31 May Monthly Commentary: May 2021

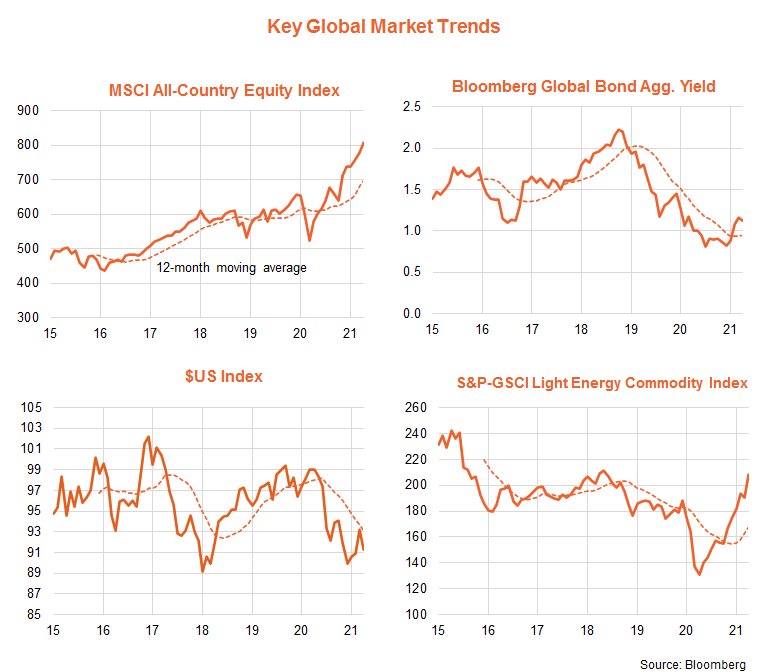

The global equity rally continued in April, helped by an easing back in global bond yields as central banks reiterated their desire to keep accommodative financial conditions. A weaker $US also helped fuel a rebound in commodity prices after they endured a small correction in March.

Relative to their 12-month moving average, the trend in equities, bond yields and commodity prices remains to the upside, while the trend in the $US is still down.

The 2-2-2 market outlook

Looking forward, the outlook for equities remains favourable given rapidly recovering global economic growth and corporate earnings. That said, further upside may be limited by already high valuations.

Based on Bloomberg estimates, for example, current market earnings expectations are consistent with 8% growth in S&P 500 forward earnings by year-end. I anticipate expectations will be revised up further such that forward earnings actually grow by 12% over this period.

The major near-term risk remains a sharp increase in bond yields as this could pressure still lofty outright price-to-earnings (PE) valuations. At 22 times forward earnings, the S&P PE ratio is well above long-run average levels, though this appears somewhat justified by the low level of interest rates and the still below-trend level of earnings after their mini-collapse last year.

My current market view can be summarised as ‘2-2-2’. For starters, despite current market concerns, I anticipate core annual U.S. consumer price inflation will end the year sub-2% – or broadly in line with its average of the past few decades. In turn, that suggests the market will remain comfortable with the view that the Fed won’t raise interest rates over 2022, which my modelling suggests should keep U.S. 10-year bond yields sub-2% also.

Assuming a year-end equity risk premium around the current level of 2.9% and a 10-year bond yield of, say, 1.85% implies an equity earning yield of 4.75% or a forward PE ratio still with a “two handle” (specifically 21 on these assumptions, which would be 5% below current PE values).

Along with modest dividends and good earnings growth, that scenario would be consistent with positive equity returns over the remainder of the year.

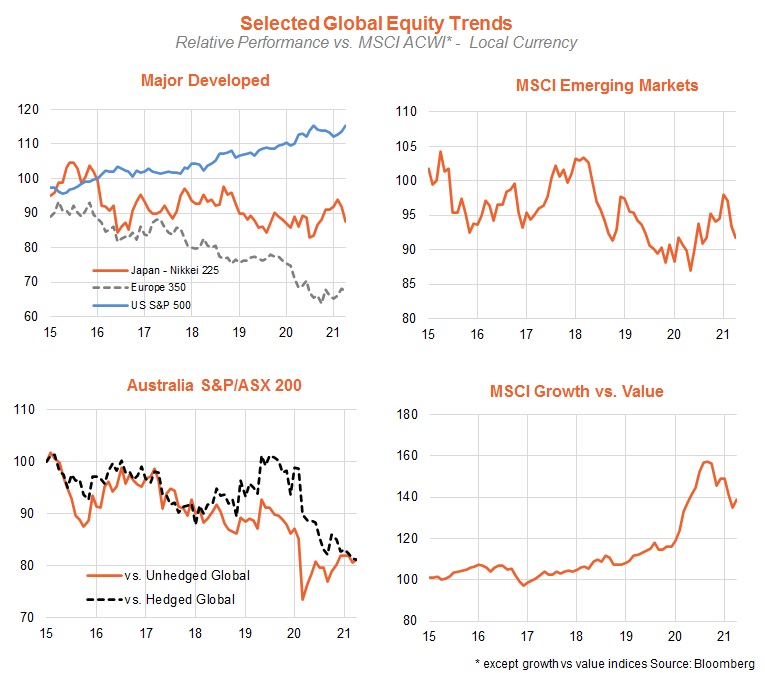

Major global equity trends

As seen in the chart set below, the growth factor and the U.S. market enjoyed a rebound in relative performance last month, likely helped by lower bond yields. Emerging markets, however, continued to weaken after strong relative performance since early last year. The Australian market also continued to generally underperform.

My base case is that value areas of the global market can continue to outperform over at least the next three to six months, though the ‘reflation/re-opening’ trade should then give way to a reassertion of the pre-COVID relative outperformance of growth sectors such as technology. Technology/growth may be challenged again once bond yields start to re-normalise and/or if inflation picks up more than I expect.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments