26 May Why it’s Challenging to Choose the Right Asset Class to Invest in Each Year

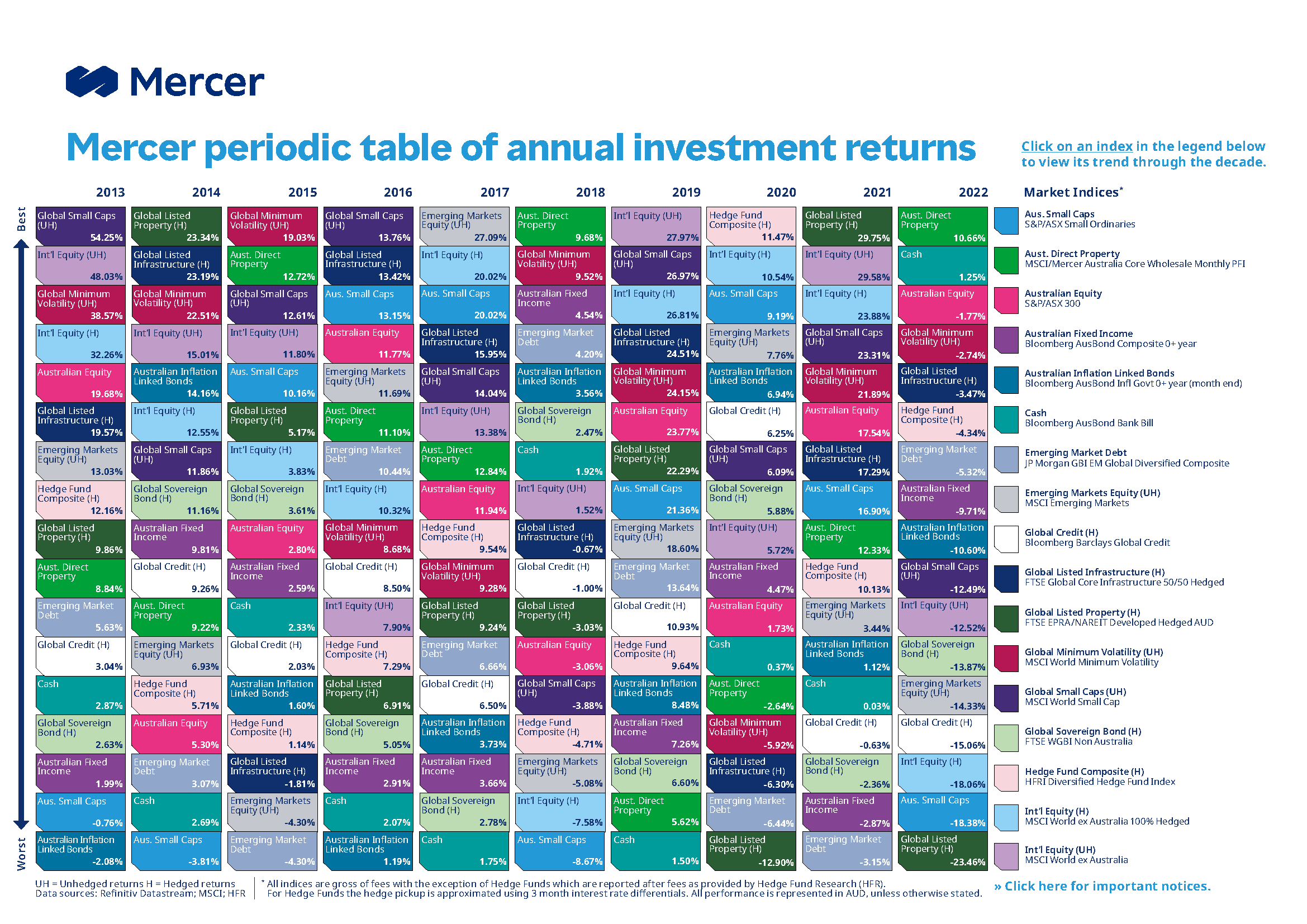

Investing in the right asset class can be a daunting task, as it requires navigating the complex and ever-changing landscape of financial markets. Each year brings its own set of economic conditions, market trends, and geopolitical factors, making the decision-making process even more challenging. In this article, we explore the reasons why choosing the right asset class to invest in each year is a difficult endeavor. As you can see below the best asset class in one year is rarely the best choice in the next.

Click HERE to download the full version of this table.

- Volatile Economic Conditions:

Economic conditions play a crucial role in determining the performance of various asset classes. Factors such as GDP growth, inflation, interest rates, and government policies significantly impact investment returns. However, these economic indicators are rarely stable from year to year. They fluctuate due to changing market dynamics, global events, and unforeseen circumstances, making it challenging to predict which asset classes will outperform others.

For instance, during periods of economic expansion, equities tend to perform well. However, during economic downturns or recessions, investors often flock to safer assets such as bonds or gold. Predicting economic cycles accurately is difficult, and even seasoned experts struggle to time their investments perfectly.

- Market Uncertainty and Sentiment:

Investor sentiment and market uncertainty can have a profound impact on asset prices. Sentiment is influenced by various factors, such as political events, trade tensions, regulatory changes, and global crises. These uncertainties introduce volatility and make it challenging to determine which asset classes will thrive in a given year.

For example, a sudden change in government policies or a geopolitical conflict can trigger significant market swings, impacting different asset classes in different ways. Investor sentiment can shift rapidly, and predicting these changes accurately is a complex task.

- Diverse Asset Class Performance:

Different market conditions can affect how different asset types perform. While stocks may deliver significant returns during a bull market, fixed-income investments like bonds or Treasury bills typically exhibit greater stability and generate income during uncertain times in the market. Alternative investments like commodities or real estate can also be quite important in a portfolio with a wide range of assets.

Accurately predicting which asset class will perform better than others in a given year is the difficult part. In-depth knowledge of market trends, sectoral analysis, and the capacity to predict potential catalysts that may propel particular asset classes are necessary.

- Information Overload:

Information is easily accessible in the age of digital technology, and investors have access to a wide range of financial data and analysis. However, the wealth of knowledge can occasionally be overwhelming and contradictory, which causes analytical paralysis.

It can take a lot of time and mental energy to sort through enormous amounts of data and determine how it relates to various asset classes. Investors may struggle to separate reliable, unbiased information from irrelevant noise, which may make it more difficult for them to make wise financial decisions.

Successful investing requires a disciplined approach, thorough research, and a long-term perspective. Investors should focus on building a well-diversified portfolio that aligns with their financial goals, risk tolerance, and investment horizon. Regular review and adjustment of the portfolio based on changing market conditions, combined with a focus on long-term fundamentals, can help navigate the complexities of asset class selection and improve the odds of successful investing over time.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments