16 Mar What does gender equality have to do with making money?

Key points

- Australia’s national pay gap is 13.4% with women earning about $25k less per annum overall

- Females have on average 47% less superannuation than men on average when they reach retirement

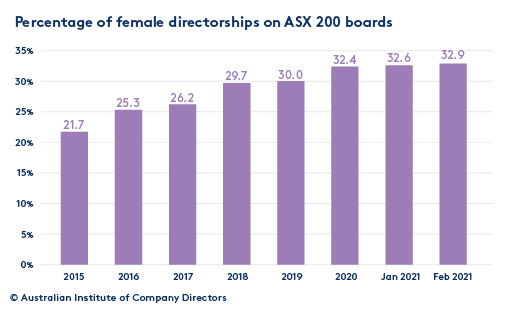

- Women are represented on 32.9% of the boards in the companies on the ASX200

- When female representation on boards of ASX listed companies increase by 10% or more, the market value increases by 4.9%

- The increase in ROE for companies with strong female leadership compared to companies without a critical mass of women at the top is 36.4%

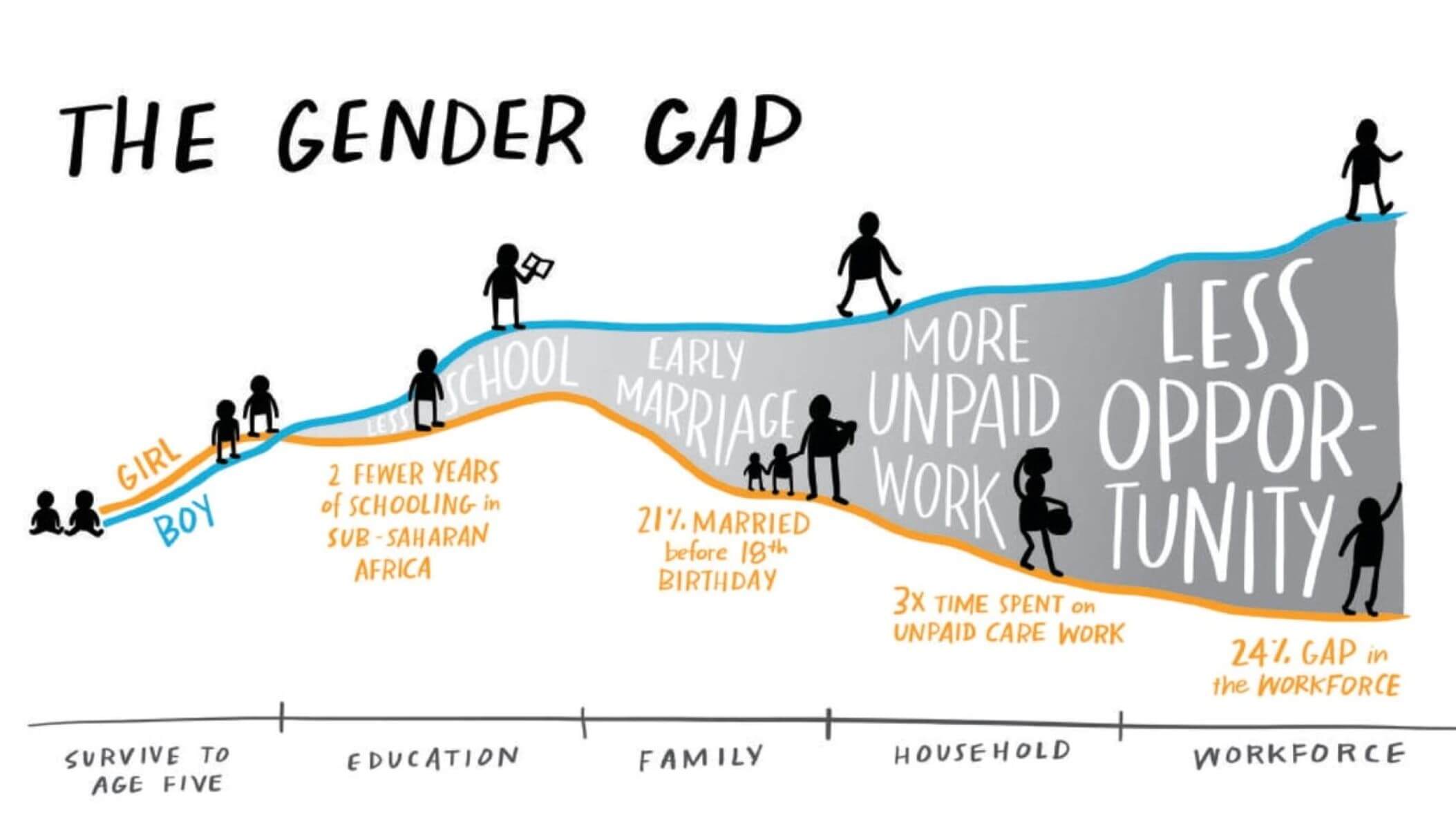

As a father of two girls, I often reflect on the world that they will grow up in. Being born a girl shouldn’t be seen as a disadvantage but how their life could potentially play out tells a very different story.

For many that don’t know me, also don’t know that my family came to Australia in 1983 as refugees from Cambodia. If my daughters had been born in Cambodia they would grow up in a world where only 15% of adult women achieve a level of secondary education as of 2019, 32% of women experience emotional abuse from their partner and 21% experience physical or/and sexual violence. One in five men reported raping a woman or girl. It gets worse if they were born in Sub-Saharan Africa, one of the poorest regions in the world.

Source: 2019 Goal Keepers Report – Gates Foundation

Fortunately for them, they were born in the ‘lucky country,’ however, it’s not all rosy for women in Australia either. The national pay gap is at 13.4% (on average women take home about $25k less than men), 64% of women with children 5 years old or younger participate in the workforce compared to 95% of men, possibly because women make less than men so it only makes sense for them to stay home and look after the kids if you had to choose. This difference in pay and working years also has a knock-on effect on their final superannuation balance and thus the quality of life in retirement, women retire with 47% less superannuation than men and at the same time live on average 5 years longer than men.

Source: Workplace Gender Equality Agency

Source: Workplace Gender Equality Agency

This divergence also starts at a very young age in a girl’s development, when my wife and I attended a school tour at a local all-girls private high school, I was shocked to find out that sports and most extracurricular activities (like Duke of Edinburgh’s Award scheme) were optional at a girls school. To be honest, I was probably more shocked at the extra cost if they wanted to take part but there are numerous benefits of participating in sports at an early age like building self-confidence, leadership and teamwork skills, not to mention the health benefits of staying fit and active. Then again why would they pursue a career in sports? In 2021, the highest-paid Women’s National Basketball Association (WNBA) player is paid USD$221k, whilst the highest-paid male counterpart is paid about USD $43mil. On a corporate level, sports participation at the early stages in life may carry on to greater interest from a spectator perspective and thus driving ratings and advertising revenue.

As a financial adviser, I have a duty to my clients to help them live their best life and often money is the fuel to help them achieve this. So what does this all have to do with making money on your investments?

How gender fits into ESG?

Let’s start at the very top. As at 28 Feb 2021, the percentage ASX200 boards with female representation was 32.9% and this has been a trend that has been growing over the past few years. Yes, it is nice to add a female’s perspective to the boards but does it make good financial sense?

When we talk about ESG (Environmental, Social and Governance) as a way of measuring the risk of loss in a business most people tend to focus on the ‘E’ and think it’s just a whole lot of saving the planet talk but fail to understand the link between gender diversity and good corporate governance (the ‘G’ in ESG) and how it impacts a company’s bottom line and in particular their share price. Here’s what one of the country’s largest fund managers (Australian Ethical) in the ethical space has to say:

According to Workplace Gender Equality Agency (WGEA), having a female CEO leads to a 5% increase in the market value of that ASX listed company and when female representation on boards of ASX listed companies increase by 10% or more, the market value increases by 4.9%. Fund managers are taking note of these numbers and because they hold a significant number of shares and in turn votes at company meetings that impact executive remuneration, the conversation in boardrooms has moved from “why do we need a woman” to “why don’t we need a woman” on the board. BetaShares (AU based fund manager) is another good example of a company, for their ethical funds, using their shareholder voting power across a whole range of issues, including seeking to require companies to adopt or improve climate-related or sustainability-related disclosure, increasing gender pay transparency, reporting on political donations and lobbying, and animal welfare reporting. If you think about it from a different angle, say invested your money into a company whose track record for gender equality has been quite poor and then capital begins to exit as fund managers and stakeholders look to divest, what do you think will happen to the share price?

This good performance is not just localised here in Australia, according to StateStreet and MSCI, research has shown that the increase in Return on Equity for companies with strong female leadership compared to companies without a critical mass of women at the top is 36.4%. Research shows that companies with greater levels of gender diversity have stronger financial performance as well as fewer governance-related issues such as bribery, corruption, shareholder battles and fraud.

S&P Global found women to be the most underutilized source of growth that could send global market valuations soaring. Acceleration in U.S. GDP growth under increased female labour force participation could add a whopping $5.87 trillion to global market capitalization in 10 years. For every 1% of GDP growth, the S&P 500 returns 3.4% on average annually. Around the world, each additional percentage point of U.S. GDP growth has also translated into a 4% jump in equities in Germany, 6.2% in China, and a staggering 9.3% in Korea.

The economic multiplier effect

Growing gender equality and women’s increasing household spending coincides with rising incomes and rapid growth in the global middle class. As more women enter the labour force and/or grow their own businesses, they show a higher propensity to use their increased earnings to buy goods and services to improve family welfare. This can create a cycle where female spending fuels economic growth. This added spending generates more revenue for global companies and economies. It’s a win/win scenario which in turn helps generate positive returns for investments.

As you can see, the further we progress towards gender equality so too do we progress with financial prosperity.

This article was produced by Michael Sik, Director and Financial Adviser of FinPeak Advisers.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Sources:

https://www.wgea.gov.au/newsroom/gender-equality-in-australia-a-guide-to-gender-equality-in-2020

https://www.wgea.gov.au/publications/australias-gender-pay-gap-statistics

https://www.wgea.gov.au/publications/australias-gender-equality-scorecard

https://www.womeninsuper.com.au/content/the-facts-about-women-and-super/gjumzs

https://www.wgea.gov.au/publications/gender-equity-insights-series

https://www.finpeak.com.au/wp-content/uploads/2021/03/she-drive-change-brochure.pdf

https://www.spglobal.com/en/research-insights/articles/how-gender-fits-into-esg

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments