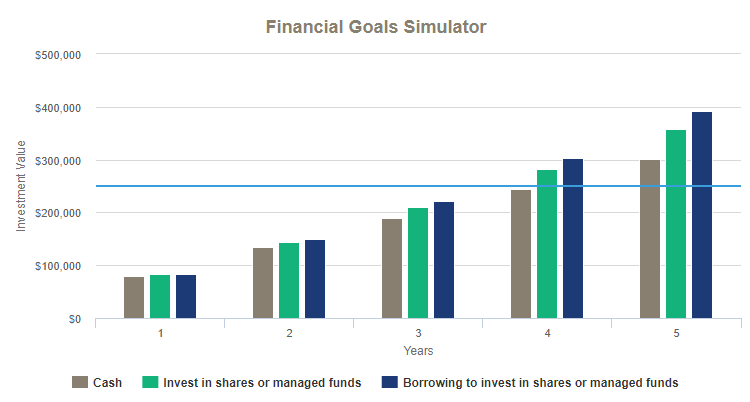

- If you have a longer time horizon (and the right tolerance and understanding of risk) you may explore other strategies such as investing in growth assets to help you boost the returns on your savings (see below);

This is where speaking to a financial adviser is key, they can assist by putting together a game plan and helping you understand your options but also keep you on track with regular check-ups along the way. They will understand which strategy is right for you and also the structure to use to get the best outcome. Laws and incentives change all the time and this means your plan may need to change and having that professional third party can add value and save you from disappointment.

2. Work out what you can afford to borrow and find the best loan

How much you can borrow will depend on factors such as:

- your income and expenses;

- the size of your deposit;

- how you earn a living (self-employed, contractor, full-time employee);

- and your credit score.

Just because an online borrowing capacity calculator says that you can borrow a certain amount, it doesn’t always mean that you should. You may have other goals and need to weigh up the tradeoffs as buying your own home will be a long term commitment.

Speaking to a mortgage broker/specialist will take the guesswork out of shopping around and the good ones will help choose the right product to save you money and give you options in the long run.

3. Find the right property

Buying a property is expensive and will likely be the largest single purchase you will ever make in your life. Not only are the purchase and transaction costs (stamp duty, legal fees and agent fees) significant but many don’t factor in the time costs in finding the right property over and over again.

If you have or are planning to have a family, will this property suit your needs now and into the future? Is it close enough to transport to get to work and close to good schools so your kids aren’t travelling hours each day to get back and forth? Make a list of what the ‘must-haves’ are and what the ‘nice-to-haves’ are so that it keeps you focused as you’ll spend most of your weekends inspecting properties. It’s not uncommon to be overly excited at the first property you inspect or fatigued after spending months looking at properties. Using a buyers agent can sometimes help, we discussed this here. Once they get a good feel for what you’re after they can then shortlist properties that fit your brief and even help you with the negotiations on price.

As house prices keep climbing, most homeowners now are putting off buying your own home until later in life and depending on your life circumstances it may mean working longer and adjusting what your ‘living your best life’ in retirement looks like.

4. Negotiating and signing on the dotted line

When you find the right house it is easy to let the emotions get ahead of you. Your property might be sold via an auction so it might help to observe a few before you bid on the property that you have chosen. You might bring someone who is experienced, this is where your buyer’s agent can help. Expect to have a cheque ready on the day eg 10% of the purchase price. If purchasing via a private treaty then the contract of sale will stipulate a deposit amount.

The seller will issue a contract of sale which you should give to your conveyance or lawyer to review before signing. You may also want to get a building inspection (to ensure the property is structurally sound) and pest inspections (to make sure there aren’t any nasties hiding under the surface).

Once you’ve ticked all the boxes it’s time to make an offer which could be unconditional (binding offer if you have your finance sorted) or conditional (pending things like bank valuation or finance etc). If everything goes through smoothly and you complete your settlement, congratulations you’re now a homeowner and it’s time to move in!

If you are buying this property as an investment

Faced with escalating real estate prices in most of our capital cities you may decide to buy a property as an investment instead of living in the property. Or you may have some equity in your current property and may want to utilise it and purchase a second property. Perhaps you would like to use some of your funds in your superannuation to own direct property. Whatever the reason, buying a property as an investment allows you to take the emotion out of the purchase and weigh up the property more on the financial metrics that it will either grow in value and allow you to cash in on the capital gains in the future or it will provide a steady income stream to fund your future needs. In this second part, we will discuss owning property directly in your name or via your superannuation fund.

1. Pros vs Cons

Direct property investment is like any investment in that it will have some sort of risk, there is no free lunch when it comes to investing. There are some pitfalls that you need to be aware of:

Pros

- Less volatility – owning direct property can be less volatile than other investments as the asset is not priced on a daily basis;

- Income – it can provide an income stream if the property has a tenant;

- Capital growth – If the property grows in value over time you can benefit from this growth when you realise (sell property) the gain and covert the value to cash;

- Tax deductions – you can offset most of the ongoing expenses of the property against the income it generates and in some cases, you may be able to offset your other income in the same name;

- Real asset – you are investing in an asset that you can see and touch;

- Leverage – you may be able to multiply your capital gains by borrowing to purchase the asset (however, as noted below this can also multiply your losses as well).

Cons

- High costs – property investment has high entry and exit costs (eg stamp duty, legal fees, mortgage settlement costs, agent fees) and in most cases, the value of the property needs to grow by more than 5% before you show a profit. There are also ongoing costs such as council fees, strata, water rates, interest expense, repairs and maintenance, property management fees and insurance;

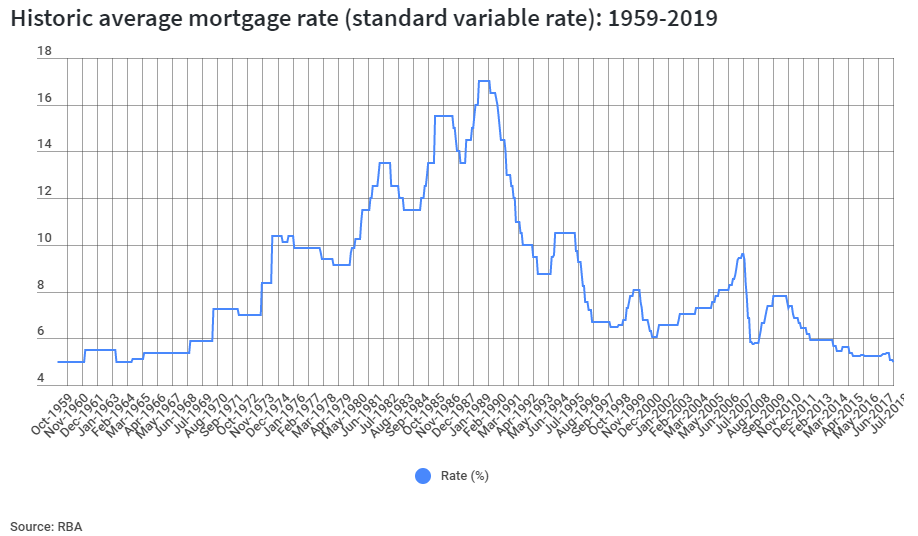

- Interest rate movements – in many cases debt is used to acquire the property. Were experiencing historically low rates at the moment, however, as you can see from the graph below, up until recently the average mortgage rate has been north of 6% pa. You can mitigate this risk by increasing your tenant’s rent, however, given that most tenants would have a lease for 6 to 12 months there will be a period of time, which you as the landlord, you will need to absorb the costs. Banks are also highly regulated and as we saw a few years ago, changes to capital requirements for banks meant that investment loans carried a higher interest rate than owner-occupied loans.

- Capital losses – in circumstances where debt is used and the value of the property falls, you could end up owing the bank more than what the property is actually worth. If there was a situation where you were forced to sell, you would walk away owing a large sum of money to the bank and putting your other personal assets at risk;

- Vacancy – there is always a risk for some period of time where you do not have a tenant and will have to fund the ongoing expenses from your back pocket;

- Liquidity risk – if you needed funds from this property it may take some time to sell the asset at the price you were expecting and in the cases of retirement you couldn’t just sell part of the property to fund your lifestyle;

- Low/no diversification – there’s a saying ‘don’t put your eggs in the one basket’, for most people, investing in direct property will mean owning only a few properties as property investing is usually requires significant capital. We will discuss ways to reduce liquidity risk and diversification in a later article.

- No reinvesting of income – Benjamin Frankin once said “Money makes money. And the money that money makes, makes money.” Unlike some other assets, the income generated from this direct property investment is generally unable to be reinvested. You may, however, be able to fund a renovation but this does not guarantee an increase in the overall value of the property.

2. Cashflow Case Study

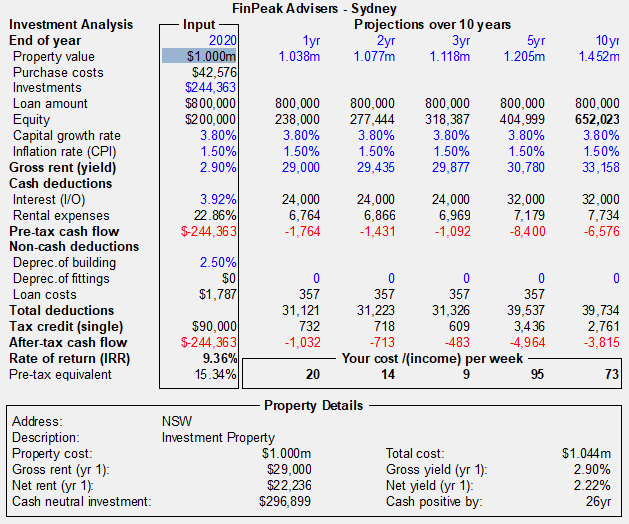

Consider an investor who is looking at buying an investment property in NSW, we have assumed that this investor earns $90,000 pa and has no other income or deductible expenses. We’ve assumed that interest rates are at 3% pa for the first three years and 4%pa in later years to reflect the current economic environment.

Based on our assumptions, and if you sold this investment after 10yrs, this represents an after-tax rate of return of 6.93% pa with a net yield (income) or 2.22%pa. By comparison, if no debt was used then the after-tax rate of return would be 3.6% pa. This just goes to show how debt can enhance returns, however, it could easily work in the opposite direction if the investment were to lose value at the end of the period. Debt (or ‘gearing’ as otherwise referred) is not unique to property investing and can also be used with other investments, such as shares, the main difference is the amount you can borrow on your capital with property is generally higher as opposed to shares.

See at the end for the source of our assumptions.

3. Investing through a self-managed super fund (SMSF)

You may decide to use the capital to purchase an investment property but to do so you must we aware of certain ‘rules’:

The property must:

- meet the sole purpose test of solely providing a retirement benefit to the members;

- not be acquired from a related party of a member;

- not be lived in by a fund member or any fund members’ related parties;

- not be rented by a fund member or any fund members’ related parties;

If your SMSF purchases a commercial premise, it can be leased to a fund member for their business. However, it must be leased at the market rate and follow specific rules.

There are essentially four ways you can invest in property through your SMSF, we discuss this in an early article here.

You need to weigh up the pros vs cons of investing through an SMSF to determine if holding the asset inside super will produce an outcome that is right for you as the costs of setting up and ongoing will be higher than holding the asset in your own name. However, the benefits could be that it may provide significant after-tax benefits in the long run due to the tax effective nature of the super/pension environment.

In Summary

Buying property at the end of the day is just a means to an end, it can be exciting and rewarding but at the same time can be costly and frustrating. This is where seeking advice can help take the headache out of the journey. Next month in Part 2 we will discuss buying other types of property through different investment structures.

Next Steps

To find out more, speak to us to get you moving in the right direction.

Assumptions and additional resources

https://www.corelogic.com.au/news/anz-corelogic-housing-affordability-report-2020

https://moneysmart.gov.au/buying-a-house

https://moneysmart.gov.au/property-investment

https://moneysmart.gov.au/property-investment/smsfs-and-property

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

Pingback:FinPeak | Tech Talk : Property Investing PART 2

Posted at 12:00h, 01 December[…] part 1 of this series, we talked about investing in residential property (you can view the post here) now we take a better look at the other side of property investing, commercial […]