23 Oct Monthly Commentary: October 2023

Higher for longer

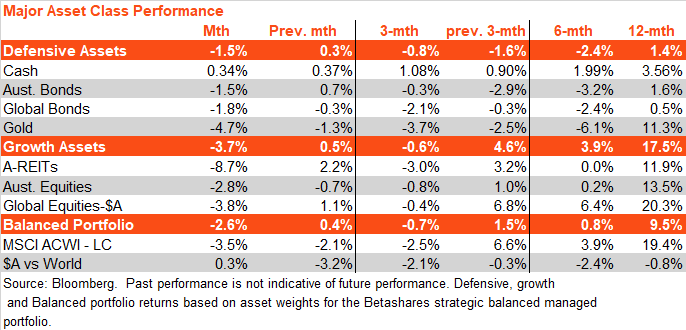

Market Overview

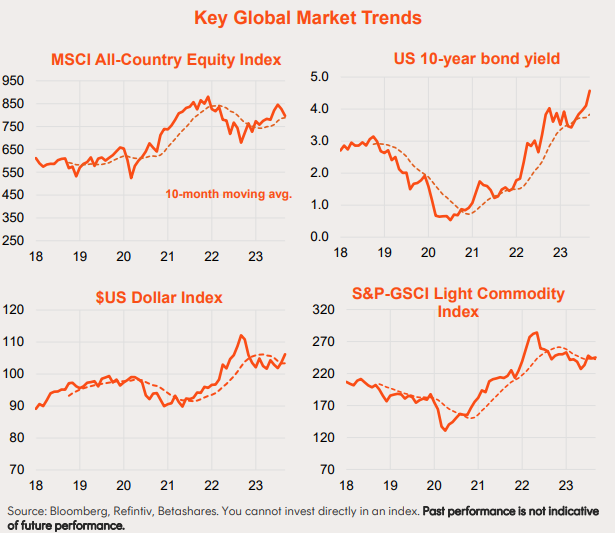

Both defensive and growth assets weakened in September, reflecting a strong further increase in global bond yields. In turn, this reflected resilient global economic growth and expectations that policy rates would remain ‘higher for longer’.

Growth assets declined more than defensive assets, with global (hedged equities) down 3.5% and Australian equities down 2.8%. The interest rate-sensitive listed property sector weakened by 8.7%.

Among defensive assets, bonds underperformed cash reflecting the rise in bond yields. Gold prices also weakened, reflecting higher bond yields and a stronger USD.

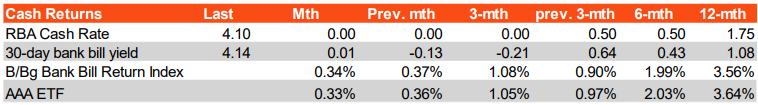

Cash Returns

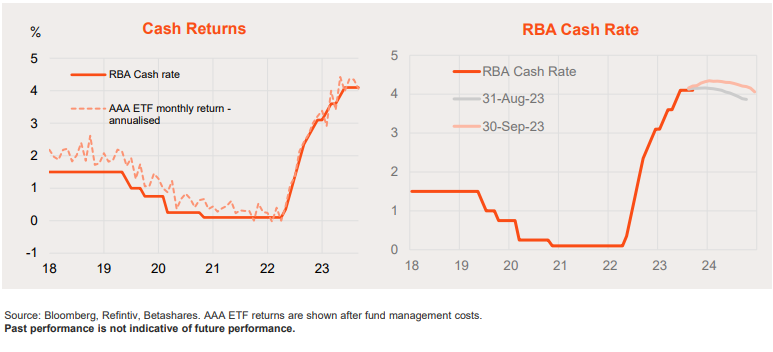

The RBA left the cash rate unchanged at 4.1% in September for the fourth month in a row.

Due to current below-trend economic growth, contained inflation expectations and high but easing inflation, the RBA appears willing to leave rates on hold as long as its central case expectation is for inflation to return to the 2-3% target zone ‘within a reasonable time frame’, which it currently

anticipates to be mid-2025.

Reflecting the current 4.1% official cash rate, the Bloomberg Bank Bill Index returned 0.34% in September, or 4% annualised.

Market-implied RBA policy tightening expectations increased moderately over September, reflecting resilient local growth in employment and house prices, a lift in headline inflation due to higher oil prices, and rising global bond yields.

The market has moved to almost fully price in the risk of one further rate hike by mid-2024 from around a 20% chance at end-August.

Floating Rate Bonds and Hybrids

After having narrowed substantially since mid-2022 (following an earlier sharp widening), the floating rate spread has been modestly widening so far in 2023.

The spread over 30-day bank bills widened a little further (0.16%) in September to 0.94%, resulting in floating-rate bond returns similar to that of cash (despite a higher yield), with floating rate bonds returning 0.29%. Spread compression and a higher starting yield allowed floating rate bonds to return 5.0% over the past year, compared to 3.6% for cash.

The FRB spread is now broadly in line with its average in the two years prior to 2020 COVID crisis.

The hybrid spread over bank bills has been in a choppy sideways range since around mid-2022. It narrowed a little further in September to be at the lower end of this range at 2.52%. The higher starting yield and spread narrowing saw major bank hybrids return 1.67% over September.

The hybrid spread remains somewhat tighter than the average of around 3.5% in the two years prior to the 2020 COVID crisis.

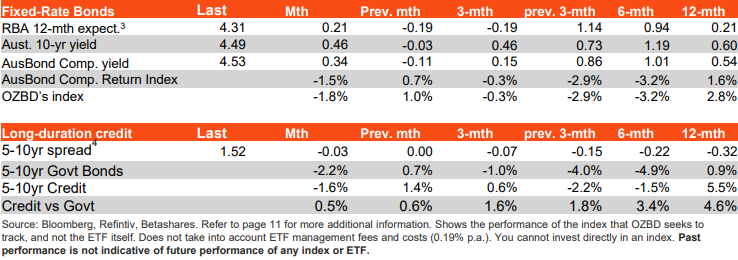

Fixed-rate Australian Bonds

Reflecting an increase in monetary policy tightening expectations, long-term bond yields rebounded in September – after declining in August – resulting in negative returns for fixed-rate bonds.

Australian 10-year bond yields rose 0.46% to 4.49% while the yield on the Bloomberg AusBond Composite Index rose 0.34% to 4.53%. As a result, the AusBond Composite Index fell by 1.5% in the month.

Bonds have underperformed cash with the rebound in bond yields since earlier this year – as markets have moved from fearing a global recession to ‘higher for longer’ interest rates due to economic resilience.

Note fixed-rate bond returns have nonetheless been positive over the past year – albeit marginally less positive than cash.

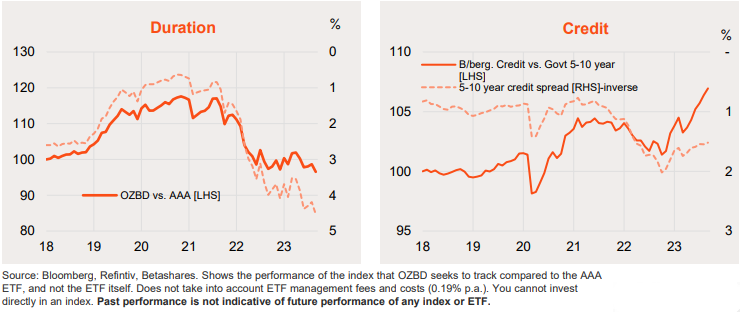

Note also despite the sell-off in bonds this year, credit spreads on longer-duration bonds have continued to narrow (likely reflecting reduced recession fears) – resulting in long-duration credit outperforming long-duration government bonds.

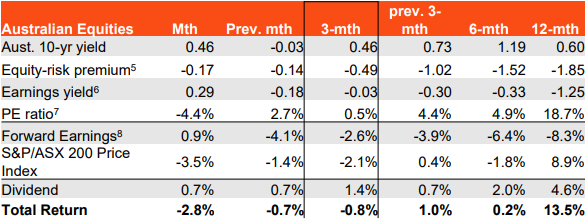

Australian Equities

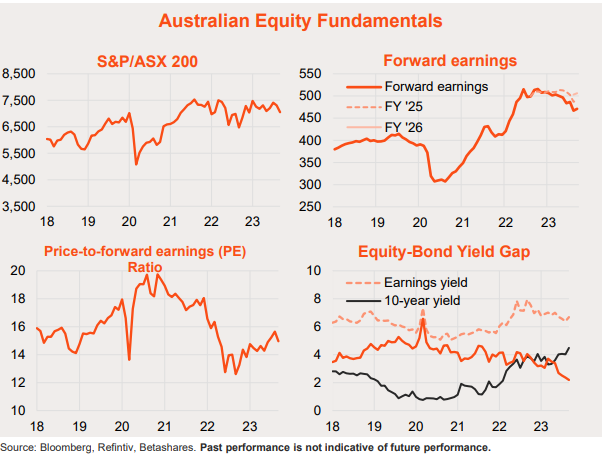

The S&P/ASX 200 Index dropped back 3.5% in September. In turn, this reflected a drop in the PE ratio – from 15.7 to 15.0 – in the face of sharply rising bond yields, partly offset by a 0.9% uptick in forward earnings.

Given the rise in bond yields, the decline in the PE ratio – and equity prices – would have been greater were it not for a further narrowing in the already relatively low equity risk premium to 2.2%.

Allowing for dividends, total returns from the market were -2.8% in September.

After recovering from the 2022 sell-off up until earlier this year, the market has since moved in a choppy sideways range in recent months – due to generally falling earnings partly offset by a rising PE ratio.

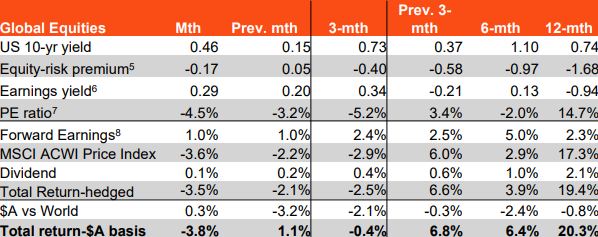

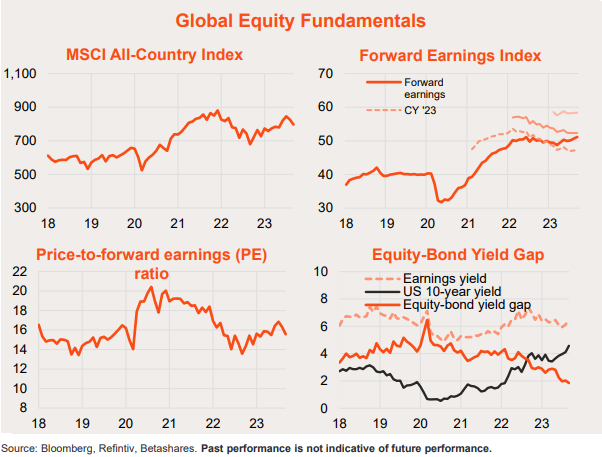

Global Equities

The MSCI All-Country World Index also declined in September, with – as in Australia – pressure on PE valuations due to higher bond yields only partly offset by a further modest

lift in forward earnings.

Global equities have outperformed Australian equities over the past year largely because of a stronger uplift in forward earnings (+2.3% vs 8.3% earnings decline in Australia). But as in Australia, global equities now face the challenge of a narrow equity risk premium by the standards of the past 10-20 years.

This article was originally produced by David Bassanese from BetaShares. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments