23 Oct What Happens to Global Share Markets if Interest Rates Stay Higher for Longer?

Falling inflation feels pretty good so far

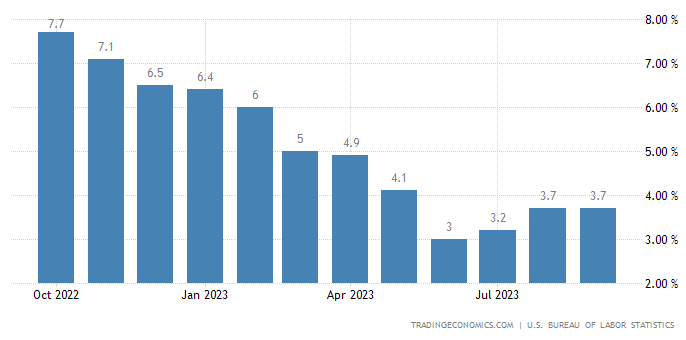

Inflation across the major global economies has come down a long way over the last year. In the US, it reached a peak of 9.1 per cent in June 2022 before falling back to 3.7 per cent in August 2023. This followed a series of 11 interest rate hikes by the US Federal Reserve.

This period of falling inflation has been marked by unexpectedly resilient consumer spending and strong equity market returns, despite rising borrowing costs. Following progress towards the 2.0 per cent inflation target in the US and elsewhere, it is tempting to hope inflation will maintain its trajectory and reach its target.

Unfortunately, this happy ending may not be realised in the short-term, or consistently over the longer term.

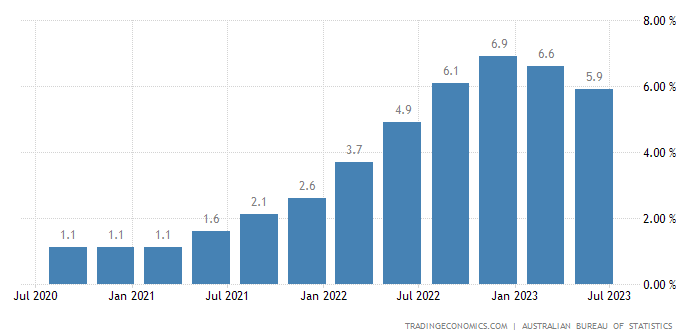

Although the core inflation rate has trended down in Australia, it is still beyond the RBA’s target of 2-3%.

Why could interest rates stay higher for longer?

Interest rates will be determined by central banks’ inflation expectations. Inflation is driven by spending, which is driven by wages. US wage growth has fallen to 4.3 per cent but getting it down to the 3.5 per cent level (consistent with 2.0 per cent inflation plus 1.5 per cent productivity growth) will be challenging in a still tight labour market.

Moreover, recent falls in inflation partly reflect earlier one-off price increases. Energy costs soared after Russia invaded Ukraine and COVID-related supply chain bottlenecks impacted goods prices. These rises are now dropping out of annual inflation data.

Core inflation faces further near-term pressures as spending shifts from goods to services, where inflation is higher due to labour shortages. Meanwhile, rents continue to grow faster than broader inflation as housing demand exceeds supply.

Over the longer term, inflationary pressures are likely to linger due to weak productivity growth, deglobalisation, lower levels of immigration, and the cost of the energy transition. A higher neutral rate of interest will also impact central bank decisions.

What does higher for longer mean for equities?

Conventional wisdom tells us that higher interest rates are generally not great for share market investing.

Higher rates impact companies’ earnings directly when their own borrowing costs increase, or indirectly if they cause new projects that could grow earnings to be rejected.

Furthermore, higher interest rates put upward pressure on longer-term bond yields, which drive up equity discount rates that analysts use to value companies. (Asset values fall as discount rates rise.)

However, the impact of higher interest rates varies across stocks.

Highly geared companies face greater challenges in a sustained period of high borrowing costs, especially businesses with shorter debt maturity profiles.

High interest rates suppress spending and stop businesses from passing through price rises, which especially impacts those most sensitive to the slowing consumer cycle.

Companies able to generate positive free cash flow should fare better. Free cash flow not only pays interest costs but finances expansion without either raising debt in what may be uncertain credit markets or issuing new equity capital.

What does this mean for investors?

The global economy has now left behind the “great moderation” when inflation and interest rates were low, and economic growth stable. Higher interest rates can be expected to bring greater volatility to economies, share markets, and individual stocks.

This does not mean that investing in a well-managed diversified global equity portfolio isn’t appropriate for many long-term investors. However, the following are worth considering:

- Beware of the zombies – companies with just enough operating profit to meet interest payments but insufficient to repay debt or invest in new growth opportunities are likely to struggle in periods of high interest rates.

- Look for companies with strong balance sheets, which are less vulnerable to higher interest rates and adverse credit environments.

- Companies that grow earnings and dividends – through aligning to structural growth trends such as artificial intelligence, decarbonisation, automation, global travel, onshoring or the ageing population – may enjoy greater resilience than those marketing discretionary items to stretched mortgage holders.

This article was originally produced by Tim Richardson CFA, investment specialist, Pengana Capital Group. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments