20 Feb Monthly Commentary: February 2023

Market Trends: Can the US pull off a soft landing?

Global bonds and equities: soft landing hopes boost returns

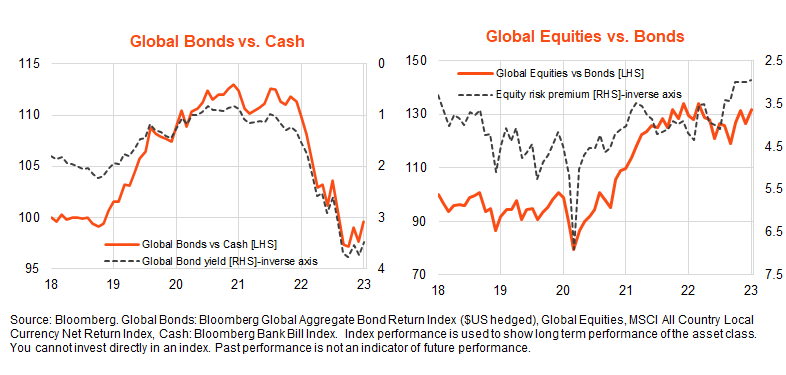

An easing in global inflation and still resilient economic growth – despite aggressive central bank rate hikes last year – has allowed global markets to start the year in a ‘goldilocks’ fashion, with both bonds and equities rallying.

The MSCI All-Country World Index returned 6.5% in January in local currency terms, though by a lesser 3.1% in $A terms due to strength in the Australian dollar. The Bloomberg Global Aggregate Bond Index ($A hedged) returned 2.1%. Cash, as measured by the Bloomberg Bank Bill Index, returned 0.3%.

Both bonds and equities have performed well in recent months, the latter by relatively more, reflecting ongoing hopes of a soft landing in the US economy. So far at least, this is being supported by an easing in US inflation and still resilient economic growth.

Outside the US, mild winter weather is helping Europe negotiate its way through its energy crisis, while China announced a dramatic U-turn in its zero-COVID strategy.

Australia vs. world: outperformance down under

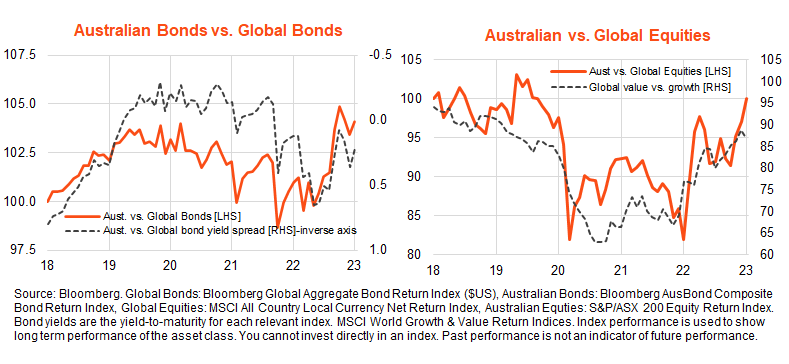

Australian equities also lifted in January, with the S&P/ASX 200 returning 6.2%. Australian equities have broadly outperformed global equities over the past year, as rising interest rates and firm commodity prices favoured value sectors – such as financials, mining and energy – over growth sectors such as technology.

Lower local bond yields also produced positive returns for local bonds in January, with the Bloomberg AusBond Composite Bond Index returning 2.8%. Largely reflecting more aggressive monetary policy tightening in the US, Australian bonds have also broadly outperformed global bonds over the past year.

Listed property and gold: benefiting from ‘soft landing’ hopes

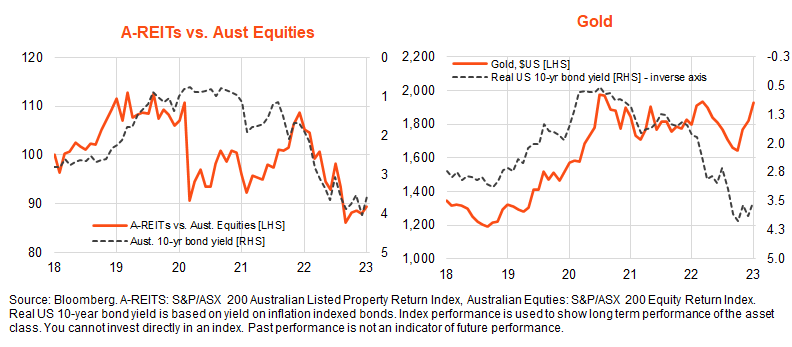

Due to lower bond yields, the interest rate-sensitive listed property sector performed especially well in January, with the S&P/ASX 200 A-REITs index returning 8.1%. The relative performance of property within the Australian equity market has tended to track movements in bond yields over the past year, with the recent easing in bond yields supporting relative outperformance of late after a period of significant underperformance over most of 2022.

Similarly, after notable weakness in the first half of 2022, gold has bounced back in recent months due to both declining global bond yields and weakness in the $US. The $US gold bullion price rose 5.7% in January.

Selected equity themes: value over growth for now

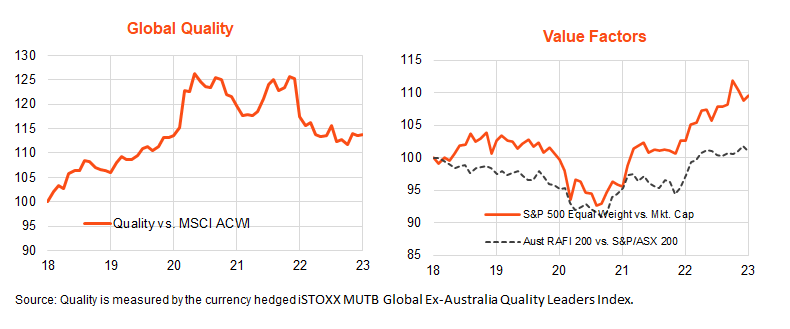

Among selected smart beta and factor exposures, a key underlying driver remains the relative underperformance of growth/technology areas compared to energy/value areas of the market – which in turn reflects upward pressure on interest rates, the $US and commodity prices over this period.

Should the latter macro trends shift, so will the likely trend in growth vs value performance.

Indeed, the broad outperformance of value over growth over the past year has tended to favour value exposure such as the S&P 500 equally weighted index (QUS ETF) over its technology-heavy market-cap weighted counterpart. The former returned 3.8% in $A terms over January, compared to an 2.6% return for the latter*. Relative performance of the fundamentally weighted Australian equity ETF (QOZ) versus the S&P/ASX200, however, has flattened off in recent months after solid gains earlier this year.

Meanwhile, the underperformance of the technology-heavy global quality factor appears to be levelling out in line with the bottoming out in global bond yields.

Outlook

Whether or not the US economy can pull off a soft landing remains the critical driver of global market trends.

A soft landing would favour both equities and bond over cash, as well as a likely shift back in relative performance to growth/global over value/Australian equities. It would also likely be positive for the relative performance of gold, listed property and quality.

Should the US quickly succumb to recession (without a lot more policy tightening beyond that already priced into the market) it would be negative for equities but more positive for bonds. This would also, however, likely not favour continued value/Australian equity outperformance over growth/global, though potentially favour quality as a factor and be reasonably neutral for gold and property in terms of relative performance.

A final scenario is ‘no landing’ for the US economy – where growth fails to slow or even re-accelerates and inflation/wages remains stubbornly firm. This would likely imply much more significant monetary tightening than currently priced into bond markets, which would likely be a negative for both bonds and equities. As evident over 2022, it would also likely not favour gold or property, though favour value/Australia over growth/global equity exposures.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments