24 Oct TECH TALK: Investment Concentration Risks

Risks you might not have thought about for your SMSF portfolio

Diversifying Your Portfolio

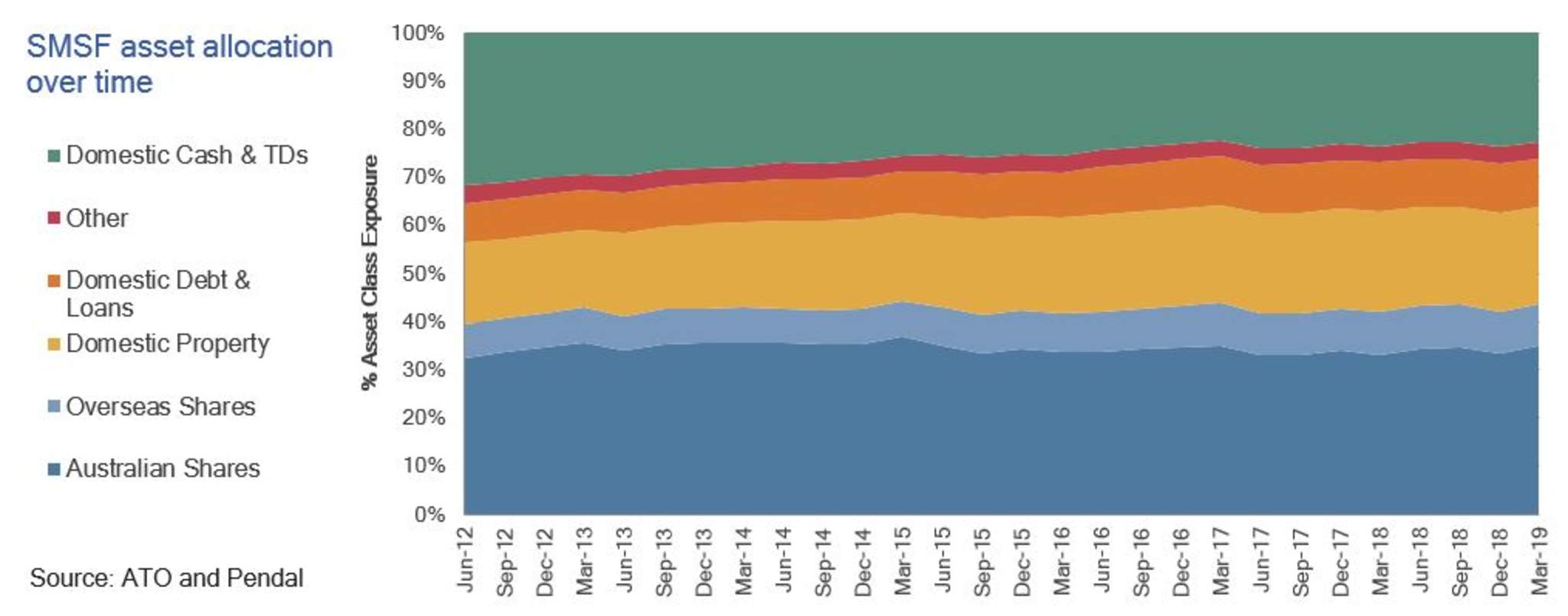

Most of us all know that a primary rule of thumb when it comes to investing is to not keep all of your eggs within one basket. Self managed superannuation fund (SMSF) asset allocation data collated by the Australian Taxation Office (ATO) suggests the average SMSF investor is highly concentrated in domestic investments, and in particular Australian shares, property and cash – a strategy which may be providing a level of unintended risk.

It is understandable investors may exhibit a favourable bias towards domestic assets for various valid reasons but they should also be aware they are exposing themselves to significant country, sector and company concentration risks that may not be rewarded over time.

It also appears there is a general lack of fixed income assets held by the average SMSF investor. Fixed income can provide meaningful portfolio diversification, higher yield, potential return enhancement, as well as downside protection if equity markets fall.

While cash and term deposits are capital stable when equities fall, fixed income can provide material capital gains, thus providing protection. It however appears fixed income has been overlooked by the average SMSF investor historically, which has resulted in a material loss of returns and additional risk to-date.

Since the GFC, we suspect SMSF investors chased yield through decreasing their defensive investments in favour of higher yielding but more capital risky assets such as domestic equities and property. In addition, a potential style bias towards higher yielding sectors and stocks are basically all concentrated in domestic banks and property. Domestic banks also have material risk exposure to domestic property, and it’s likely that the largest personal asset of SMSF investors is domestic property (the family home). Should domestic property prices fall materially further, there’s the potential that SMSF investors will experience capital losses on all areas of their personal asset portfolio beyond expectations.

The material level of investment concentration and lack of diversification can result in lost returns of around 0.6% a year. For the average SMSF size of $1m and over a 20-year period (superannuation is a long-term investment), this results in a loss of about $390,000. Clearly, this level of lost returns can materially decrease wealth accumulation over time and hamper retirement lifestyle choices. SMSFs could mitigate this lost return through reducing investment concentrations and investing more in overseas investments, fixed income, as well as other alternative asset classes.

An evident home country bias within SMSF portfolios

Asset allocation data provided from the ATO suggests material concentration risks within SMSFs. The chart below shows broad asset class exposures since the initial collection of quarterly data.

While this asset class classification requires subjectivity in terms of the particular ATO investment classifications (e.g. managed investment schemes were evenly allocated to overseas shares and domestic debt), it does highlight significant investment concentrations that also appear to be increasing through time.

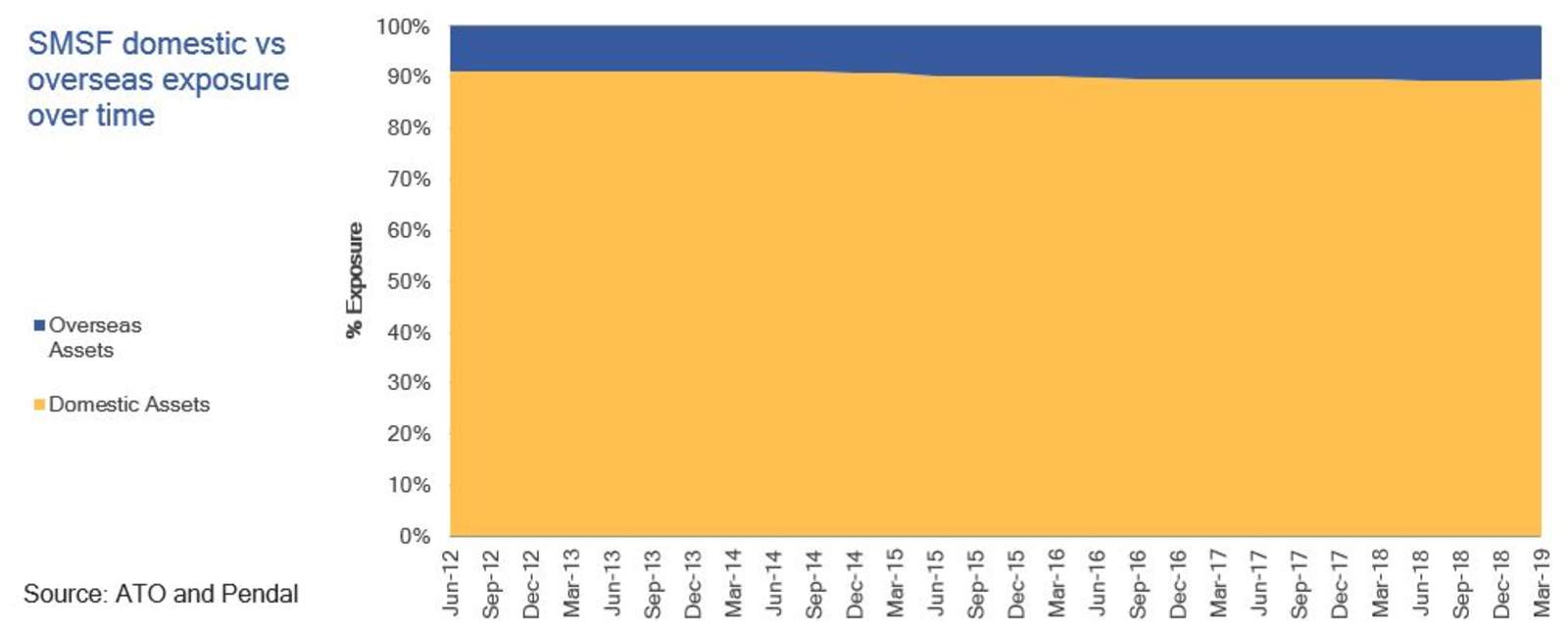

Note the significant bias to domestic assets, particularly domestic shares, property and cash. The chart below highlights the degree of exposure to domestic assets, constituting around 90% of the typical SMSF portfolio. There may be evidence this reliance on the domestic investment opportunity set has been decreasing but the reduction has been marginal at 1.8% over the last seven years.

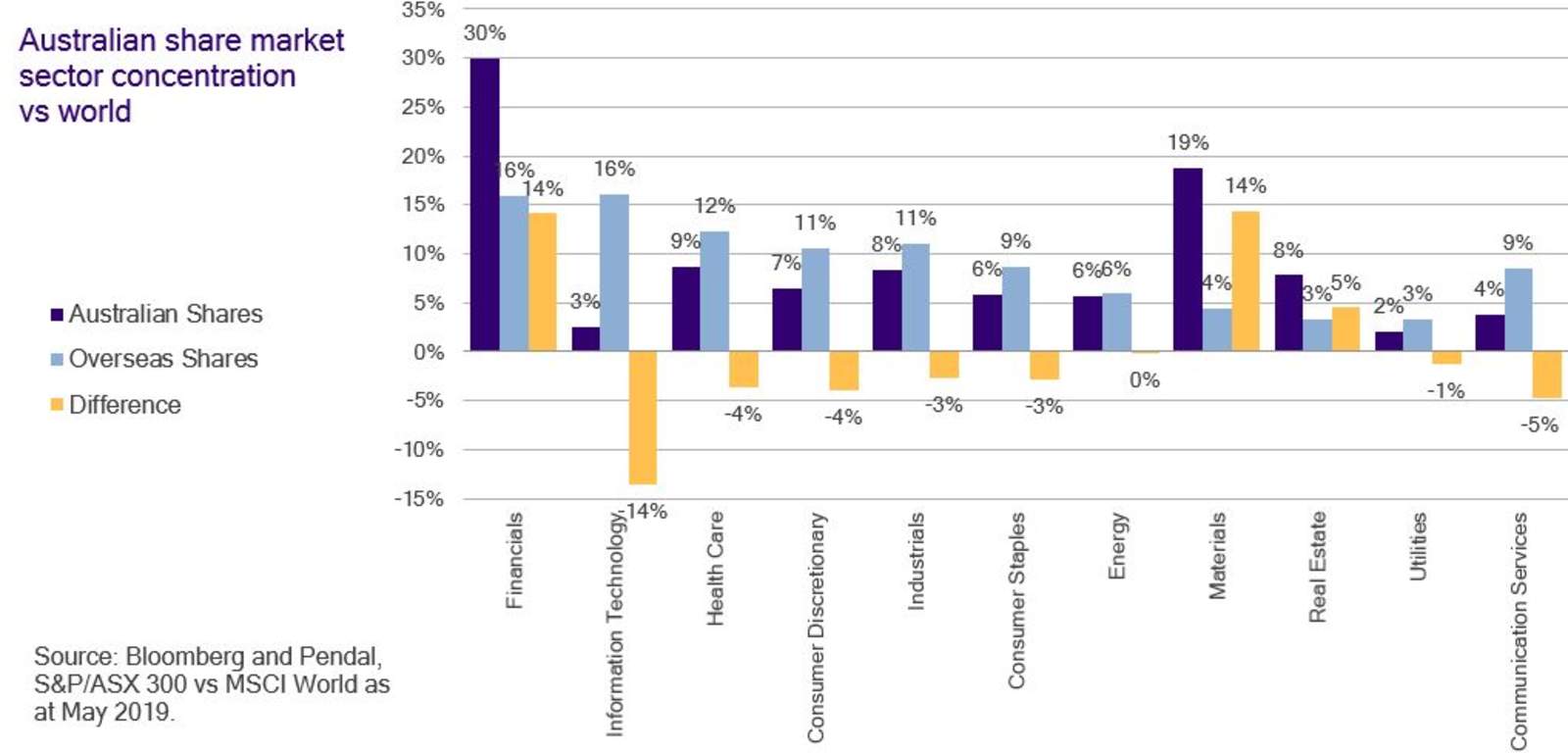

Concentration risk of the Australian share market

The rationale for a home bias is even more pronounced for Australian investors towards the domestic share market, partly attributed to the attractiveness of franking credits and lure of higher dividend yields than many other markets. However, investors should at least be aware this exposes them to material concentration risk that comes with the domestic share market, including significant exposure to a single country versus a broad spread, a high level of concentration in just two sectors (financials and commodities) and potential poor performance from a few large domestic companies (e.g. the ‘big 4’ banks and BHP). SMSF investors should ask themselves whether their conviction on the Australian economy, the Australian share market, a narrow array of sectors and high stock concentration is an effective risk/return trade-off and reflects their level of confidence on domestic exposures compared to the rest of the world.

The chart below highlights the significant bias of the Australian share market to just two key sectors, financials (including real estate) and materials, which constitute 57% of the Australian market.

An increasing risk-taking theme within SMSF portfolios

The ATO data also highlights the typical SMSF having about 65% growth asset exposure, which has increased materially from 58% seven years ago. This represents a significant increase in risk taking. The clear theme in the data appears to be a material move away from increasingly lower yielding cash and term deposits (defensive assets) and into Australian shares (most likely higher yield banks and listed property trusts), property and perhaps yield-focused investments through managed investment schemes.

This movement out of defensive assets and into higher risk assets may leave SMSF investors exposed to material capital losses beyond their expectations; the trade-off for chasing higher yield in higher risk assets. While the capital risk associated with more volatile asset classes has been reasonably latent since the GFC, the true risk of these investments will come to fruition at some point in time. Further this increased exposure to domestic shares and property, a likely bias towards higher yielding sectors and stocks, are basically all concentrations on the same risk exposures. In short there’s a very significant concentration on domestic banks, and domestic banks have material risk exposure to domestic property. This significant look-through exposure to domestic property within the average SMSF portfolio is further compounded by the likely largest personal asset of SMSF investors, being domestic property (i.e. the family home). Should domestic property prices fall materially further, it’s possible that SMSF investors may experience capital losses on all areas of their personal asset portfolio beyond the recent experience.

So to put it simply, having an investment portfolio that is highly concentrated ignores the one free lunch in investment management: diversification! The amount of diversification SMSFs employ should be consistent with members’ risk tolerance and appetite for return. These levels of tolerance and appetite usually change as retirement nest-eggs grow and the need for income to help fund retirement grows. Accordingly, the investment mix for an SMSF, including its level of diversification, is expected to change over time. There is anecdotal evidence to suggest this change may be happening less than required.

The original article was produced by BT Financial Group, to see the full article please click here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

[/vc_column_text][/vc_column][/vc_row]

No Comments