23 Sep TECH TALK: How to protect your income

Many people don’t think twice about insuring your car, with the average premium being about $1,239 per annum in NSW (according to mozo.com.au). The value of the asset that you are protecting is probably going to half in value in the first five years, the potential claims paid is probably valued in the tens of thousands at most and you’re probably going to be paying premiums for most of your life. Yet, people hesitate when it comes to protecting you and your income.

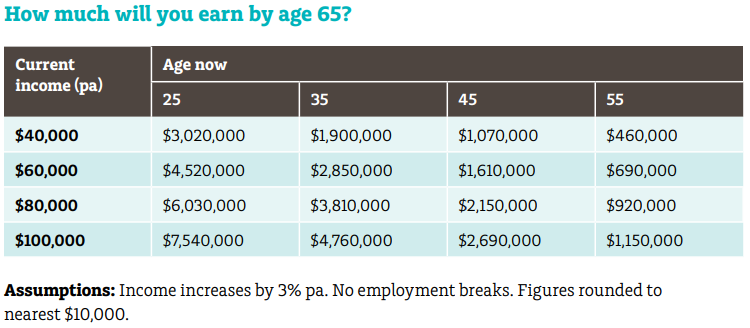

If you’re in any doubt about the importance of protecting your income, the table below shows how much you could earn by the time you reach age 65.

If you are unable to work for an extended period due to illness or injury, you could run down your savings very quickly and face financial difficulty. Rather than putting your family’s lifestyle at risk, by taking out income protection insurance, you could receive a monthly benefit of up to 75% of your income to help replace your lost earnings while you recover. The premiums for income protection insurance are generally tax-deductible and benefits received will generally be assessable as income.

The concept of income protection is easily understood, however, there are many things to consider including:

- your pattern of income (eg does your income fluctuate or is it reasonably steady)

- your cashflow position

- your marginal tax rate

- your employment and any anticipated unpaid leave such as maternity leave, and

- if there is a requirement for ‘extra benefits’

In this article, we will take a brief overview of the types of policies available and commonly used ownership options. We also outline other key advice considerations. Note: This article does not consider business or family trust policy ownership.

Indemnity vs agreed value

There are two broad types of income protection (IP) policies available.

Indemnity policies

Indemnity IP policies broadly indemnify you for the income lost at the time of claim up to a maximum of the monthly benefit insured.

Indemnity policies will generally base the benefit on your earnings in the 12 months immediately prior to ill-health. This can be an issue if during that 12 month you have had time off paid employment or have otherwise experienced a drop in income.

More recently, some insurers have upgraded their indemnity benefit to look back further than 12 months. For example, some insurers are looking at the highest continuous income earned for a 12 month period for up to three years prior to a claim. Indemnity policies are generally suitable for people who don’t need (or would prefer not) to lock in a monthly sum insured.

Key examples are people who:

- earn a stable income, or

- expect their income to increase over time (where it’s important to review the sum insured regularly to ensure it remains sufficient).

Agreed value policies

Agreed value policies pay an agreed monthly amount at the time of claim. Premiums for these policies are typically 15% to 20% higher than indemnity policies. Agreed value policies outside super will pay the agreed value to the insured on claim.

Agreed value policies in super take into account the greater of your:

- highest 12 months of earnings for a number of years (eg up to three years) prior to disability, and

- earnings in the 12 months prior to application.

The maximum that would be paid in all cases is the monthly benefit insured.

Agreed value policies are typically suitable for people who require a greater degree of certainty of what their monthly benefit will be at the time of claim. Examples may include people who:

- earn an income that fluctuates (eg due to bonuses, self-employment or seasonal work), or

- expect their income to trend downwards.

For example, if an agreed value sum insured was $5,000 per month (based on 75% of earnings of $80,000 pa) and at the time of claim earnings were $4,167 per month (or $50,000 pa), the claim payments would be $5,000 per month.

By contrast, where a person in this scenario took an indemnity policy where the sum insured was also $5,000 per month, the claim payments would be $4,167 per month, assuming pre-disability earnings in the 12 months prior to claim were $50,000. Like indemnity policies, the agreed value sum insured should be reviewed regularly. This is particularly important where you have had a significant drop in income (eg due to reduced working hours) that is expected to be sustained. In this scenario, the sum insured should be reduced so that the benefit payable on a claim isn’t higher than your work income.

Super vs non-super

Having determined whether an indemnity or agreed value policy is suitable for you, the next decision is whether the policy should be held within or outside super.

Key take-outs

- The after-tax cost will generally be the same for most people when funding IP insurance within and outside super from cashflow.

- There are a number of limitations and access issues that can arise when holding IP insurance in super that doesn’t apply to non-super IP policies.

- Holding the insurance outside super will typically suit a person who:

- has sufficient personal cashflow available to fund the premiums

- would prefer to use your concessional contribution (CC) cap (currently $25,000 pa) to build your retirement savings and fund life and TPD insurance, and/or

- want your cover to include ‘extra benefits’.

- Holding the insurance inside super will generally suit people who:

- don’t have sufficient cashflow to pay the premiums outside super (eg you are establishing a business), and/or

- want the option of funding your premiums from your super account balance in the future.

Below is a more detailed explanation of the taxation implications and access issues that can arise when insuring in super.

Taxation implications when funding premiums from cashflow

While the net tax outcomes are essentially the same when funding IP premiums within and outside of super from cashflow, the process and steps involved are quite different.

With non-super IP, the insured client can generally claim the premiums paid as a tax deduction when theycomplete their tax return. Conversely, with IP in super:

- the trustee receives a deduction for the cost of the premiums, which in retail super funds is generally passed back to the member

- the member receives a deduction for personal deductible contributions made to fund the IP premiums

- where the member makes salary sacrifice contributions, they derive a tax benefit through reducing their assessable income (and effectively paying premiums with pre-tax salary), and

- the 15% contributions tax that would normally be payable on these CCs is effectively offset when the trustee passes the deduction back to the member.

Given the similarity in tax outcomes, the decision to hold IP insurance within or outside super will usually be influenced by other factors.

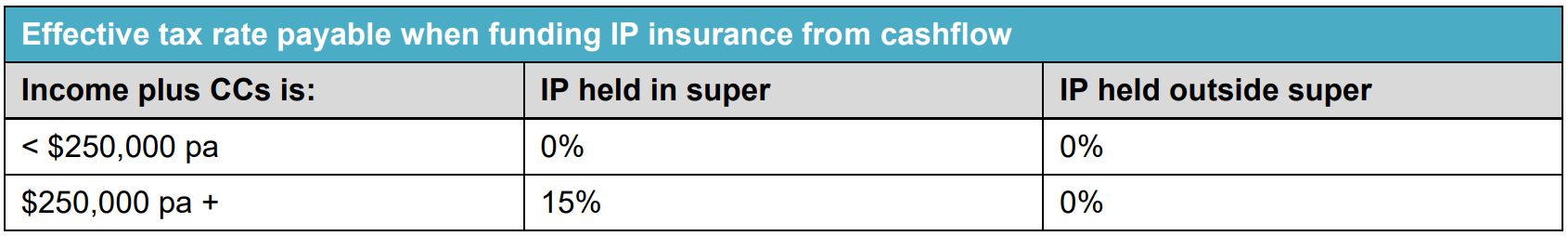

High-income earners

An exception to the above applies where your income from certain sources and CCs exceeds $250,000 (currently from 2017-2018 onwards). In this scenario, you are required to pay an additional 15% tax on your CCs, which makes funding IP insurance in super less tax-effective than the non-super alternative. This is known as Division 293 tax.

The table below summarises the effective tax rate payable when funding IP insurance within and outside super for people with incomes (including CCs) above and below $250,000 pa.

Although the cost of holding IP in super for certain high-income earners may be greater, depending on your circumstances, there may still be compelling reasons to maintain or take out IP within super.

Access to benefits

Regardless of the policy definitions, to access benefits from an IP policy in super, the release of funds must meet the requirements of super legislation. This includes first meeting the ‘temporary incapacity’ condition of release. Also, the legislation restricts the amount the you can receive in the way of periodic payments from the fund.

‘Temporary incapacity in relation to a member who has ceased to be gainfully employed (including a member who has ceased temporarily to receive any gain or reward under a continuing arrangement for the member to be gainfully employed), means ill-health (whether physical or mental) that caused the member to cease to be gainfully employed but does not constitute permanent incapacity’.

Having met the condition of release, benefits may then be paid as ‘a non-commutable income stream’ for the purpose of continuing the gain or reward which the member was receiving before the temporary incapacity’.

A member must be gainfully employed prior to claim

A member’s incapacity must lead to the cessation of gainful employment. This means you must be gainfully employed at the time of claim. If you are on unpaid leave or between jobs, you can therefore not access the benefits. Government paid maternity leave is not considered to be employment income and therefore would not qualify the person as having been gainfully employed at the time of claim. This restriction does not apply when holding IP outside super.

Paid sick leave

When a member is on any form of paid leave, including paid sick leave, they are still considered to be gainfully employed, as they are receiving ‘gain or reward’, Paid sick leave must therefore cease prior to payment of IP from super. This is also often the case for non-super IP, but for a different reason.

A member must be totally disabled

Where a member’s illness or injury is such that they can still work, but at reduced hours, they cannot access temporary incapacity benefits, as there must be a total cessation of gainful employment. A common example is where a member has a degenerative illness. However, there doesn’t have to be a termination of employment to meet the condition of release, nor does the disability have to be permanent.

This requirement for total disability is in contrast to non-super policies, which are not restricted by super legislation. In this case, benefits may commence to be payable for partial disability. This product feature is optional and available at additional cost. It’s often referred to as ‘day one partial’.

All income benefits cannot be paid to the member

Where a member has an agreed value IP policy in super and they have a significant drop in income for a lengthy period of time, the trustee generally won’t be able to pay the full agreed value sum insured to the member.

This is due to the cashing restriction which, as mentioned above, restricts the trustee to paying benefits ‘for the purpose of continuing…the gain or reward which the member was receiving before the temporary incapacity’.

The legislation does not prescribe how long ‘before’ the incapacity the trustee must consider or what ‘continuing the gain or reward’ means in relation to a member whose income drops or fluctuates. So the trustee will have some latitude in interpreting this where a member’s income drops or fluctuates.

There’s also effectively a ‘buffer’ of up to 25% as most IP policies pay a maximum of 75% of a member’s income, while the cashing restriction allows payment equivalent to a member’s pre-disability income. Nonetheless, where a member’s income decreases to a greater degree and for a number of years, there will clearly be an issue in paying the agreed value to the member.

Extra benefits cannot be accessed by a member

Some clients may want to include ‘extra benefits’ in their IP policy beyond core income replacement, such as rehabilitation benefits, nursing care benefits and home assistance. However, extra benefits usually do not align with the temporary incapacity cashing restriction. Extra benefits are otherwise available in non-super policies.

Split IP Policies

A product development that solves virtually all of the potential access issues that can arise when holding IP in super, while addressing the cashflow requirements of clients who require some of the premiums to be funded from super for cashflow reasons is split IP policies.

Split IP policies are those where benefits are held under two linked policies for the same income sum insured. The cost of the linked split policies is the same as a non-super policy with the same benefit features.

The core income benefits that align with the temporary incapacity condition of release are held in and premiums funded from super. The second policy, which is held outside super, enables benefits to be paid where there’s an issue with the client meeting the condition of release or benefits not being payable due to the associated cashing restriction.

In Conclusion

The decision to protect your income is an important one as the financial outcomes could vary greatly at the time of the claim, depending on how you initially set up the strategy. It’s important to fully read the appropriate disclosure statements, as not all policy features are the same and a poor decision could end up costing you thousands of dollars in the long run.

This article was produced with the assistance of the technical team of GWM Adviser Services, part of the National Australia Bank group of companies.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments