30 Nov Understanding Private Debt

Understanding Private Debt: A Strategic Component of Investment Portfolios

In the realm of investment strategies, private debt has gained significant attention and prominence among discerning investors seeking diversified opportunities. Characterized by its distinct nature and potential for attractive risk-adjusted returns, private debt plays a crucial role in bolstering investment portfolios. This article aims to demystify the concept of private debt and elucidate its relevance as a strategic investment avenue.

Defining Private Debt

Private debt refers to capital borrowed by companies or entities from private sources, excluding traditional financial institutions like banks. This form of debt typically involves direct lending, where investors extend funds to businesses, often in the form of loans, credit facilities, or bonds. Unlike public debt instruments traded on stock exchanges, private debt securities are not available for public trading and are negotiated directly between the borrower and the lender.

Diverse Investment Opportunities

Private debt offers a spectrum of investment opportunities across various segments:

- Direct Lending: Investors lend funds directly to companies, mitigating intermediary costs and potentially earning higher returns compared to traditional fixed-income instruments.

- Mezzanine Financing: Involves providing capital to businesses, usually in the form of subordinated debt, with an equity component. This type of financing holds the potential for higher returns but may come with increased risk.

- Private Placements: Investors can participate in offerings of debt securities by private companies, often seeking capital for expansion or strategic initiatives. These placements offer a chance to diversify portfolios beyond conventional market options.

Benefits of Including Private Debt in Portfolios

Enhanced Portfolio Diversification

Private debt presents an avenue for diversification, offering exposure to assets uncorrelated with public markets. Its distinct nature can help offset market volatility, potentially enhancing overall portfolio stability.

Yield Enhancement

Compared to traditional fixed-income securities, private debt often yields higher returns. Investors can benefit from attractive risk-adjusted returns, especially in a low-interest-rate environment.

Risk Mitigation and Consistent Income

Private debt instruments are typically secured against tangible assets or collateral, reducing the risk of default. Moreover, regular interest payments contribute to a steady income stream for investors.

Access to Niche Markets

Investing in private debt provides access to sectors or companies that might not be available through public markets. This access allows investors to capitalize on niche opportunities and specialized industries.

Considerations and Risks

While private debt offers lucrative prospects, it’s essential to acknowledge the associated risks:

- Illiquidity: Investments in private debt tend to be less liquid compared to publicly traded assets, potentially limiting the ability to quickly sell or exit positions.

- Credit and Default Risk: Despite collateral, there’s a risk of borrower default, especially in economic downturns. Thorough due diligence on borrowers and risk assessment is crucial.

- Market Fluctuations: Changes in economic conditions or regulatory environments can impact the value and performance of private debt investments.

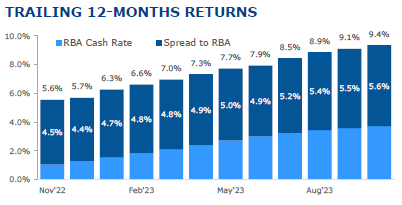

Below are the typical returns you would expect from this particular asset class at the composition of the diverse industry of borrowers:

Conclusion

In conclusion, private debt, with its unique characteristics and potential for attractive risk-adjusted returns, serves as a compelling component of an investment portfolio. Its ability to diversify, generate consistent income, and access niche markets makes it an enticing option for investors seeking to optimize their portfolios. However, prudent due diligence, risk assessment, and a balanced approach remain essential when incorporating private debt into an investment strategy.

Understanding the intricacies of private debt empowers investors to make informed decisions, harnessing its potential to augment and fortify investment portfolios in pursuit of long-term financial objectives.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments