21 Sep Monthly Commentary: July 2021

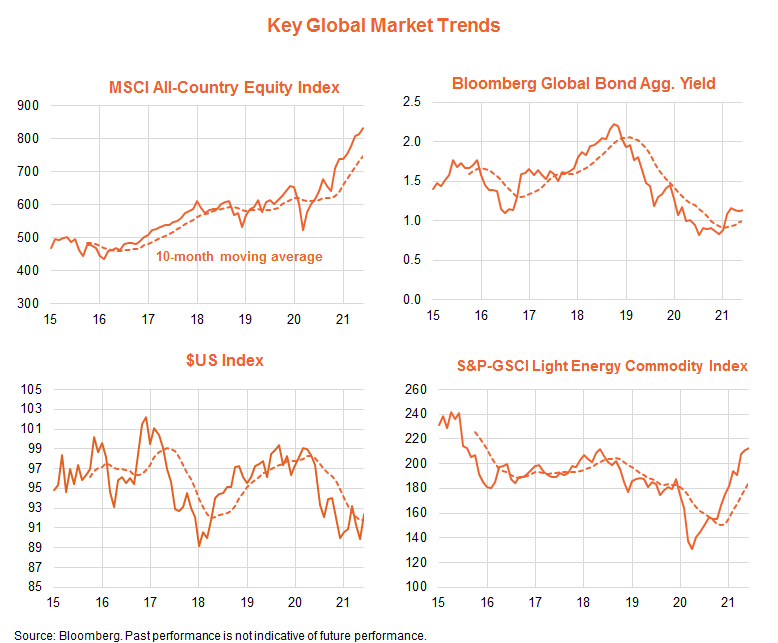

An apparent easing of inflation concerns and central bank tightening fears were the major market drivers in June, along with continued progress in the global vaccine rollout and reduction in COVID-related restrictions.

As a result, the global equity rally continued, with the MSCI All-Country World Equity Index returning 2.2% in local currency terms, to be up 37.4% over the year. Growth outperformed value. Global bond yields remained broadly steady, while the $US bounced higher. Commodity prices continued to rise.

Notwithstanding the likelihood that the U.S. Federal Reserve will announce a tapering in bond purchases in coming months (as early as late next month), the global equity outlook should be supported by ongoing strength in corporate earnings, an easing in U.S. inflation, and a likely glacial and well-telegraphed slowdown in Fed policy support.

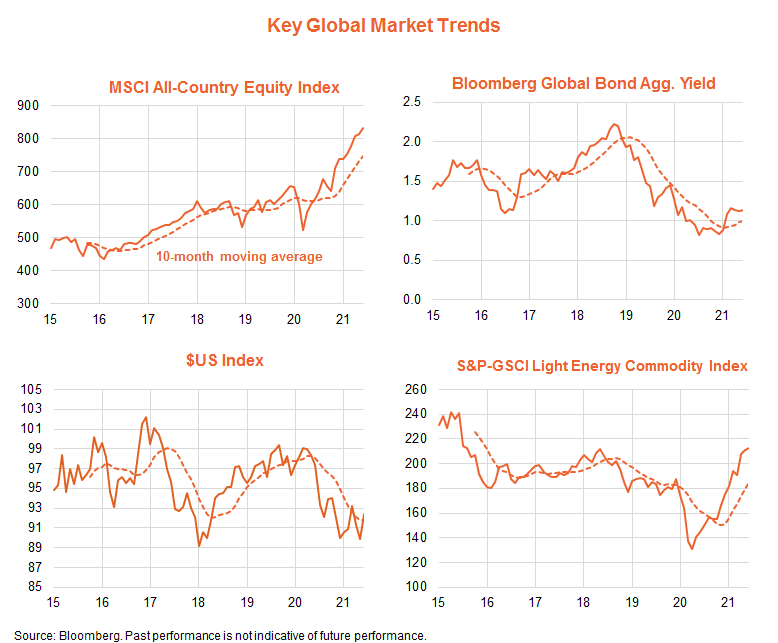

Global regional trends – U.S./growth on the rebound

As seen in the chart set below, the rotation towards non-U.S. regions (such as Japan and emerging markets) has petered out somewhat in 2021 so far, though there are tentative signs of a bottoming out in the underperformance of Europe and Australia.

By industry sector and factor, there are also tentative signs of a rotation back towards growth and quality. This has come at the expense of food and gold producers as well as banks, although oil producers continue to be supported by the ongoing strength in oil prices.

On the view that bond yields remain contained and inflation concerns ease, we could already be on the cusp of a return to pre-COVID trends that tended to favour the U.S. market and growth/technology exposures.

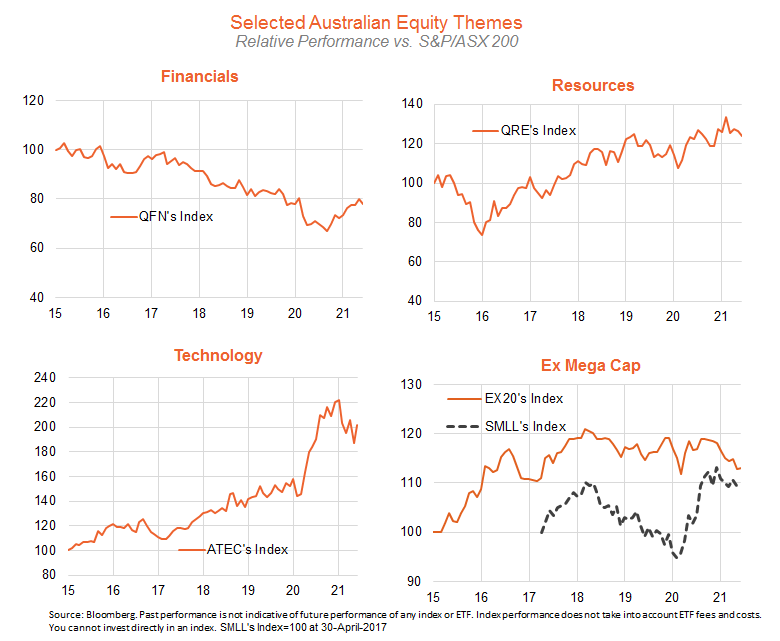

Australian equity themes

As evident in the chart set below, major recent ETF trends in the Australian market have been a rotation towards financials since late last year, largely at the expense of technology and smaller cap stocks. Relative performance of the resources sector has been choppy but continues to point upwards. If the growth thematic is on the rebound globally, that might mean local technology will also re-commence its previous outperformance trend.

That said, the overall outlook for local financials still appears encouraging, with a lower than feared lift in bad debts, strong credit growth and financial capacity to lift dividends for income-starved investors. The resources sector, meanwhile, also continued to enjoy sky-high iron-ore prices well above local extraction costs.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments