21 Jul Monthly Commentary: July 2023

Recession averted?

Global markets

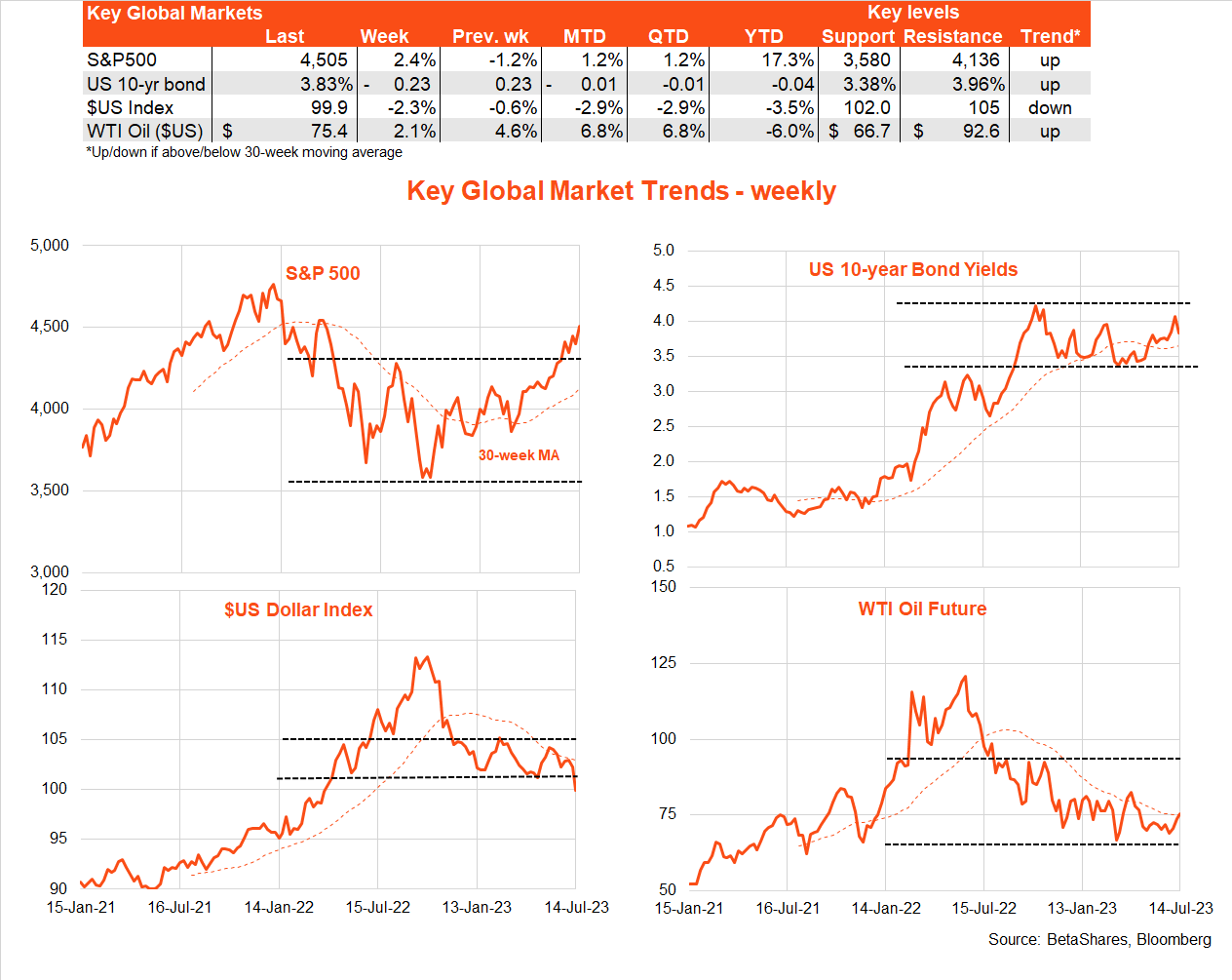

The key development over the past week was the weaker-than-expected US CPI result, which has reduced the risk of further aggressive Fed action that ultimately pushes the economy into recession. According to Fed comments, it still seems likely the Fed will hike at next month’s policy meeting, though further rate hikes after that are now questionable provided inflation continues to ease. Most encouraging was an easing in core service sector inflation.

Of course, the US labour market remains tight and wage inflation uncomfortably high – suggesting the Fed might still require a period of below-trend economic growth (rising unemployment) to be sure inflation gets back to target. But with tentative signs of an easing in wage growth, the need for a hard landing is no longer as evident as it seemed only a few months ago. Indeed, there’s growing evidence that the lingering excess US labour demand gap is being met by an improved labour supply response (higher immigration and workforce participation) and some scaling back in corporate America’s hiring ambitions.

Likely encouraging Q2 earnings results and a likely solid US retail sales report are the key US events this week.

Elsewhere around the world, the Bank of Canada still saw fit to lift rates 0.25% last week, though the RBNZ left rates on hold. A key update on NZ inflation will be out this week. In China, lower-than-expected inflation data is instead giving rise to deflation scares amid a sluggish economic recovery. Chinese Q2 GDP is out today. UK CPI data will also reveal just how problematic inflation remains and whether the BOE needs to hike rates further even in the face of a weakening economy.

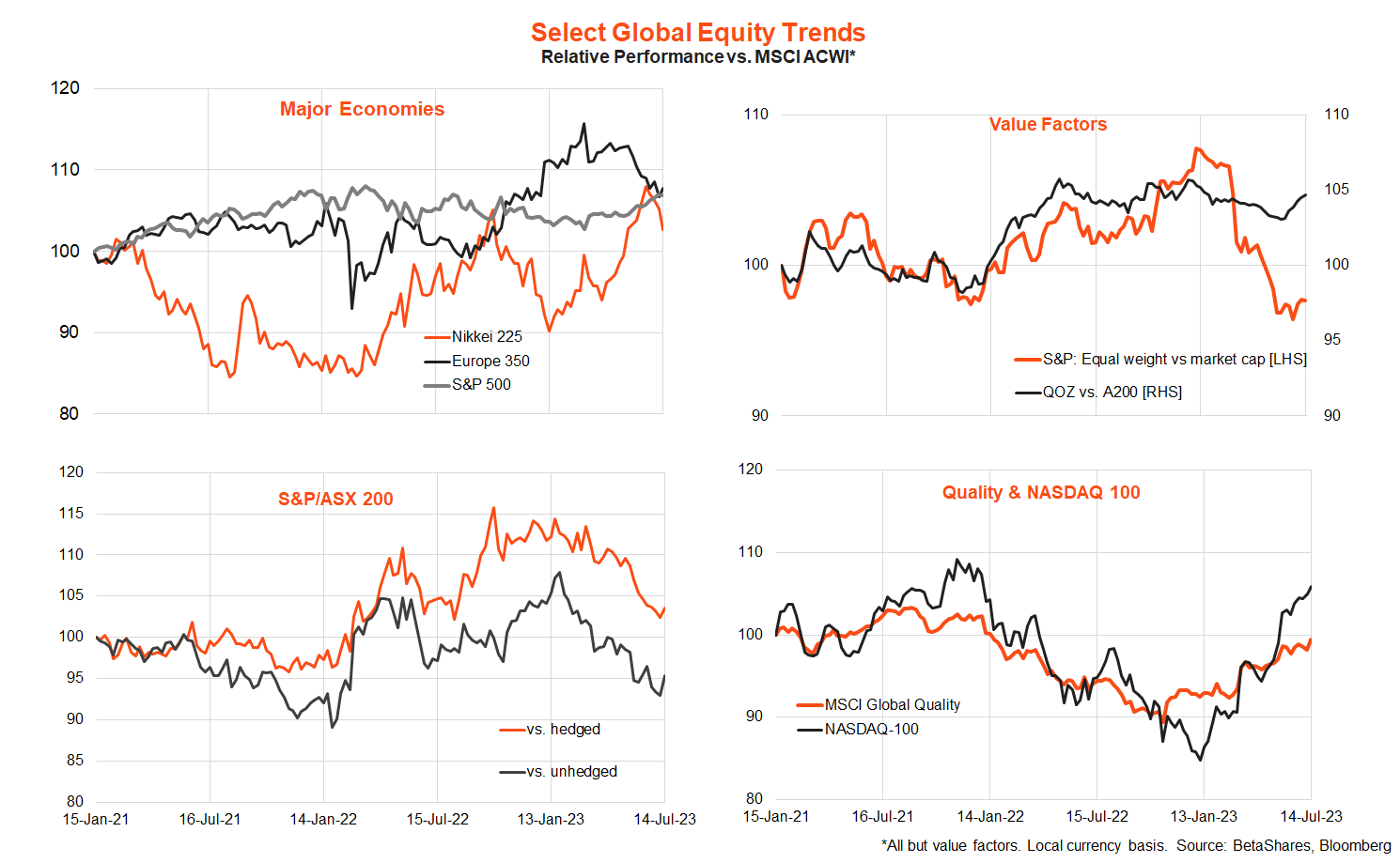

While soft landing hopes have so far favoured growth/technology/quality exposures, there is some evidence of a broadening in the equity recovery in recent weeks.

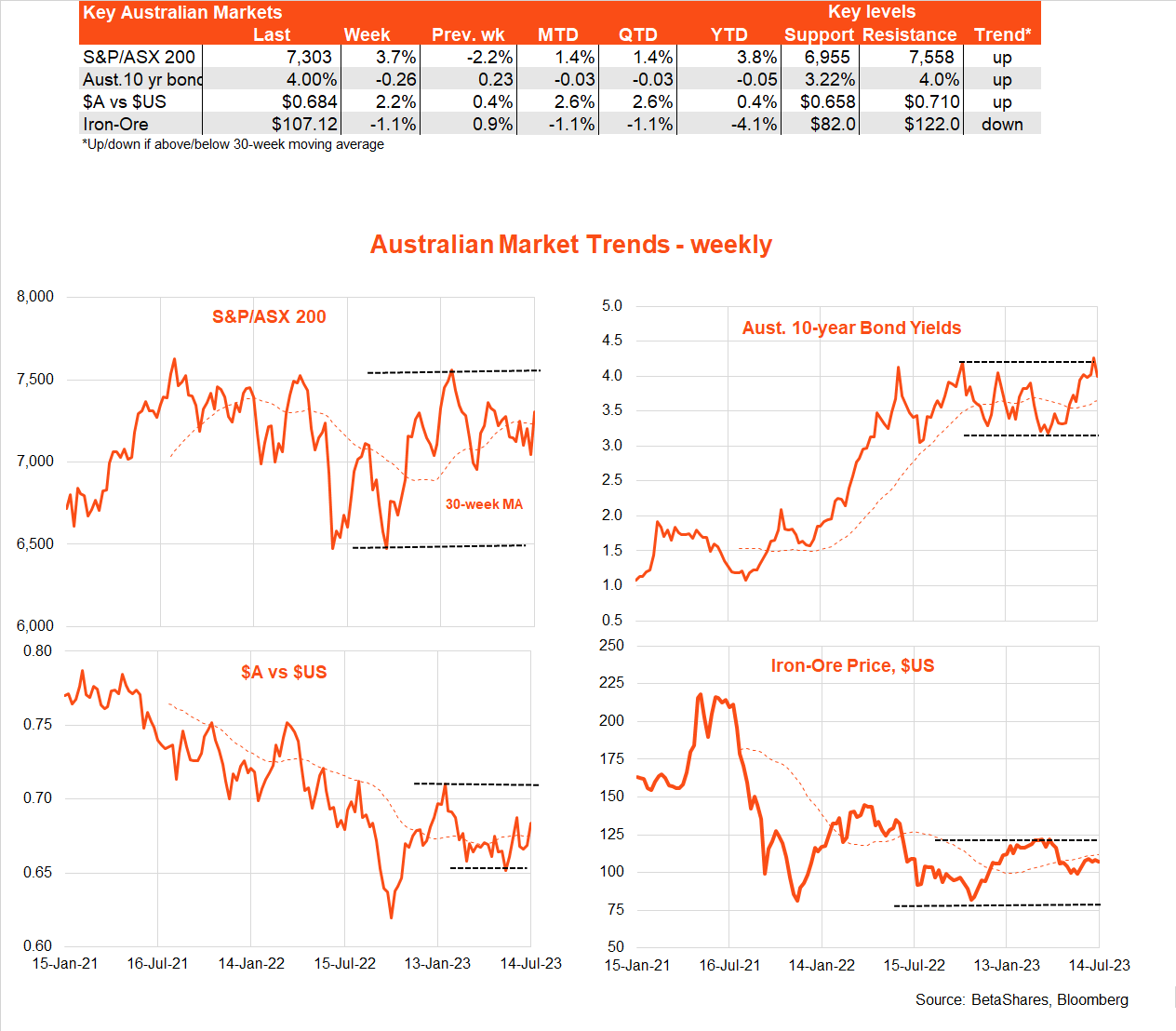

Australian market

There was mixed local economic data last week, with a bounce in consumer sentiment (albeit from low levels) and a steady NAB index of business conditions (which remain at above-average levels). One wrinkle in the NAB business survey was a modest rebound in wage and price pressures, which will likely keep the RBA on edge.

But the biggest news was the announcement of the new RBA Governor Michele Bullock and confirmation that new arrangements with regard to RBA meetings will begin next year. Being a long-established insider, the elevation of Bullock to the job suggests only incremental change at best to how the RBA thinks and acts. The biggest risk factor remains how having a new batch of ‘monetary experts’ on the Board will affect decisions over time.

Key highlights this week include minutes of the July RBA policy meeting (at which rates were left on hold) and Thursday’s labour market report. Insights from both will have a key bearing on whether the RBA raises rates next month.

This article was originally produced by David Bassanese from BetaShares. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments