16 Jul Tech Talk: Investment Strategies for your super

Your super returns may be doing ok, but could they be better?

Being actively involved in how and where your super is invested, could make a real difference to your retirement savings over the long-term.

If you are considering going down this route, there are some factors to think about such as your retirement goals, how long you have until you retire and the amount of risk you’re comfortable taking on.

In this article, we consider four examples of investment strategies for your super.

The importance of diversification

Before we discuss the various investment strategies, it’s important to highlight the significance of diversification. Like any type of investment, spreading your super across different types of investment options can help to build a strong portfolio and manage risk.

Why?

Because if you were to invest all of your super into one asset class such as property, your investment may suffer a loss if the property market was to fall in value. However, if you spread your money across multiple assets, you may have a different result.

Different investment strategies

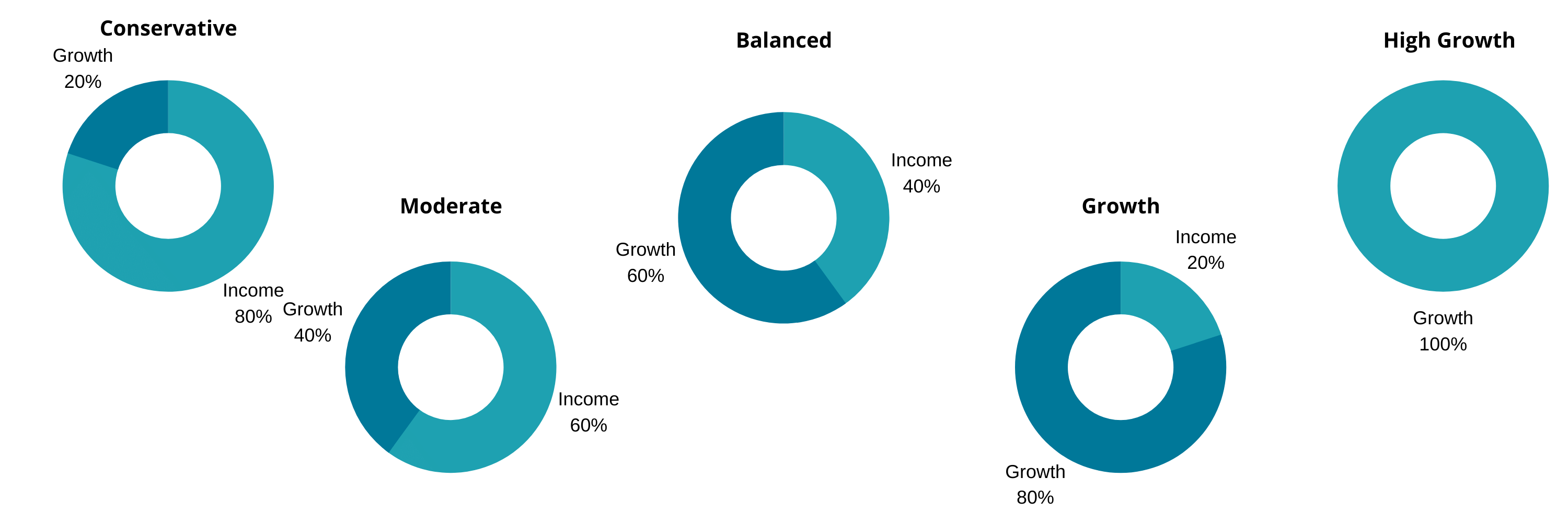

*Graphic is an example of different investment mixes between the various strategies

*Graphic is an example of different investment mixes between the various strategies

1. Growth

If you don’t think you’ll be accessing your super for at least 10 years or more, a growth strategy may work for you as a longer timeframe may help an investment portfolio withstand volatility while aiming for returns.

A growth strategy that follows a higher risk, higher return approach tends to have a larger focus on assets that are exposed to capital appreciation. That is, investing in assets which are expected to grow at a higher rate than the industry or overall market.

For instance, this may involve an investment of around 70-85 per cent in shares or property with the rest in fixed interest and cash-based investments.

Historically, over any 20-year period, a growth strategy has delivered better returns than more conservative portfolios which would mainly be invested in fixed interest and cash. However, over a short-term period, you may experience significant losses as a result of market volatility.3

Another key benefit of a growth strategy is that by making greater returns on your investment, your savings are more likely to keep up with the rising cost of living. This is arguably important because over time inflation may reduce the value of your retirement savings, which could make it difficult to maintain your standard of living when you’re retired.

2. Balanced

Similar to a growth strategy, if you aren’t planning to access your super anytime soon, opting for a balanced investment portfolio may be another option.

This strategy is aimed at balancing risk and return so your portfolio has enough risk to provide reasonable returns, but not enough to cause significant losses.

A balanced strategy typically involves investing around 60-70 per cent2 in shares or property, with the rest in fixed interest and cash-based investments.

3. Conservative

You may be considering how you could protect your capital if you want to access your super within 3-5 years.

A safe or conservative strategy follows a lower risk, lower return approach so it’s really about preserving the value of your investment portfolio. While there may be less risk of losing money, a downside could be that your returns may not keep up with inflation.

For example, this could involve investing around 20-30 per cent2 of your super in shares and property, with the rest in fixed interest and cash-based investments.

4. Ethical and Sustainable

Studies have shown that the 9 out of 10 Australians (RIAA 2020 benchmark report) are looking to have their super invested responsibly.

What does this mean? It means that your super is invested into assets, mainly companies, that are approved under an ethical, social, and governance screening (otherwise known as ESG). For example, this includes not investing in weaponry or companies doing wrong by their employees.

Some super funds are now offering ethical investment strategies. Likewise, if you’re a self-managed super fund (SMSF) trustee, there are a range of sustainable managed funds which you can tap into. So if these factors are important to you, speak to your financial adviser for more details.

Recent events have brought the inter-dependencies between our society, environment and economy into sharp focus, and reaffirm the relevance of impact as the third paradigm of investing, alongside risk and return.

Next Steps

If you’re want to learn which investment strategy is best for your super, speak with us to get you moving in the right direction

This article was produced with the help of BT, click here to view the full article.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. FinPeak Advisers does not provide personal tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments