05 Jan Tech Talk – What are the different styles of investing?

Investing can take many different forms, and the style of investing that is right for you will depend on your financial goals, risk tolerance, and investment horizon. Some common styles of investing include:

- Growth investing;

- Value investing;

- Income investing;

- Index/passive investing; and

- Fundamental/active investing.

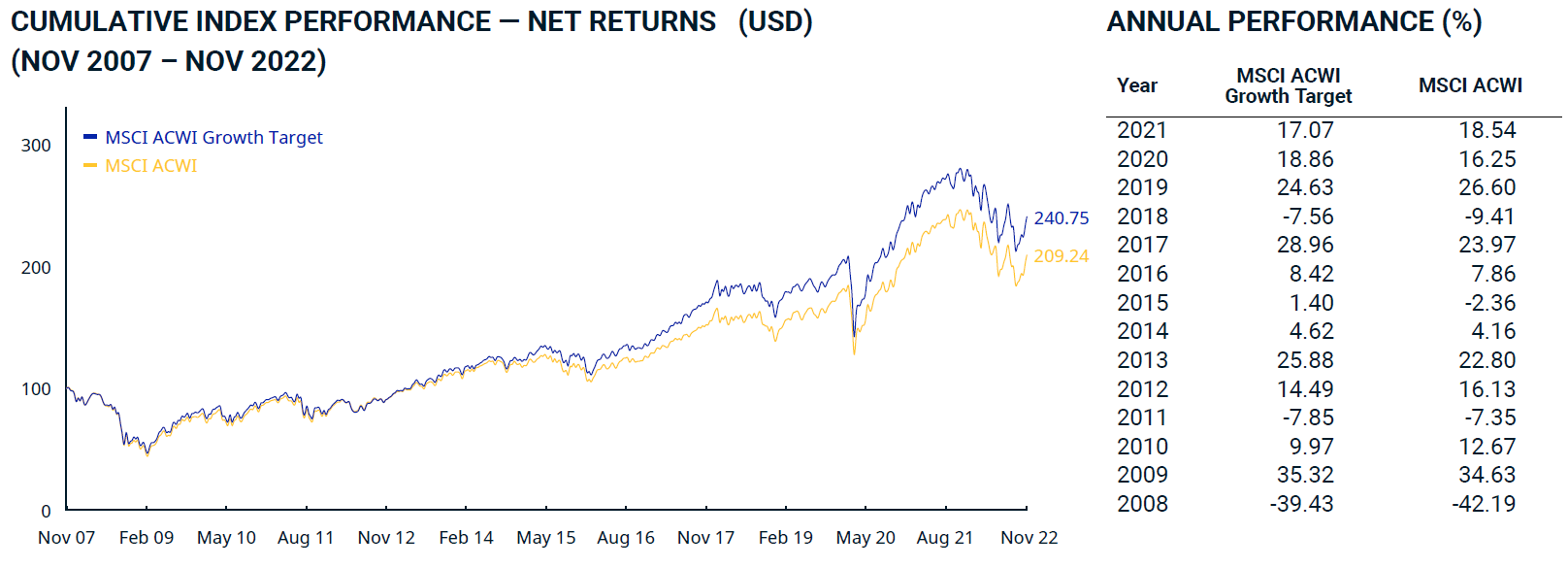

Growth Investing

Growth investing involves investing in companies that are expected to grow at a faster rate than the overall market. Growth investors look for companies with strong potential for revenue and earnings growth, as well as other characteristics such as a competitive advantage in their industry, a solid management team, and a scalable business model. Growth stocks are often associated with younger, high-tech companies, but they can also be found in more established industries. The goal of growth investing is to ride the wave of a company’s expanding business and realise capital gains from the appreciation of the share price. However, growth investing can also be riskier than other styles of investing, as the market may not always recognise a company’s growth potential, leading to price volatility.

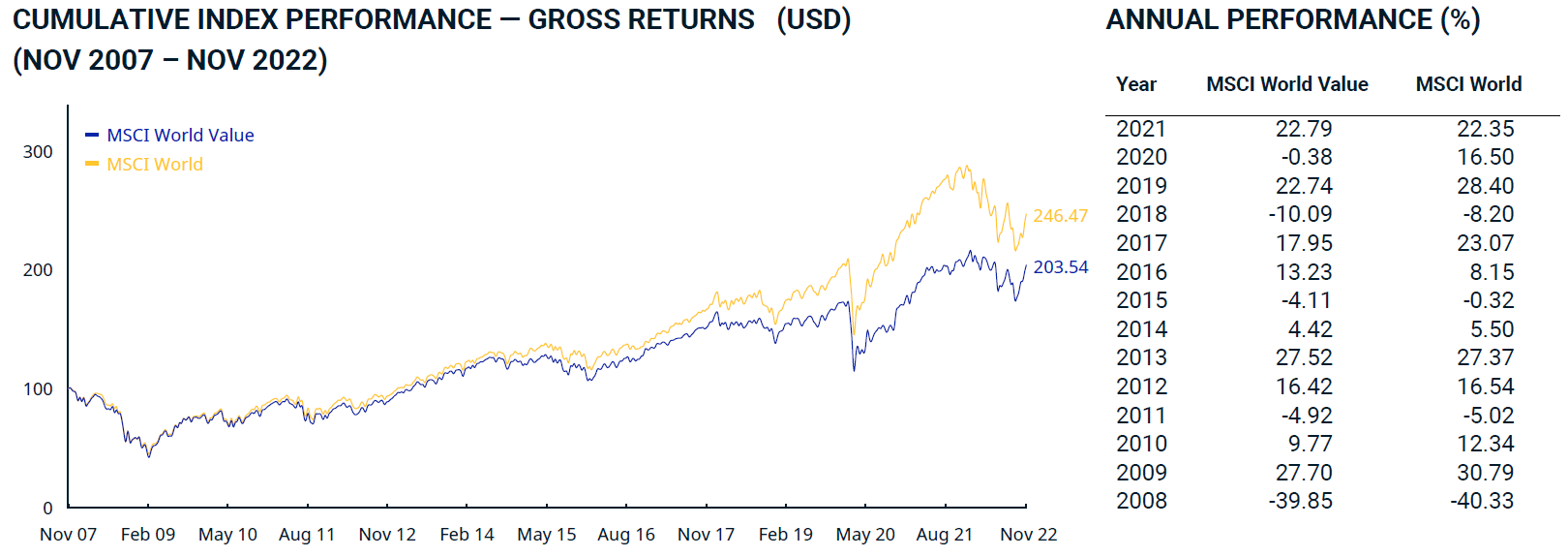

Value Investing

Value investing is a style of investing that involves seeking out undervalued companies with the expectation that the market will eventually recognise their true value. Value investors look for companies that are trading at a discount to their intrinsic value, which is typically calculated using fundamental analysis of a company’s financial statements and other key metrics. These metrics may include the price-to-earnings ratio, price-to-book ratio, and dividend yield. Value investors believe that by purchasing undervalued companies, they can realise capital gains as the market corrects its mispricing. Value investing can be a more conservative approach to investing, as the goal is to find companies with strong fundamentals that are being overlooked by the market. However, value investing can also be risky, as there is no guarantee that the market will eventually recognise a company’s true value.

Income Investing

Income investing involves investing in assets that generate regular income, such as dividends from stocks or interest from bonds. The goal of income investing is to generate a steady stream of cash flow from investments, rather than focusing on capital appreciation. Income investors may prioritise investments with high yields, such as high-dividend stocks or high-yield bonds, in order to maximise their income. Income investing can be a good strategy for investors who are retired or approaching retirement, as it can provide a dependable source of income to supplement other sources of retirement income. However, it is important for income investors to be mindful of the risk of their investments, as higher yielding assets may come with higher levels of risk. It is also important for income investors to consider the tax implications of their investments, as the income generated from some types of investments may be taxed at higher rates.

Index/Passive Investing

Index investing is a style of investing that involves investing in a basket of assets, such as a share or bond index, rather than picking individual shares or bonds. Index funds aim to track the performance of a particular index, such as the S&P 500 or the MSCI World Index, by holding a representative sample of the shares in the index. Index investing can be a passive approach to investing, as the goal is to match the performance of the index rather than outperform it. This can make index investing a lower-cost and lower-risk option compared to actively managed funds, which seek to outperform the market. Index investing can also provide diversification, as the baskets of assets in an index fund may hold a wide variety of shares from different sectors and industries. However, it is important for investors to understand the specific index that an index fund is tracking, as well as the fees and other expenses associated with the fund.

Fundamental/Active Investing

Fundamental investing is a style of investing that involves analyzing a company’s financial statements and other key metrics to make investment decisions. Fundamental investors seek to understand a company’s underlying business and financial health in order to identify companies with strong long-term potential. They may use tools such as financial ratios and fundamental analysis to evaluate a company’s financial statements and assess its profitability, growth potential, and risk. Fundamental investors may also consider non-financial factors such as a company’s competitive advantage, management team, and industry conditions. The goal of fundamental investing is to identify companies with strong fundamentals that are being overlooked by the market, with the expectation that the market will eventually recognize their value. However, it is important for fundamental investors to be aware of the limitations of financial analysis and to consider other factors that may impact a company’s future performance.

Conclusion

There are many different styles of investing to suit different investment goals, risk tolerances, and time horizons. Along with these styles, there are other factors that were not discussed in this article but also play an important role when constructing a portfolio such as ESG, momentum, quality and size. It is important for investors to carefully consider their investment objectives and risk tolerance before deciding on the right style of investing for them.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments