12 May Federal Budget 2021

Last night the Federal Treasurer, the Hon. Josh Frydenberg MP, delivered his third Federal Budget. Here’s a summary of some of the announcements that may impact you.

Summary

On the personal taxation front, the proposed changes include an extension to the low and middle-income earner tax offset and modernising the tax residency rules.

For businesses, there are proposed extensions to full expensing and loss carryback rules, as well as a number of employment boosting initiatives.

The superannuation changes include a repeal of the work test, a reduction in the downsizer contribution minimum age, and changes to the self-managed superannuation funds (SMSF) residency rules.

There are also changes to child care, social security and other housing measures.

Personal income tax

Retaining LAMITO in the 2021-22 income year – The Government will retain the low and middle income tax offset (LAMITO) for the 2021-22 income year, providing further targeted tax relief for low- and middle-income earners. It is worth up to $1,080 for individuals or $2,160 for dual income couples. Consistent with current arrangements, the LMITO will be received on assessment after individuals lodge their tax returns for the 2021-22 income year.

Modernising the individual tax residency rules – The Government will replace the individual tax residency rules with a new, modernised framework. The primary test will be a simple ‘bright line’ test — a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident. Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria. The measure will have effect from the first income year after the date of Royal Assent of the enabling legislation.

Business Owners

Temporary full expensing extension – The Government will extend the 2020-21 Budget measure titled JobMaker Plan — temporary full expensing to support investment and jobs for 12 months until 30 June 2023 to further support business investment and the creation of more jobs.

Temporary full expensing will be extended to allow eligible businesses with aggregated annual turnover or total income of less than $5 billion to deduct the full cost of eligible depreciable assets of any value, acquired from 7:30pm AEDT on 6 October 2020 and first used or installed ready for use by 30 June 2023.

Temporary loss carry-back extension – The Government will further support Australia’s economic recovery and business investment by extending the 2020-21 Budget measure titled JobMaker Plan — temporary loss carry-back to support cash flow. The extension will allow eligible companies to carry back (utilise) tax losses from the 2022-23 income year to offset previously taxed profits as far back as the 2018-19 income year when they lodge their 2022-23 tax return. Loss carry-back encourages businesses to invest, utilising the 2021-22 Budget measure titled Temporary full expensing extension by providing eligible companies earlier access to the tax value of losses generated by full expensing deductions.

Companies with aggregated turnover of less than $5 billion are eligible for temporary loss carry-back. The tax refund is limited by requiring that the amount carried back is not more than the earlier taxed profits and that the carry-back does not generate a franking account deficit. Companies that do not elect to carry back losses under this measure can still carry losses forward as normal.

JobTrainer Fund — extension – The Government will provide $506.3 million over two years from 2021-22 to extend the JobTrainer Fund. This includes an additional $500.0 million in funding for the National Partnership Agreement on the JobTrainer Fund, to be matched by contributions from the states and territories, to deliver around 163,000 additional low fee and free training places in areas of skills need, including 33,800 additional training places to support aged care skills needs and 10,000 places for digital skills courses. Eligibility for the Fund will be expanded to include selected employed cohorts that are continuing to be affected by COVID-19. This measure also includes $6.3 million for a campaign to encourage take-up of training opportunities.

Boosting Apprenticeship Commencements wage subsidy — expansion – The Government will provide an additional $2.7 billion over four years from 2020-21 to expand the Boosting Apprenticeship Commencements wage subsidy to further support businesses and Group Training Organisations to take on new apprentices and trainees. This measure will uncap the number of eligible places and increase the duration of the 50 per cent wage subsidy to 12 months from the date an apprentice or trainee commences with their employer. From 5 October 2020 to 31 March 2022, businesses of any size can claim the Boosting Apprenticeship Commencements wage subsidy for new apprentices or trainees who commence during this period. Eligible businesses will be reimbursed up to 50 per cent of an apprentice or trainee’s wages of up to $7,000 per quarter for 12 months.

SME Recovery Loan Scheme – The Government will support the economic recovery of, and provide continued assistance to, firms that received JobKeeper or are eligible flood-affected businesses through the SME Recovery Loan Scheme.

The Government will provide participating lenders with a guarantee for 80 per cent of secured or unsecured loans of up to $5 million for a term of up to 10 years and with interest rates capped at 7.5 per cent, with some flexibility around variable rate loans. Loans can be used by the SME for a broad range of business purposes, including to support investment and refinancing existing loans. Lenders will be able to offer borrowers a repayment pause of up to two years.

To be eligible, SMEs, including self-employed individuals and non-profit organisations, will have a turnover of up to $250 million and have been either:

recipients of the JobKeeper Payment between 4 January 2021 and 28 March 2021

located or operating in a local government area that has been disaster declared as a result of the March 2021 New South Wales floods and were negatively economically impacted.

Superannuation

Repealing the work test for voluntary superannuation contributions – The Government will allow individuals aged 67 to 74 years (inclusive) to make or receive non-concessional (including under the bring-forward rule) or salary sacrifice superannuation contributions without meeting the work test, subject to existing contribution caps. Individuals aged 67 to 74 years will still have to meet the work test to make personal deductible contributions. The measure will have effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

Currently, individuals aged 67 to 74 years can only make voluntary contributions (both concessional and non-concessional) to their superannuation, or receive contributions from their spouse, if they are working at least 40 hours over a 30-day period in the relevant financial year.

Removing the requirement to meet the work test when making non-concessional or salary sacrifice contributions will simplify the rules governing superannuation contributions and will increase flexibility for older Australians to save for their retirement through superannuation.

Reducing the eligibility age for downsizer contributions – The Government will reduce the eligibility age to make downsizer contributions into superannuation from 65 to 60 years of age. The measure will have effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

The downsizer contribution allows people to make a one-off, post-tax contribution to their superannuation of up to $300,000 per person (or $600,000 per couple) from the proceeds of selling their home. Both members of a couple can contribute in respect of the same home, and contributions do not count towards non-concessional contribution caps.

This measure will allow more older Australians to consider downsizing to a home that better suits their needs, thereby freeing up the stock of larger homes for younger families.

Relaxing residency requirements for SMSFs – The Government will relax residency requirements for SMSFs and small APRA-regulated funds (SAFs) by extending the central control and management test safe harbour from two to five years for SMSFs, and removing the active member test for both fund types. The measure will have effect from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects to have occurred prior to 1 July 2022.

This measure will allow SMSF and SAF members to continue to contribute to their superannuation fund whilst temporarily overseas, ensuring parity with members of large APRA-regulated funds. This will provide SMSF and SAF members the flexibility to keep and continue to contribute to their preferred fund while undertaking overseas work and education opportunities.

First Home Super Saver Scheme FHSSS — The Government will increase the maximum releasable amount of voluntary concessional and non-concessional contributions under the First Home Super Saver Scheme (FHSSS) from $30,000 to $50,000.

Voluntary contributions made from 1 July 2017 up to the existing limit of $15,000 per year will count towards the total amount able to be released. The increase in maximum releasable amount will apply from the start of the first financial year after Royal Assent of the enabling legislation, which the Government expects will have occurred by 1 July 2022. This measure will ensure the FHSSS continues to help first home buyers in raising a deposit more quickly.

Super Guarantee (SG) – Abolishing the $450 pm income threshold – The current $450 per month minimum income threshold before SG contributions become payable will be removed. This means employees at all income levels will receive SG contributions. Note: The SG rate is currently legislated to increase to 10% from 1 July 2021 and incrementally to 12% in the following years. This remains unchanged.

Childcare Subsidies

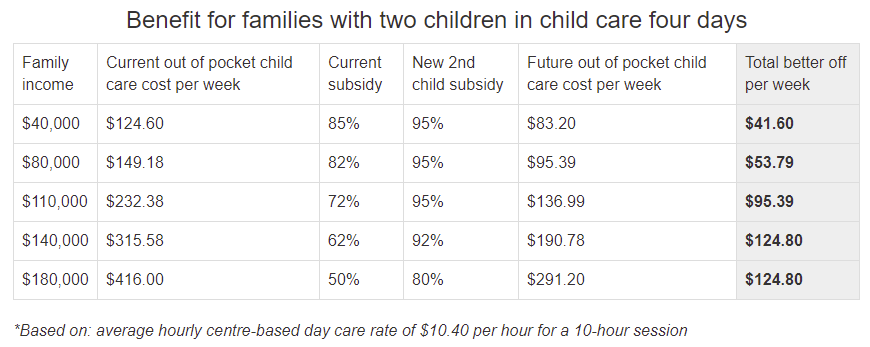

Child care subsidy – Starting on 1 July 2022 the Government will provide $1.7 billion over 5 years (and $671.2 million per year ongoing) to:

Increase the child care subsidies available to families with more than one child aged five and under in child care, benefitting around 250,000 families

for those families with more than one child in child care, the level of subsidy received will increase by 30% to a maximum subsidy of 95% of fees paid for their second and subsequent children.

remove the $10,560 cap on the Child Care Subsidy, benefitting around 18,000 families.

Source: https://ministers.treasury.gov.au/ministers/josh-frydenberg-2018/media-releases/making-child-care-more-affordable-and-boosting

Social Security

Increasing the Flexibility of the Pension Loans Scheme – The Government will provide $21.2 million over four years from 2021-22 to improve the uptake of the Pension Loans Scheme by:

- allowing participants to access up to two lump sum advances in any 12-month period, up to a total value of 50 per cent of the maximum annual rate of the Age Pension

- introducing a No Negative Equity Guarantee so borrowers will not have to repay more than the market value of their property

Other Housing Measures

Extending the First Home Loan Deposit Scheme (FHLDS) – The Government has announced that an additional 10,000 places will be made available in the FHLDS (New Homes). The new places will be available in the 2021-22 year. The extension of the FHLDS will apply to first home buyers who buy a newly constructed home or who build a new home.

The FHLDS allows first home buyers/builders to borrow more than the standard 80% of the property’s value with only a 5% deposit, with the balance (15%) being underwritten by a government agency in the event of loan default and shortfall. The FHLDS allows eligible first home buyers to borrow more without paying the premium for Lender’s Mortgage Insurance which would otherwise apply in such situations.

Application for a place in the scheme is made by participating lenders on behalf of the borrowers when the borrowers make their loan application.

HomeBuilder Program – the Government will extend the construction commencement requirement under this existing program from the existing 6 to 18 months.

Family Home Guarantee Scheme – the Government will establish a program similar to the FHLDS above to allow eligible single parents with dependants to enter or re-enter the housing market with a deposit as little as 2%. The scheme will have 10,000 places and be available from 2021-22.

Lastly, what it means for the market

The 2021/22 Federal Budget largely plays a background role this year – with the early cycle and re-opening dynamics of the domestic and global economy a far more important factor. At the margin though, this Budget will provide some support to certain sectors – particularly the construction and materials sectors (given the extra infrastructure spend) and some support to education providers (given the childcare subsidies). More broadly though, we expect that the continued economic recovery will continue to support the cyclical and value segments of the equity market.

We think there is little in this Budget that is of big consequence for interest rates or government bonds. The direction of global overseas interest rates and the evolution of the RBA’s monetary policy will be more important. We see the potential for longer-dated government bond yields to drift a bit higher through the year on the back of the improving economic outlook. However, this upside is likely to be limited, as we expect the RBA to continue its Quantitative Easing (QE) program through the rest of the year.

Like the outlook for government bonds, we see this Budget having limited impact on the Australian dollar. While commodity prices remain supportive, the Australian dollar has become a de facto policy target of the RBA and the RBA has been active in trying to contain interest rate differentials through its QE program and thus try and reduce further appreciation in the Australian dollar.

This is a business-friendly budget and we do not see anything that is a major concern for the overall equity market. The ‘pro-growth’ focus should be welcomed, following years of budget repair, particularly when the economic recovery remains vulnerable to disruptions and the vaccine rollout has underwhelmed.

Corporate confidence and conditions are at all-time highs and should remain in positive territory following this Budget. The focus on returning the economy to full employment should provide a solid backdrop for domestic activity to continue increasing and support already positive earnings momentum.

If full employment is achieved it would place some upward pressure on wages growth and interest rate expectations, but we think it is far too early for investors to start pricing this in as enough excess capacity remains for inflation pressures to stay muted.

Implications for Australian assets

Cash and term deposits – with the cash rate likely remain at 0.1%, cash & bank deposit returns will stay low for a long time.

Bonds – still low bond yields combined with a rising trend in yields as the economy recovers resulting in capital loss mean that medium-term bond returns are likely to be low.

Shares – ongoing fiscal stimulus, strong growth and low rates all remain supportive of Australian shares, notwithstanding the high risk of a short-term correction.

Property – more home buyer incentives along with low rates & economic recovery will likely see house prices rise further this year and next although the pace of increase is likely to slow.

The $A – ongoing fiscal stimulus, rising commodity prices and a declining $US point to more upside for the $A.

Sources:

http://contentz.mkt6994.com/lp/41985/282118/Federal_Budget_Flyer.pdf

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments