24 Oct Things You Need To Know About Bonds

WHAT IS A BOND?

At their most basic level, bonds are a way for one entity to raise money by borrowing from another. For example, governments and corporations issue bonds to raise money from investors when they need new sources of capital to fund their activities.

When investors purchase a government bond, they are effectively lending the government money. When they buy a corporate bond, they are lending a company money.

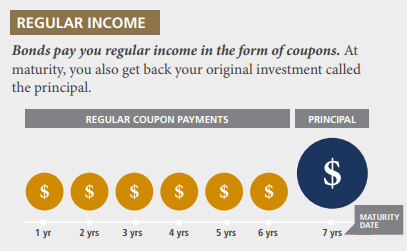

Like a loan, a bond pays a periodic interest payment known as a coupon to the bondholder. At the end of the bond’s life – called maturity – the principal is paid back to the investor.

Let’s look at an example

A company wants to build a new manufacturing plant that will cost $1 million. To raise the money needed, company executives decide to issue a corporate bond. Each bond will be issued at $1,000 – this is known as the face value of the bond.

The company – or bond issuer – offers a coupon of 5% per annum to be paid quarterly. The bonds will mature after five years, at which time the company will repay the $1,000 face value to each bondholder.

THE DIFFERENT TYPES OF BONDS

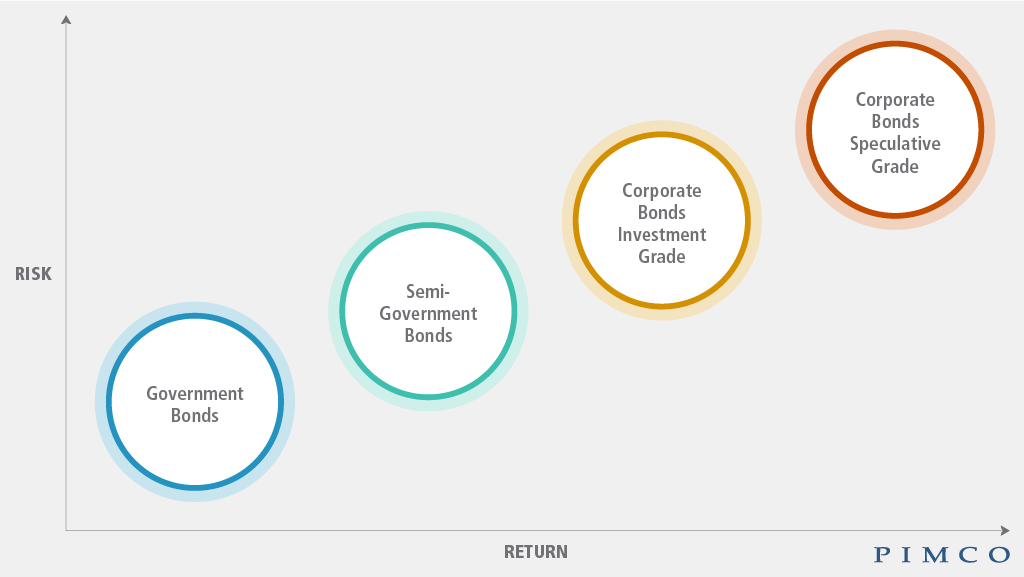

Broadly speaking, government bonds and corporate bonds remain the largest sectors of the market. The chart below provides an overview of the key categories of bonds through a risk/return lens.

In developed market economies, government bonds are generally considered low- risk investments. However, this is not true for all markets, and investors need to be aware that some government bonds, for example those issued in emerging markets, may carry higher levels of risk. On the flipside, such bonds can provide investors with access to investments offering different income and growth profiles.

Corporate bonds fall into two broad categories – investment grade and speculative grade (also known as high yield or junk bonds). Speculative-grade bonds are issued by companies perceived to have lower credit quality and higher default risk than more highly rated investment-grade companies. Ratings can be downgraded if the credit quality of the issuer deteriorates. Conversely, they can be upgraded if fundamentals improve.

HOW DO BONDS GENERATE A RETURN?

HOW BONDS GENERATE INCOME

As we discussed in Topic 1 of this series, governments and corporations issue bonds when they need to raise money. In return for buying the bonds, the investor – or bondholder – receives periodic interest payments known as coupons. The coupon payments, which may be made quarterly, twice yearly or annually, provide regular, predictable income to the investor.

At the end of the bond’s life known as maturity, the principal is paid back to the investor.

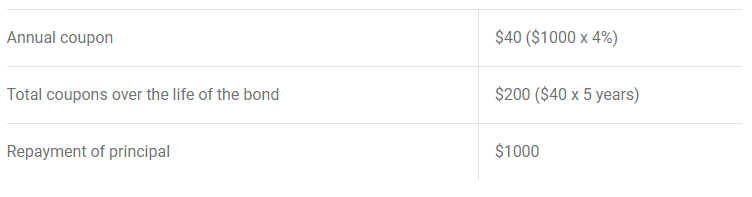

For example, a company may decide to issue five-year bonds with a face value of $1,000 each paying an annual coupon of 4%. The investor will pay $1,000 to buy the bond and, assuming there are no defaults, they will receive:

MAKING MONEY FROM THE SECONDARY BOND MARKET

Just like shares, investors can buy and sell bonds in a secondary market, where the prices of bonds fluctuate in response to market conditions. Investors can take advantage of these price movements as another way of making money from bonds.

Investors may be confused about why the price of bonds can change when the face value is fixed. An important distinction to make is that the face value of a bond never changes, while the market price can change daily.

HOW ARE BONDS DIFFERENT FROM SHARES?

BONDS VERSUS SHARES: SIMILARITIES AND DIFFERENCES

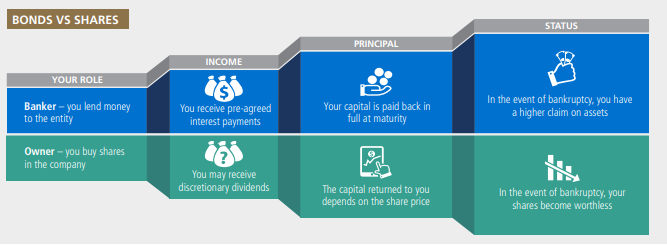

If investors want to invest in a company, they can choose to purchase its shares or its bonds. Both are a way for the company to raise money needed to fund its activities. The overall mix of debt and equity that the company uses is referred to as its capital structure.

If investors buy shares in the company, they become part-owners of the company. If investors buy the company’s bonds, then they become lenders to the company.

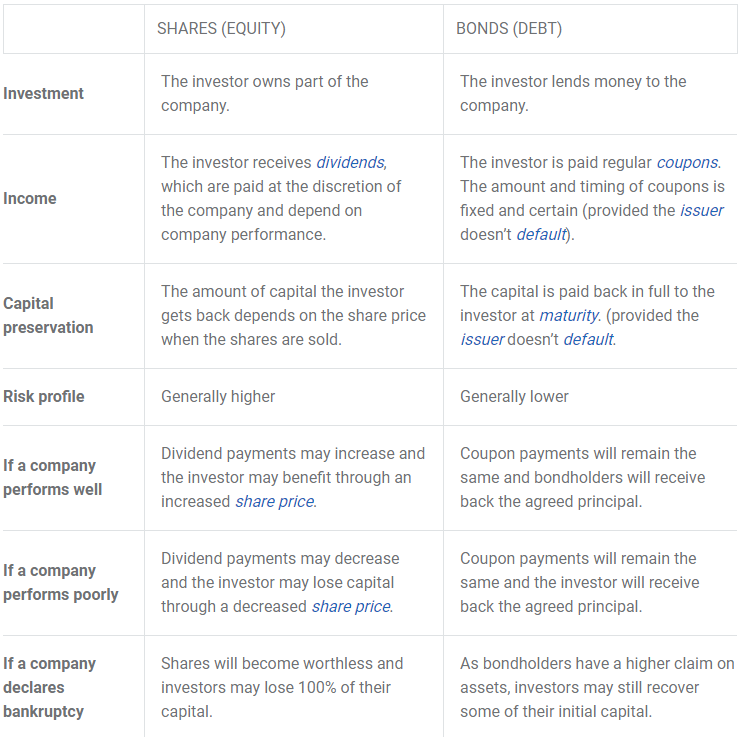

There are several key differences between an investment in bonds and an investment in shares, as highlighted in the table below.

THE RISK-RETURN PROFILES OF BONDS VERSUS SHARES

During recent decades, bonds have evolved into a $100 trillion global market. Not surprisingly, there is a wide range of bonds available, each offering different risk and return profiles.

Most bond investments, however, are designed to provide regular income and capital preservation. As such, they are generally considered to be a lower risk investment when compared with shares.

The chart below provides a high-level overview of where bonds fall on the risk and return spectrum relative to shares and several other asset classes.

What role do bonds play in a portfolio?

THE ROLE OF BONDS IN A PORTFOLIO

Investors include bonds in their investment portfolios for a range of reasons including income generation, capital preservation, capital appreciation and as a hedge against economic slowdown. In this section, we look at each in turn.

- Income generation

Bonds provide investors with a source of income in the form of coupon payments, which are typically paid quarterly, twice yearly or annually. The investor can use the income generated by their investments for spending or reinvestment. Shares also provide income in the form of dividends: however, such payments are less certain and tend to be less than bond coupons. - Capital preservation

Unlike shares, the principal value of a bond is returned to the investor in full at maturity. This can make bonds attractive to security-minded investors who are concerned about losing their capital. - Capital appreciation

Although bonds are often viewed as a capital preservation tool, they also offer opportunities for capital appreciation. This occurs when investors take advantage of rising bond prices by selling their holdings prior to maturity on the secondary market. This is often referred to as investing for total return and is one of the more popular bond investment strategies. - Hedge against economic slowdown

While investors in shares typically do not welcome a slowdown in economic growth, it can be a good thing for bond investors. This is because a slower growth usually leads to lower inflation, which makes bond income more attractive. An economic slowdown is also usually negative for company profits and share market returns, adding to the attractiveness of bond income during such a time.

What impacts the price and performance of bonds?

WHY BOND PRICES MOVE UP AND DOWN

Investors who plan on holding their bond until maturity don’t need to worry about the movement of bond prices on the secondary market as they will be repaid their principal in full at maturity, barring a default. But for those looking to sell their securities sooner, an understanding of what drives secondary market performance is essential.

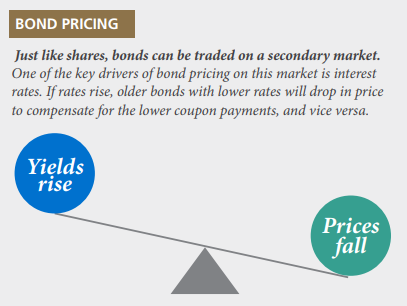

The price of a bond relative to yield is key to understanding how a bond is valued. Essentially, the price of a bond goes up and down depending on the value of the income provided by its coupon payments relative to broader interest rates.

If prevailing interest rates increase above the bond’s coupon rate, the bond becomes less attractive. In this situation, the bond price drops to compensate for the less attractive yield. Conversely, if the prevailing interest rate drops below the bond’s coupon rate, the price of the bond goes up as it becomes more attractive.

For example, if a bond has a 4% coupon and the prevailing interest rate rises to 5%, the bond becomes less attractive and so its price will fall. On the other hand, if a bond has a 4% coupon and the prevailing interest rate falls to 3%, that bond becomes more attractive which pushes up its price on the secondary market.

FACTORS THAT INFLUENCE THE PERFORMANCE OF BONDS

Apart from interest rate movements, there are three other key factors that can affect the performance of a bond: market conditions, the age of a bond and its rating. Let’s look at each in turn.

- Market conditions

Broader market conditions can have on impact on bonds. For example, if the stock market is buoyant, investors typically move out of bonds and into equities. By contrast, when the stock market is going through a correction, investors may seek the safety of bonds. - Ratings

Bonds are assigned credit ratings by ratings agencies, such as Moody’s and Standard & Poor’s. The ratings signal to investors the agency’s view of the safety of the bond. If a bond’s credit rating is downgraded, the bond becomes less attractive to investors and its price will probably fall. - The age of a bond

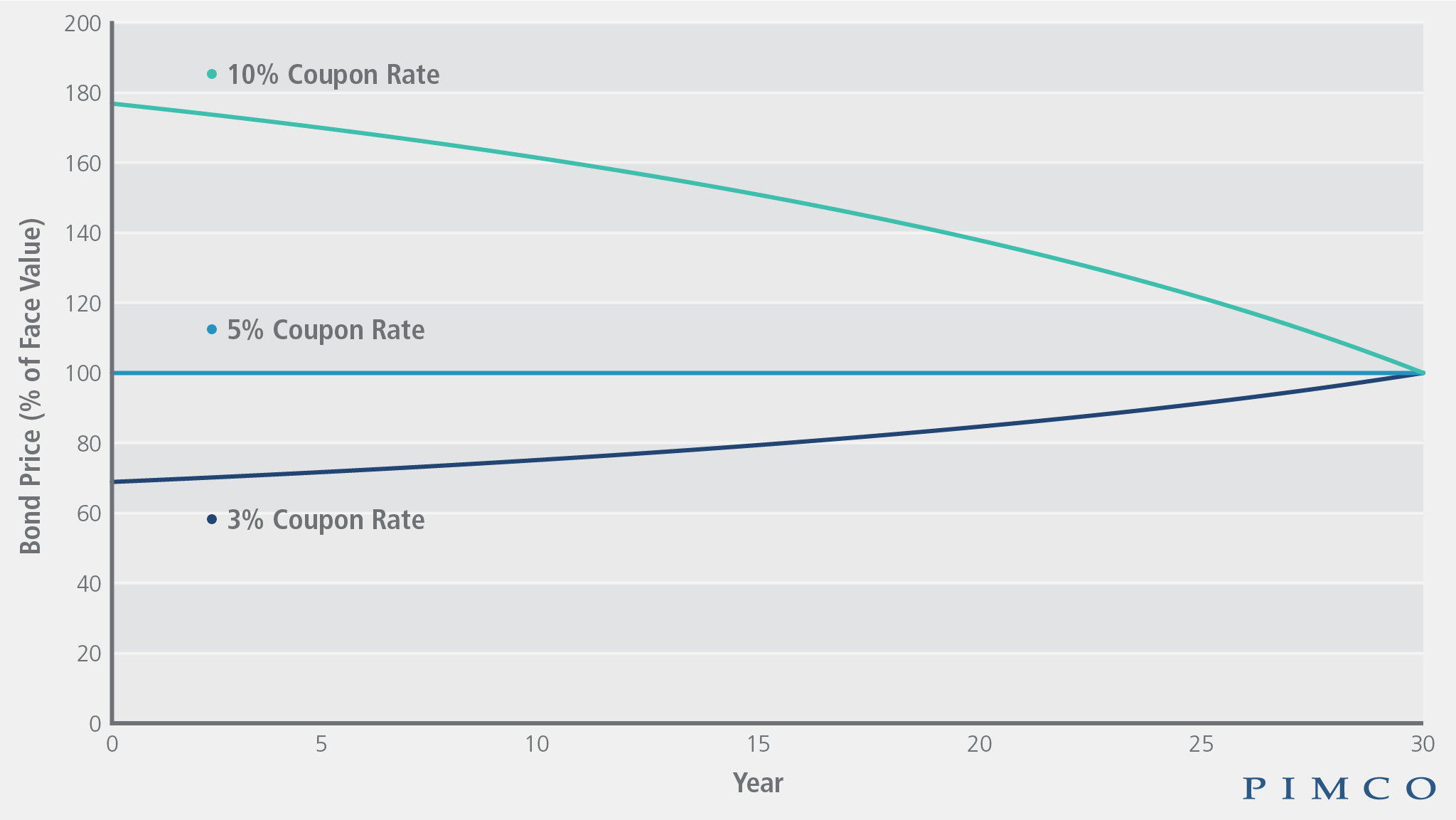

The age of a bond relative to its maturity date can affect pricing. This is because the bondholder is paid the full face value of the bond when the bond reaches maturity. As the maturity date gets closer, the bond’s price will move towards par. The diagram below shows the effect of time on the price of a bond when the prevailing interest rate is 5%.

What this chart tells us

- Blue line (at par) – The blue line that runs across the middle of the chart represents a bond that has a coupon of 5% – the same as the current prevailing interest rate. As such, this price of this bond is also at par ($100)

- Green line (premium to par) – The green line represents a bond offering a coupon of 10%. Because it is paying more than the prevailing interest rate of 5%, it costs more to buy ($180 instead of $100).

- Black line (discount to par) – The black line represents a bond offering a coupon of 3%, which is below the prevailing interest rate of 5%. As such, this bond costs less to buy ($70).

All three bonds converge on the same price at maturity because they will all repay the same face value amount of $100.

This article was originally produced by PIMCO. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments