16 Jun Tax Tips and Super Strategies to Help You Prepare for the End of Financial Year

The lead-up to June 30 is a great time to review your financial situation to make sure you take advantage of end of financial year strategies and concessions available to you. The following tax and super strategies could minimise your tax bill and maximise your retirement savings.

EOFY Tax Strategies

Most people wait until it’s time to lodge their tax return before thinking about tax deductions they can claim. However, being prepared ahead of time could help you take advantage of additional strategies and further increase your tax savings. Types of deductions include:

Work-Related Expenses

To claim a deduction for a work-related expense, there are three conditions you need to meet:

- The expense relates directly to you earning income.

- You spent the money yourself and weren’t reimbursed.

- You kept a record (generally a receipt).

Don’t forget to keep receipts for work-related expenses such as uniforms, safety equipment and education throughout the year, as these may be tax-deductible.

Home Office Expenses

If you work from home, you may be able to claim a deduction for work related expenses, such as:

The methods available to calculate working from home deductions are the ‘revised fixed rate’ and ‘actual cost’ methods. While the actual cost method remains unchanged, the revised fixed rate method has been updated, making it easier to calculate expenses and avoid time-consuming apportionment calculations. Visit the ATO website or talk to your tax agent to see which method is right for you.

Income Protection Premiums

If you have an income protection policy that isn’t part of your super fund, you may be able to claim the premiums as a tax deduction.

Your Investments

Investment expenses

Expenses incurred while earning investment income may be tax-deductible. These include:

Talk to your tax agent about which expenses are immediately deductible and which can be claimed over future financial years.

Prepay Investment Loan Interest

If you have an investment loan, you can prepay up to 12-months’ interest in advance. You may be able to claim a tax deduction for the prepayment in this financial year (subject to the relevant prepayment rules), which may work well if your total taxable income is going to be lower in the next financial year.

Review Investment Ownership

If you have investments in your personal name, transferring ownership to your spouse (if they are on a lower marginal tax rate) or self-managed super fund (conditions apply), may reduce your tax bill on future investment income and capital gains. However, these transfers may have capital gains tax (CGT) implications so it’s important to seek tax and legal advice before proceeding.

Managing Capital Gains

It’s important to assess if you have made any capital gains or losses from your investments. The most common way you realise a capital gain (or capital loss) is by selling assets such as property, shares or managed fund investments. Managed funds also distribute capital gains which you must report in your tax return. The Australian CGT system is quite complex so it’s important to consult your tax agent.

EOFY Super Strategies

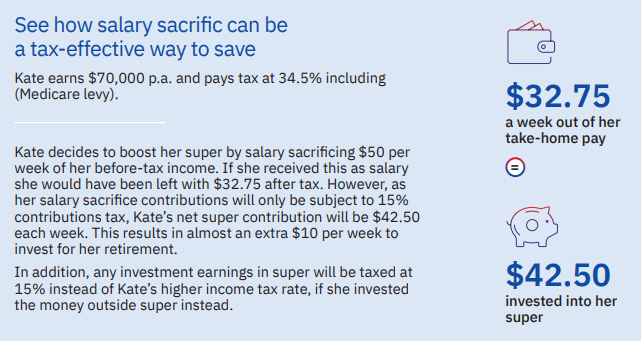

Salary Sacrifice

Most employees receive super guarantee (SG) contributions from their employer of at least 10.5% of their salary.1 Adding to these contributions directly from your gross (before tax) salary can be an easy and tax-effective way to top up your super. This is called salary sacrifice, and it can be a great way to help you save for the lifestyle you want in retirement. Make sure you check with your employer to see whether salary sacrifice is available. Some of the benefits of salary sacrifice are:

- It’s simple, automatic and consistent.

- You can reduce your taxable income.

- Salary sacrifice contributions are paid from your before-tax salary and are generally taxed at 15% instead of your marginal rate (plus Medicare levy).2 Note: there are limits to the amount you can salary sacrifice without incurring extra tax.

- The difference in taxation may mean more money is available to invest in super than if you were to receive the money as after-tax income and then invest it.

- Future earnings on contributions made to super are taxed at a maximum of 15%, whereas any earnings on investments outside of super may be taxed at a higher rate, depending on your taxable income.

Personal Tax-Deductible Contributions

Anyone who is eligible to contribute is also eligible to claim a personal tax deduction for their contributions.3 Therefore, if your employer doesn’t offer salary sacrifice, you are self-employed or only derive income from passive investment (such as a share portfolio), you may be able to make a personal tax-deductible contribution to reduce your taxable income. Personal deductible contributions count towards your concessional contributions (CC) cap, which is $27,500 for the 2022–23 financial year. You may be able to contribute even more if you did not fully utilise your CC cap in a year (from 1 July 2018 onwards) and are eligible to carry those unused amounts forward to use in a later year. To be eligible your total super balance must have been less than $500,000 at the end of the prior financial year. Making personal tax-deductible contributions to your super may prove timely if you have made a considerable capital gain from the sale of a property or shares, as your deductible contribution may help to offset your assessable capital gain and could also reduce your marginal tax rate. For this strategy to be effective, you need to have sufficient taxable income to offset with the personal tax-deductible contribution. Talk to your financial adviser about the best way to implement this strategy.

Split Super Contributions with your Spouse

Up to 85% of your taxable contributions such as SG, salary sacrifice and personal tax-deductible contributions can be transferred to your spouse’s super. You can do this every year, once the financial year has ended. If the receiving spouse is over preservation age but under age 65 at the time of the split request, they must declare they aren’t retired. Splits cannot take place once the receiving spouse turns 65. Here’s how splitting your super can help:

- Transferring contributions to an older spouse could enable them to access more retirement money earlier.

- Transferring money to a younger spouse could enable the older spouse to receive more Age Pension by delaying the date their super becomes an assessable asset for Centrelink purposes.

- The transferred amount doesn’t count towards the receiving spouse’s contributions cap.

- Transferring contributions to a spouse may allow a couple to equalise their balances and maximise the combined amount they can use to commence tax-free pensions, as each of them is limited by a transfer balance cap (currently $1.7m but will be indexed to $1.9m on 1 July 2023).

Super splitting is not offered by all funds, so you will need to check if your fund offers this feature.

Spouse Contribution Tax Offsets

This strategy may be available if you make after-tax contributions directly to your spouse’s super account – these are known as eligible spouse contributions. As well as increasing your spouse’s super balance, another advantage of making a spouse contribution is that you may be eligible for a tax offset, which reduces the tax you pay on your own taxable income. If your spouse’s assessable income, reportable employer super contributions and reportable fringe benefits are under $37,000 p.a., you may receive an 18% tax offset up to the first $3,000 you contribute on their behalf (i.e., there is a maximum tax offset of $540 p.a.). The offset operates on a sliding scale and phases out to zero once your spouse’s income exceeds $40,000 p.a.

You can open a super account in your spouse’s name and make contributions from your after-tax pay, or make the contributions to your spouse’s existing super account.

Spouse Contribution Eligibility : To take advantage of this strategy in 2022–23, your spouse needs to be under age 75 when the spouse contribution is made to their super account.

A Word on Contributions Caps

When considering any super strategy, it’s important to assess how much you are contributing to super in any one financial year. The government has set annual limits known as contributions caps. The contributions caps for 2022–23 are:

- $27,500 for before-tax (concessional) contributions, regardless of age. This cap may be higher if you have any unused concessional contributions cap amounts left over from previous financial years (since 1 July 2018), and your total super balance was under $500,000 on 30th June 2022.

- $110,0006 for after-tax (non-concessional) contributions, or up to $330,000 under the bring-forward rule if you are under 75 at any time during the financial year you make the contribution.

- Your non-concessional cap will also depend on your total superannuation balance, which you can find through ATO online services accessible via MyGov.

Note: From 2022–23 onwards, new rules allow people between age 67 and 75 to make non-concessional contributions under the bring-forward rule without having to meet the work test. You just need to be under age 75. This is a great opportunity to increase super savings before or even during retirement. However, if you want to claim a tax deduction for that contribution you will still need to meet the work test.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments