25 Aug Monthly Commentary: August 2023

Easing inflation fuels hopes of soft landing

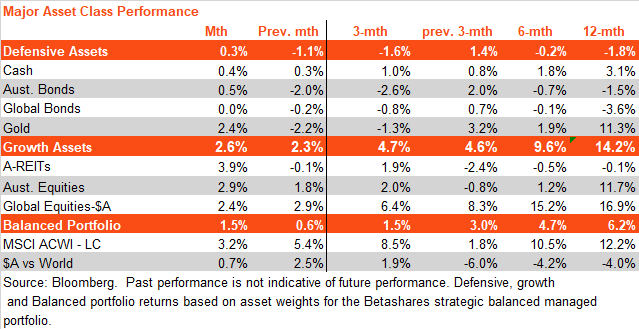

Growth vs defensive assets

Global equities rose further in July despite continued upward pressure on bond yields as central banks retained firm policy tightening biases. With corporate earnings still broadly flat, the gain in equities reflected a further lift in valuations to what are becoming historically expensive levels. That said, investors remained upbeat in the month due to encouraging inflation results which increased the prospects of an economic soft landing. As a result, growth assets outperformed defensive assets in July, with the former showing positive relative performance over recent months.

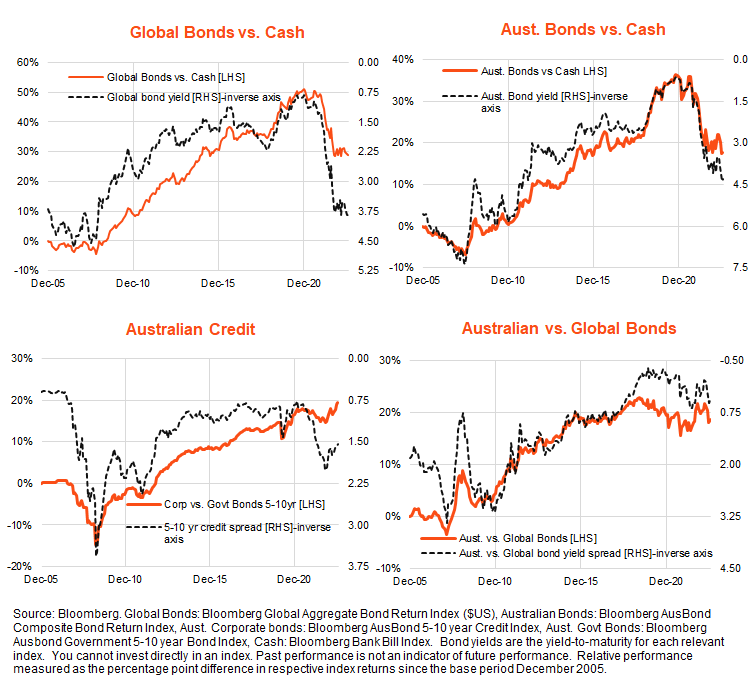

Fixed-rate bonds and cash

After appearing to top out earlier this year, long-term bond yields have pushed somewhat higher in recent months, resulting in bond returns lagging that from cash.

Credit spreads, by contrast, continue to narrow with the recovery in equity prices from late last year, leading to outperformance of corporate bonds relative to government bonds. Australian versus global bond yield spreads have traded in a choppy range in recent months, resulting in a similar choppy range for Australian bond performance relative to global bonds.

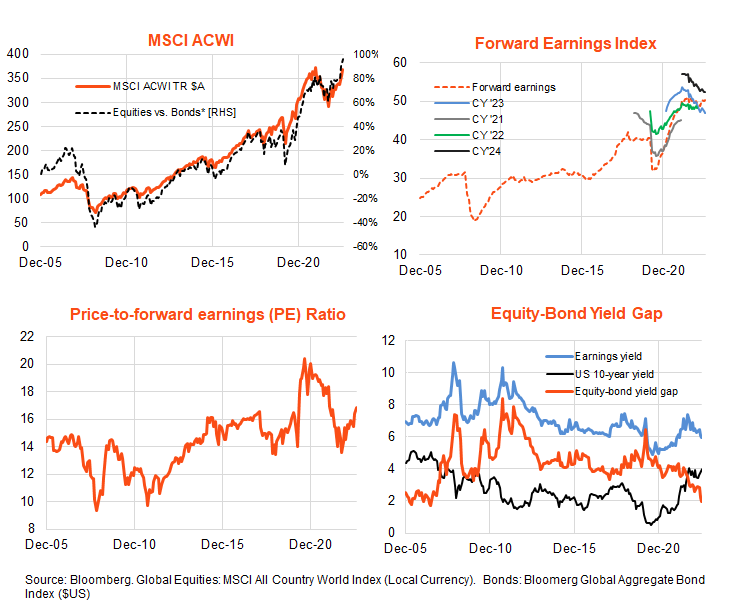

Global equities

Global equities continue to move higher. With forward earnings still broadly flat (reflecting ongoing downgrades to expected global earnings growth for both this year and next year) most of this gain has reflected higher price-to-earnings (PE) valuations. With bond yields also still reasonably high, equity gains have also been reflected in a narrowing equity risk premium – which is now at its lowest level since 2007.

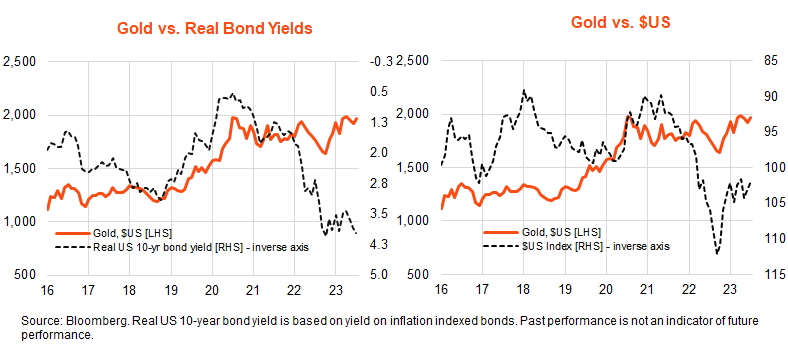

Gold

Despite somewhat higher US bond yields, gold prices bounced back in July – supported by a weaker US dollar. Gold prices have broadly trended up along with the improvement in risk sentiment since late last.

Australian equities and listed property

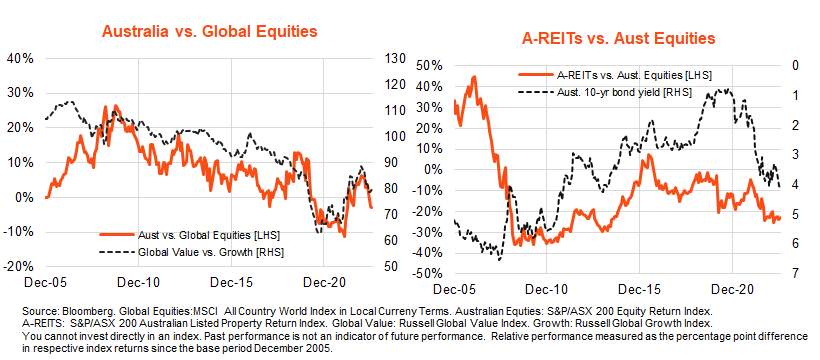

Australian equities continue to broadly underperform global equities, in line with the global outperformance of growth/technology exposures compared to resources/value. Listed property produced a positive return in July, likely supported by steadier local bond yields, though relative performance against the broader market remains under downward pressure.

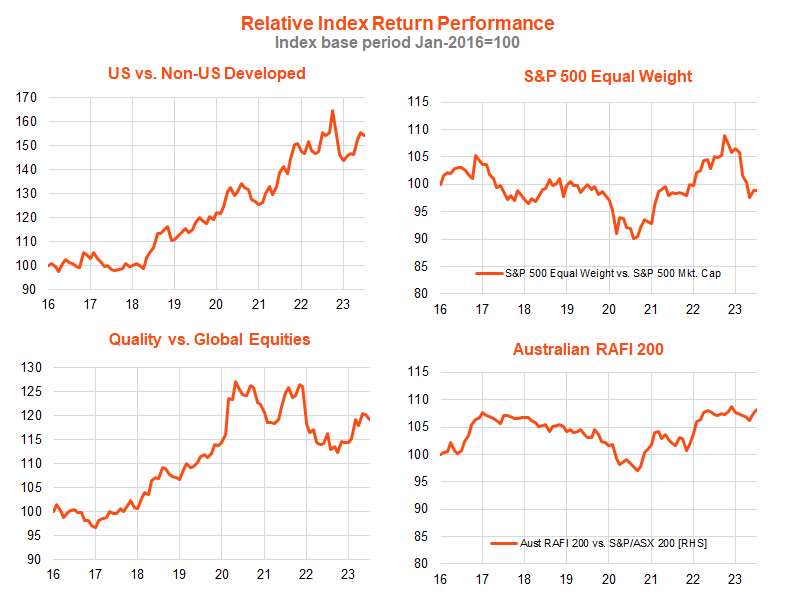

Global equity themes

Technology/quality/US market themes have broadly tended to outperform since the global equity recovery from end-October 2022. That said, with hopes for a global soft landing increasing in recent months, a modest broadening in returns has been evident in recent months, with the S&P 500 Equal Weight and Australia RAFI 200 indices modestly outperforming their market cap-weighted counterparts. Global quality and the US market have also had small relative performance pullbacks.

Source: Bloomberg. Indices: US: S&P 500. Non-US Developed: MSCI World, ex-US. Global Equities: MSCI ACWI. Quality: iSTOXX MUTB Global Ex-Australia Quality Leaders Index AUD Hedged. You cannot invest directly in an index. Past performance is not an indicator of future performance.

Outlook

As was also evident in June, July was notable in that global equities withstood a further rise in bond yields. That said, equity gains are still being driven largely by valuations rather than earnings in the hope of better times ahead. Most of the global disinflation, moreover, has been in the goods and energy markets, with wages and service sector inflation still uncomfortably high – in line with still relatively tight labour markets. While there are some encouraging signs of easing US wage inflation – helped by a rebound in labour supply to fill some outstanding vacancies – it remains to be seen whether wage growth can fall back to pre-COVID levels without a recessionary-like rise in unemployment. History suggests it will not be easy.

Meanwhile, even in the absence of recession, stretched valuations may make equity markets more vulnerable to a decent correction if the anticipated recovery in earnings fails to appear relatively soon and/or the pace of global disinflation levels out at a still-high level. Perhaps a taste of this vulnerability came with the US credit rating downgrade by Fitch in the past week.

This article was originally produced by David Bassanese from BetaShares. You can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments