15 Sep Monthly Commentary: September 2022

Market Trends: Equities and bonds struggle

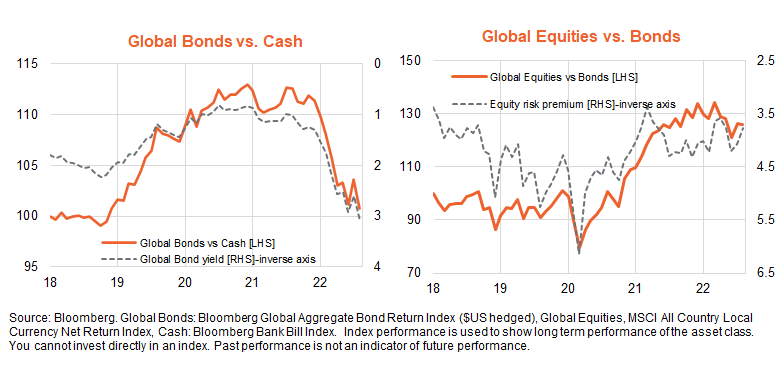

After posting positive returns in July, both global bonds and equities fell back in August, with equity returns marginally weaker than that of bonds.

The Bloomberg Global Aggregate Bond Return Index ($US hedged) was down 2.6%, reflecting a 0.5% rise in the index’s yield-to-maturity to 3.1%. In turn, this reflected a notable increase in central bank tightening expectations, with the US Fed funds rate expected to reach 3.85% in 12 months (up from a 12-month expectation of 3.1% at the end of July).

Major asset classes: Equities, bonds and cash

The MSCI All-Country World Equity Return Index in local currency terms declined by 3.0%, as higher interest rates pushed down valuations.

All up, August market performance reaffirmed the trend so far this year of both bonds and equities underperforming cash due to high post-COVID inflation and aggressive central bank tightening expectations.

That said, with aggressive central bank rate hikes priced into the market, and inflation likely past its peak, the period of bond underperformance versus cash seems to be near an end. The outlook for equities, however, is less optimistic given the growing downside risk to corporate earnings. The one upside risk to equities is a speedy decline in global inflation which would then allow central banks to ease back on their policy tightening intent – in which case both bonds and equities would be expected to rally.

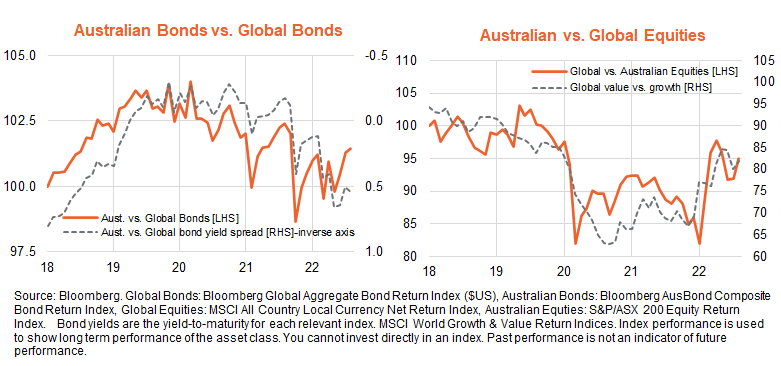

Australia vs. the world

Australian bond yields largely matched the rise in global yields over the past month, resulting in local bond performance broadly matching that of global bonds – with the Bloomberg AusBond Composite Bond Index declining by 2.5%. Australian bond returns have broadly matched global returns so far this year, albeit with choppy month-to-month performance. On the view that local policy tightening expectations likely remain too aggressive (with the market expecting the RBA to match the Fed in raising short-term rates to 3.8% over the next 12 months) there is scope for spread narrowing and Australian bond outperformance over coming months.

Australian equities outperformed global stocks last month, consistent with higher bond yields hurting the growth/technology sectors harder than value exposures such as financials and commodities. Assuming slowing global growth begins to place downward pressure on global bond yields and commodity prices, however, there is a risk of Australian equity market underperformance in the months ahead.

Selected equity themes

As might be expected, the lift in bond yields and associated weakness in equity markets hurt growth more than value over August, with commodity-related equity exposures again outperforming to a degree.

On the basis that equity markets overall will remain under pressure, it seems likely that the value/resource/energy exposures will remain most vulnerable, while growth/technology/quality exposures might at least stop underperforming if bond yields drop further. The health care sector also looks well placed to outperform in a weak equity market environment.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments