21 Jul Tech Talk – How much do you need to retire?

Since 2004 The ASFA Retirement Standard has served as Australia’s trusted retirement savings companion, providing a comprehensive breakdown of expenses for both a comfortable and modest lifestyle, for couples and singles to maintain a healthy, vital and connected lifestyle in retirement. It also estimates the superannuation balance required to achieve this.

ASFA Research and Resource Centre has created two separate documents to reflect the above information; the Detailed Retirement Expenditure Breakdowns estimating the weekly/annual expenses in retirement (with figures updated quarterly), and the ASFA Retirement Standard Explainer outlining the lump sums needed at retirement and how this is calculated.

How much you spend in retirement

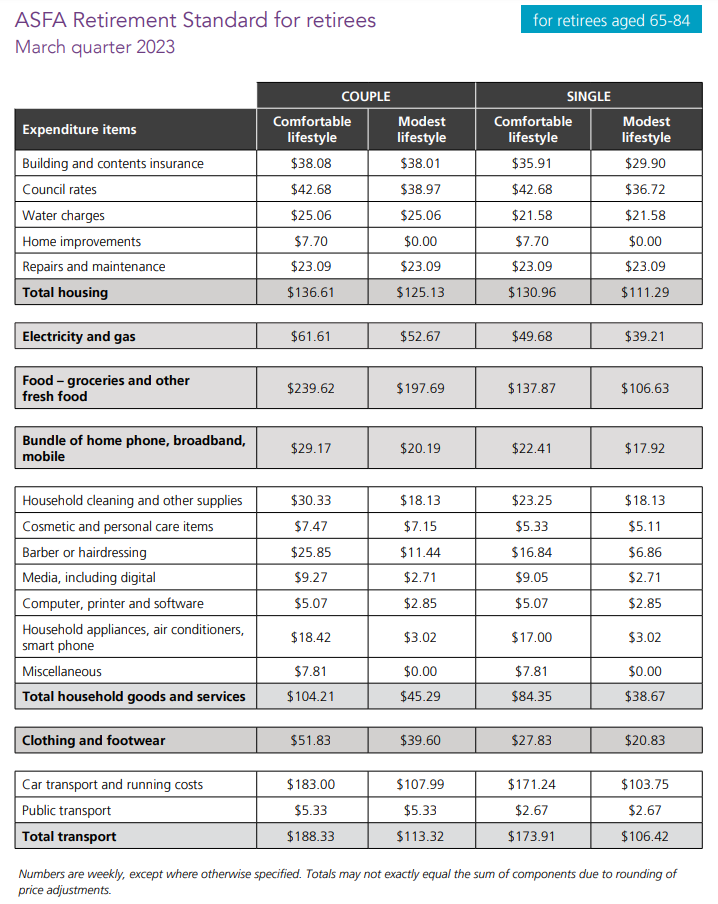

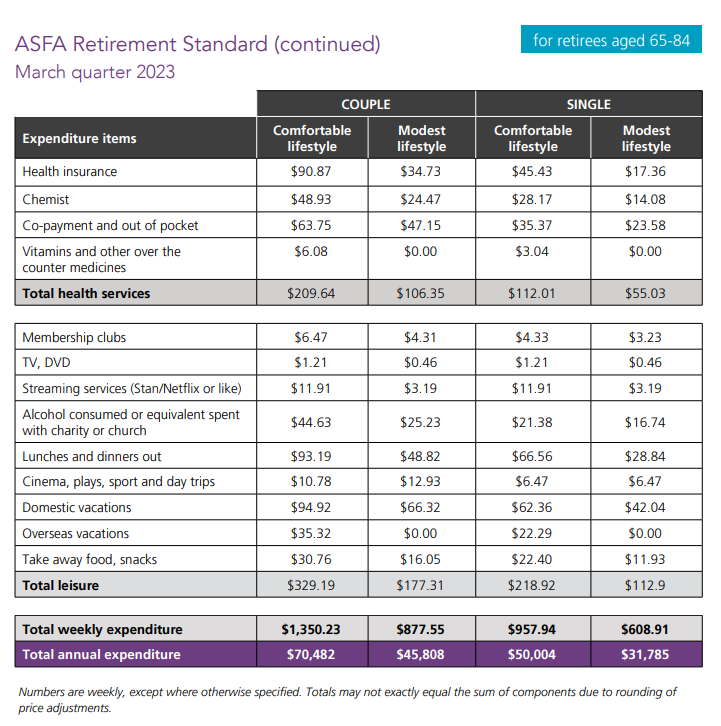

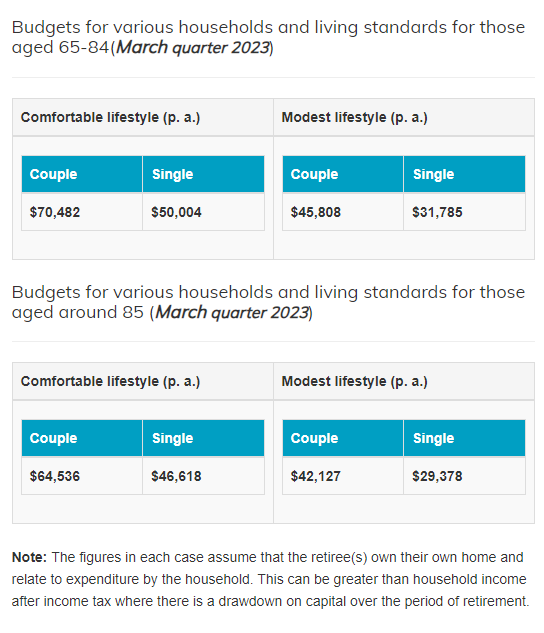

The Detailed Retirement Expenditure Breakdowns list the weekly and annual expenditure required for both comfortable and modest lifestyles in retirement, for both couples and singles. Updated quarterly to reflect changes to the Consumer Price Index (CPI), the budgets assume that the retirees own their own home outright and are relatively healthy.

ASFA Retirement Standard: March Quarter 2023

Detailed Budget Breakdowns

The lump sum you need for retirement at age 67

The ASFA Retirement Standard Explainer shows the lump sum amount needed by the average Australian to fund a comfortable and modest retirement (for both couples and singles) and the methodology behind the calculations.

It is assumed that the retiree will draw down all their capital and receive a part Age Pension.

What is the ASFA Retirement Standard?

One of the most important steps in planning to save for your retirement is figuring how much you will need to spend each year to live a comfortable lifestyle. However, many people struggle when it comes to developing a budget for their future needs, particularly when their retirement is many years away.

The ASFA Retirement Standard has been developed to help solve this problem by objectively outlining the annual budget needed by the average Australian to fund a comfortable standard of living in their post-work years. It provides benchmarks for both a comfortable and modest standard of living, for both singles and couples, and is updated quarterly to reflect changes to the Consumer Price Index (CPI).

In March 2023, ASFA revised the modest and comfortable lump sums needed to reflect the high rate of inflation, and that there has been no real increase in the Age Pension as price growth has been greater than the increase in average wages.

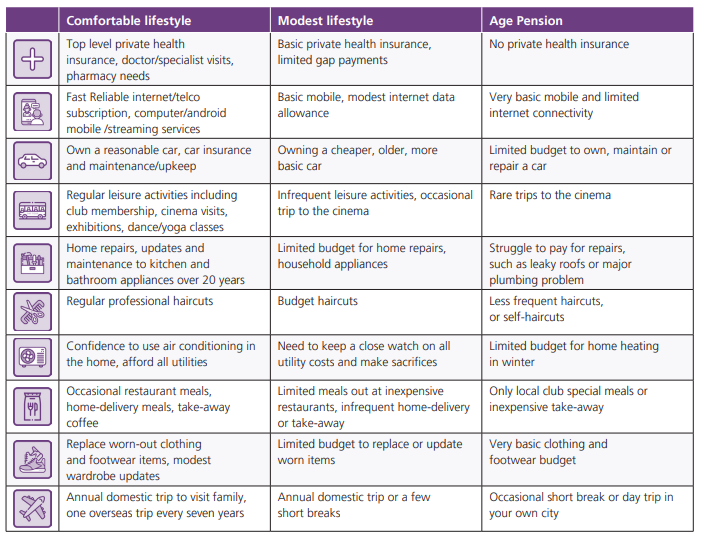

What is considered a modest and comfortable retirement lifestyle for younger retirees?

A modest retirement lifestyle is considered better than the Age Pension, but still only allows for the basics.

A comfortable retirement lifestyle enables an older, healthy retiree to be involved in a broad range of leisure and recreational activities and to have a good standard of living through the purchase of such things as; household goods, private health insurance, a reasonable car, good clothes, a range of electronic equipment, and domestic and occasionally international holiday travel.

Both budgets assume that the retirees own their own home outright and are relatively healthy.

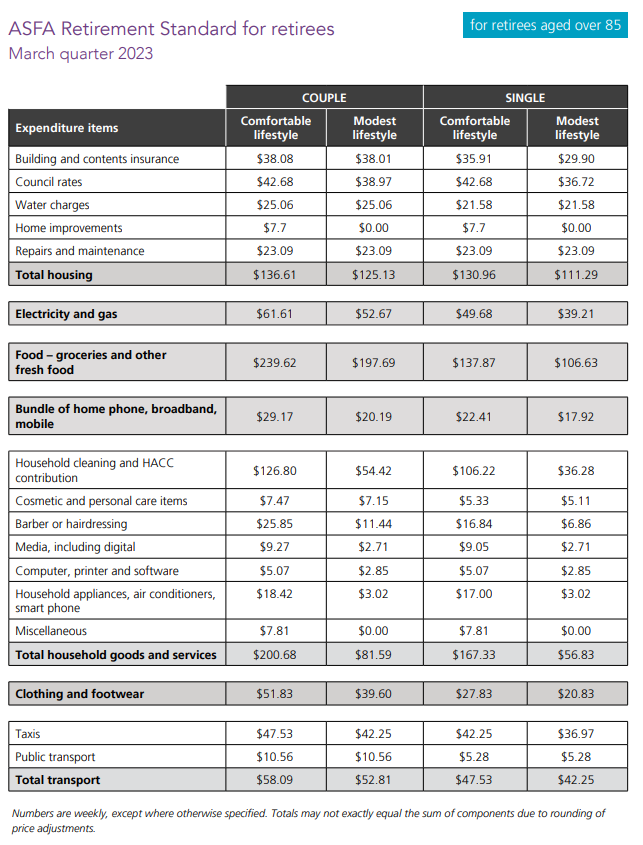

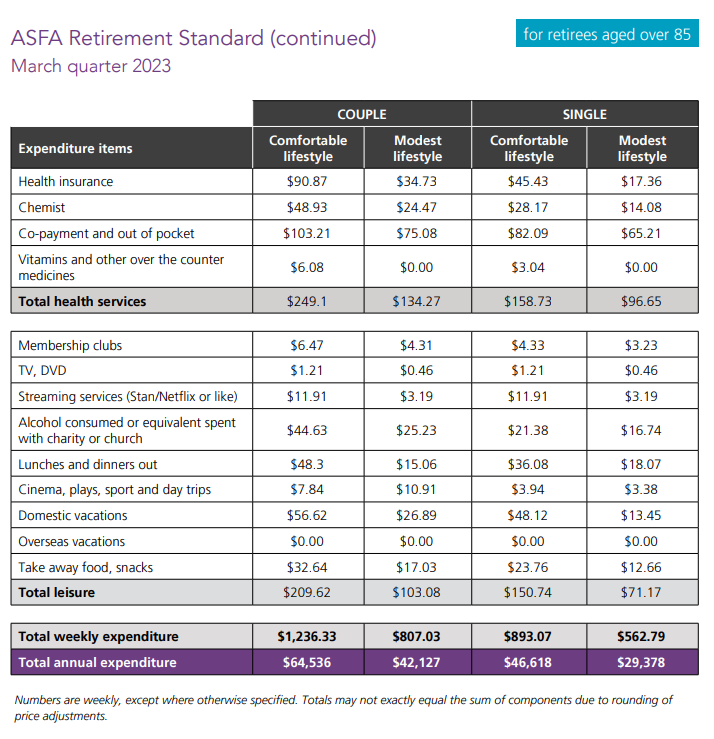

Changes in spending patterns as retirees age

As people age, their spending requirements change as they are often unable to engage in the same types of activities and require a higher level of care and support. This has an impact on their budget and expenditure requirements. For example, older retirees tend to spend more on assistance in the home, including for cleaning services and meals, as well as contributions towards home and community care services. They also tend to have increased out-of-pocket expenses for major medical procedures and ongoing chemist and other medical expenses. On the other hand, they also tend to spend less on holidays and other leisure activities outside the home, most likely reflecting their reduced capacity for activity.

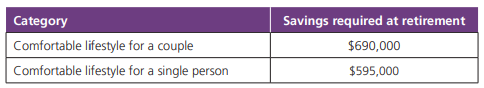

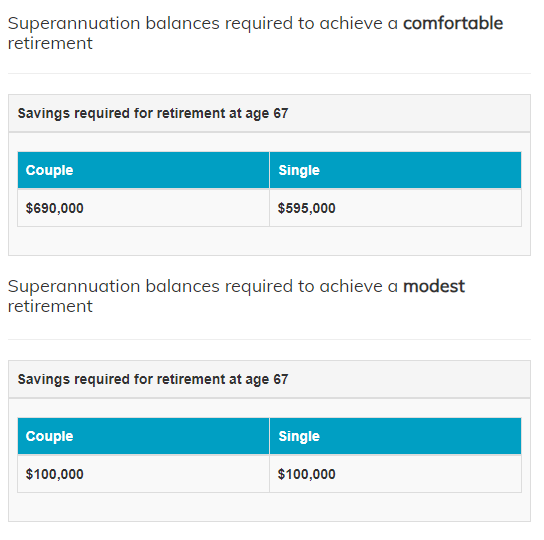

Superannuation balances required to achieve a comfortable retirement

The lump sums required for a comfortable retirement assume that the retiree/s will draw down all their capital, and receive a part Age Pension.

All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 percent.

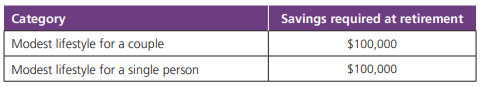

Superannuation balances required to achieve a modest retirement

The lump sums needed for a modest lifestyle are relatively low due to the fact that the base rate of the Age Pension (plus various pension supplements) is sufficient to meet much of the expenditure required at this budget level.

All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 per cent. The fact that the same savings are required for both couples and singles reflects the impact of receiving the Age Pension.

The lump sum estimates prepared by ASFA take into account the receipt of the Age Pension both immediately and into the future.

The Age Pension is adjusted regularly by either the increase in the CPI or by a measure of wages growth, whichever is higher.

The ASFA lump sum figures are therefore not updated quarterly.

All figures in today’s dollars using 2.75% AWE as a deflator and an assumed investment earning rate of 6 per cent. The fact that the same savings are required for both couples and singles reflects the impact of receiving the Age Pension.

Note: The lump sum estimates prepared by ASFA take into account the receipt of the Age Pension both immediately and into the future. The Age Pension is adjusted regularly by either the increase in the CPI or by a measure of wages growth, whichever is higher. The ASFA lump sum figures are therefore not updated quarterly.

To check how much super you should have at your age, please click here.

This article was originally produced by ASFA – the voice of super. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments