21 Sep Monthly Commentary: September 2021

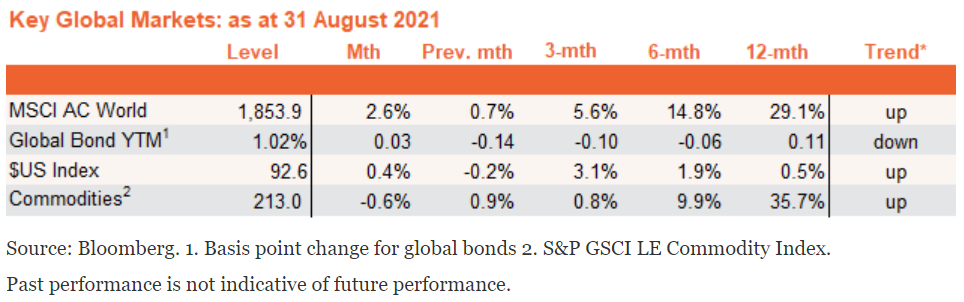

Global equities rose 2.6% in August, and the outlook remains encouraging.

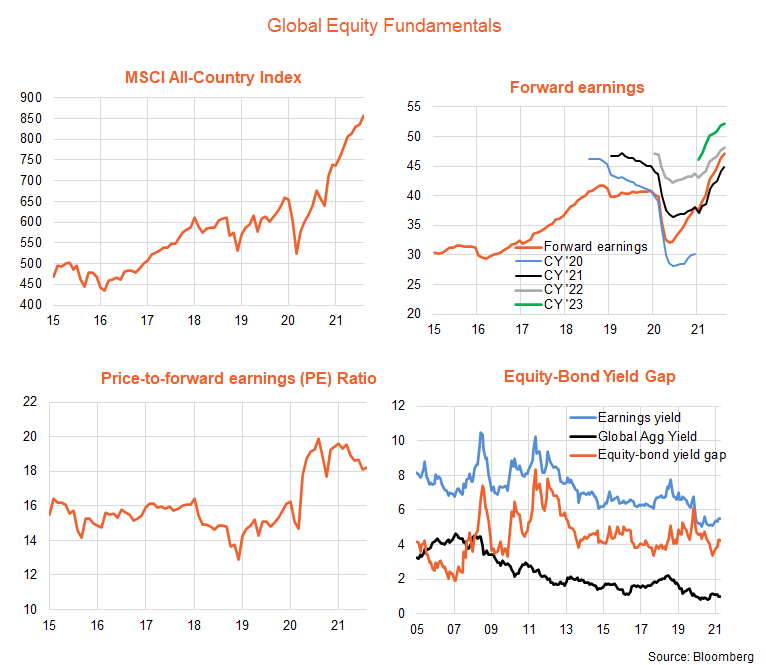

Global forward earnings accounted for most of the increase in equity prices, rising 1.9%. Despite a renewed wave of global COVID cases, rising vaccination rates have meant fewer are ending up in hospital or dying – allowing major economies such as the United States and Europe to avoid a return to lockdowns. Current consensus earnings expectations are consistent with 10% growth in forward earnings by the end of 2022.

Valuations also lifted modestly in August, with the global forward price to earnings (PE) ratio rising from 18.1 to 18.2, despite a small increase in U.S. 10-year bond yields from 1.22% to 1.27%. The equity risk premium eased to 4.2% from 4.3%, which is at the lower edge of its post-GFC range but still above longer-run average levels. The outlook for interest rates and valuations remains benign, with most global central banks still committed to extremely easy monetary conditions until labour markets tighten and a sustainable lift in wage and price inflation seems likely.

Recent signalling from the U.S. Federal Reserve suggests it will announce a gradual tapering of bond purchases in the coming months, which now appears well priced into the market.

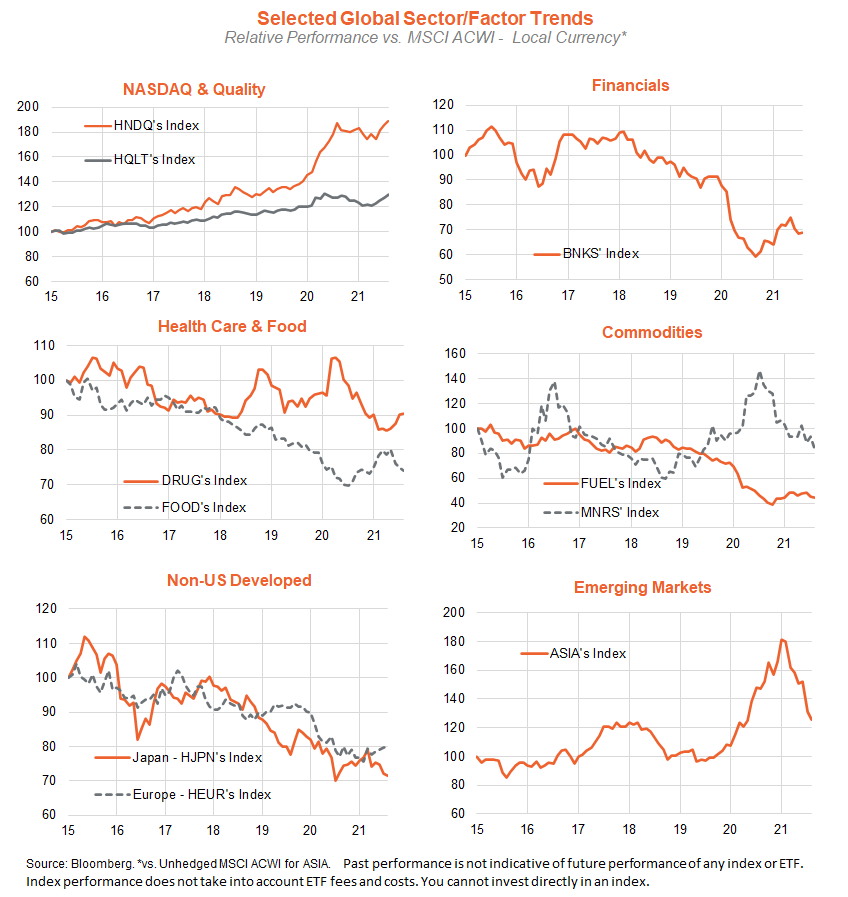

Global equity themes – U.S./growth/technology return to favour

As seen in the charts below, the pullback in bond yields and commodity prices over recent months has been associated with a rotation back to the tech-heavy Nasdaq-100, global quality and global health care over value exposures such as energy and banks.

Emerging markets, meanwhile, continue to be hurt by a shakeout in the Asian technology sector in recent months, and a stabilisation in the U.S. dollar.

Given the relatively strong outlook for the U.S. economy and continued low bond yields, trends favouring the U.S./growth/technology areas could persist for some time. Critical in the coming months will be how bond yields react to Fed tapering and whether U.S. inflation does start to moderate after moving higher earlier this year. Our expectation is that bond yields will remain relatively well contained, and U.S. inflation will also ease back.

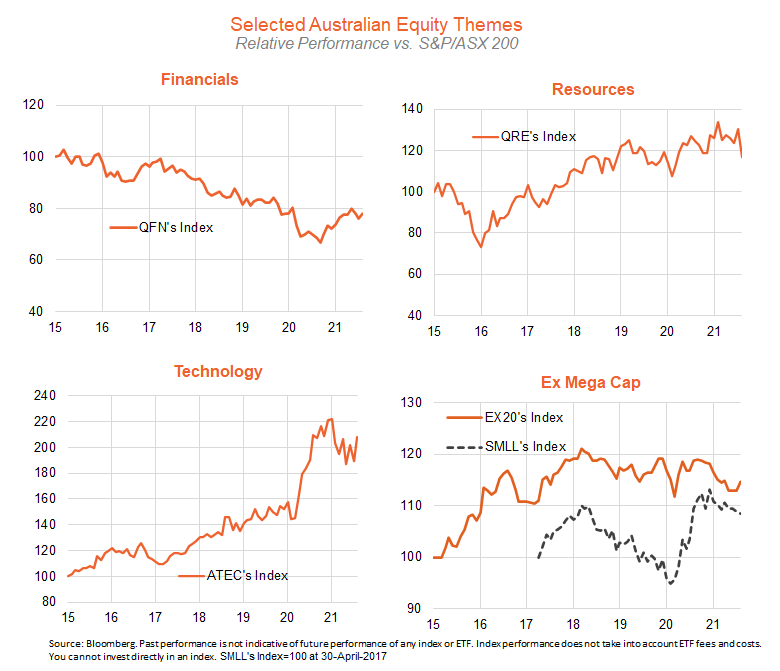

Australian equity themes – a return to tech?

Weaker iron-ore prices saw local resource stocks underperform over August, while the local technology sector surged, helped by the large takeover offer for AfterPay.

With financial sector outperformance waning of late, weaker iron-ore prices weighing on the resources sector, and the growth thematic lifting globally, the local market may soon see a rebound in the relative performance of smaller cap stocks and the technology sector.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments