26 Aug Monthly Commentary: August 2022

Market Trends: Falling yields boost stocks

Major asset classes: Equities, bonds and cash

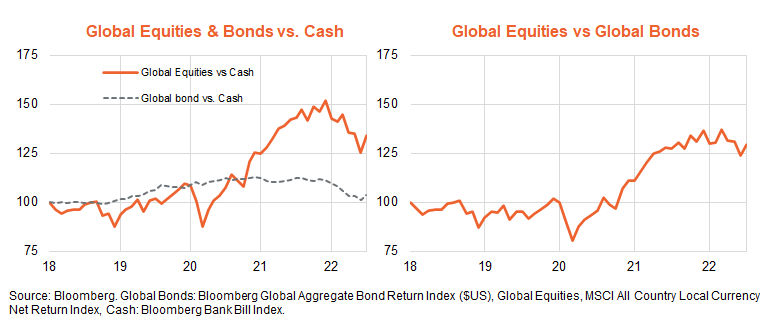

Global equities and bonds staged a rebound in July, with both outperforming cash.

Emerging signs of weakening global growth saw bond yields ease, as markets scaled back central bank rate hike expectations and began to pencil in potential rate cuts (at least in the US) over 2023.

In turn, falling bond yields contributed to a 2.5% gain in the Bloomberg Global Aggregate Bond Index in $US hedged terms, though the Index remains 7.8% below its recent peak in July 2021.

With aggressive central bank rate increases still priced into the market, it seems likely that bond yields peaked a few months ago and bonds may well continue to outperform cash over coming months.

Global equities returned 7.1% in local currency terms, reflecting a bounce back in the price-to-forward earnings ratio from 13.9 to 14.9 – which in turn was largely explained by the drop in bond yields. The global equity risk premium eased only modestly, from 4.2% to 4.1% – to remain around average levels. Forward earnings actually fell 0.3%, reflecting a modest downgrade to CY’22 and CY’23 earnings expectations. Forward earnings are only expected to rise a further 2.6% this year, though by a still surprisingly strong 11% in 2023.

Further earnings downgrades – and a rise in equity risk premiums – remain the major equity market risk if inflation fails to fall quickly enough and forces central banks into allowing the global economy to tumble into recession. On this base case view, equities are expected to continue to underperform cash and bonds for some months.

Australia vs. the world

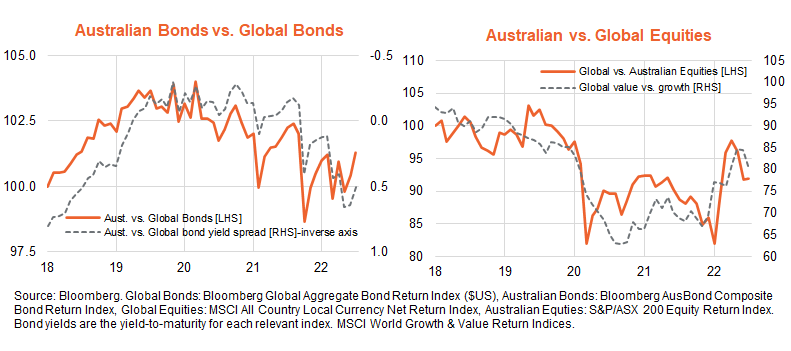

Australian bond performance versus the global benchmark has been in a choppy modest downward trend since early 2020, initially reflecting more aggressive global interest rate cuts to deal with the COVID crisis and now relatively more aggressive RBA rate hikes expectations. With the Reserve Bank not expected to raise rates as aggressively as the US, some of this bond underperformance is expected to be recovered in coming months.

Similarly, relative Australian equity performance has been in a choppy sideways range since the COVID slump of early 2020 – and broadly in line with the relative performance of global value stocks over growth stocks. Rising interest rates and commodity prices since late last year contributed to the outperformance of the Australian market until earlier this year, but some of this outperformance has unwound with falling bond yields and commodity prices in recent months. Assuming slowing global growth continues to put downward pressure on global bond yields and commodity prices, these trends suggest the Australian market may underperform for a while longer.

Selected equity themes

In terms of major global equity themes, the clearest recent trends have been the reversal in the relative performance of value/resource/energy exposures and tentative signs of a bottoming out in the underperformance of growth/technology/quality exposures. The relatively defensive health care sector has also enjoyed outperformance since mid-2021, though there was a setback in July due to the increase in risk-on sentiment. Financials have tended to broadly track market performance.

On the basis that equity markets overall will remain under pressure, it seems likely that the value/resource/energy exposures will remain most vulnerable, while growth/technology/quality exposures might at least stop underperforming if bond yields drop further. The health care sector also looks well placed to outperform in a weak equity market environment.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments