28 Feb Market Commentary – February 2020

Key Global Trends – virus fears

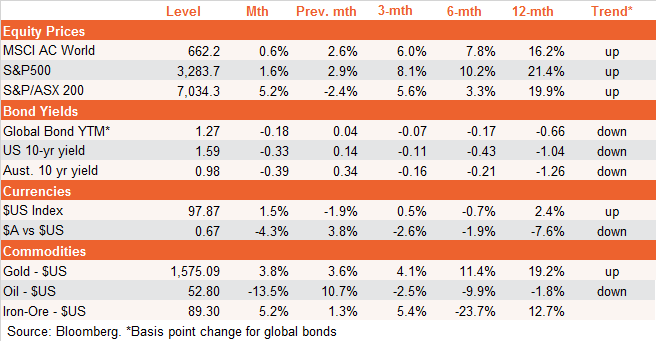

Global equities started the new year on a strong footing, thanks to an easing in global trade tensions. That said, new fears related to the coronavirus have more recently caused a setback, such that overall global equities posted a modest 0.6% gain in January. Australian and US equities outperformed.

Reflecting virus fears, bond yields and the Asia-exposed $A dropped notably, while gold again demonstrated its appeal as a safe haven asset. Oil prices slumped.

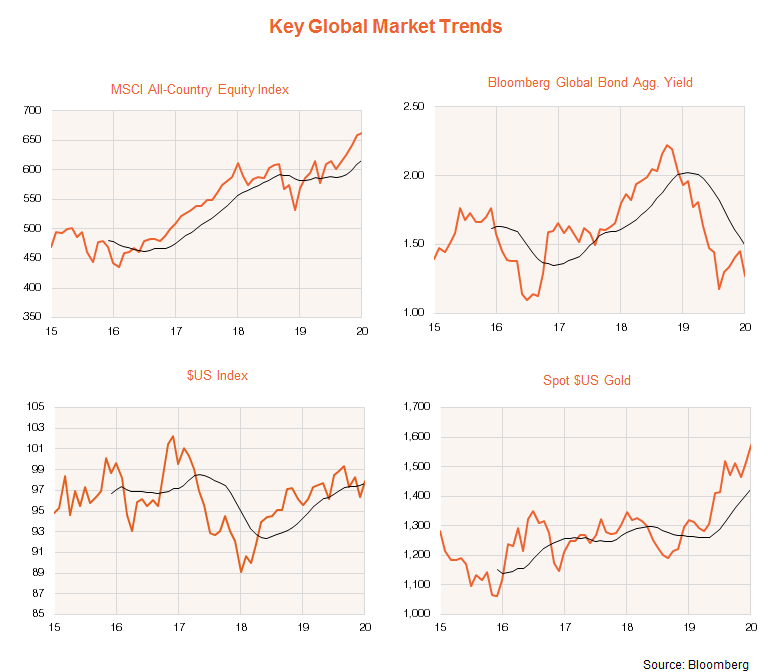

As seen in the chart set below, major trends across the four major markets remained unchanged last month, with equities, the $US and gold in an uptrend, and bond yields in a downtrend.

Major global economic events and implications

US economic data was mostly good with strong home builder conditions and housing starts, gains in manufacturing conditions in the Philadelphia and New York regions, continuing low jobless claims and a rise in the leading index. However, February business conditions PMIs fell sharply likely reflecting concerns about the impact of Covid-19 on the economy.

Eurozone business conditions PMIs and consumer confidence surprisingly improved in February, despite Covid-19 fears.

Japanese GDP fell sharply in the December quarter thanks to the hit from the GST hike in October and the hit from the coronavirus outbreak in the current quarter raises the risk that it has entered yet another recession. Possibly consistent with this, Japan’s composite business conditions PMI fell sharply in February. Core inflation also fell back to 0.8%yoy in January.

Chinese credit rose more than expected in January possibly reflecting PBOC efforts to offset the impact from the coronavirus outbreak, although annual credit growth slowed slightly. Meanwhile, home prices showed continued modest growth in January. Chinese policy stimulus measures continued to ramp up with more rate cuts and plans to cut more corporate taxes and fees. This could supercharge the post Covid-19 growth rebound when it comes.

Australian economic events and implications

Australian data was soft and points to the need for further policy stimulus. While employment rose by slightly more than expected in January and full time employment rebounded after 3 weak months, annual jobs growth slowed to its weakest in nearly 3 years, hours worked slowed, unemployment rebounded to 5.3% and underemployment rose to 8.6% which combined to push labour underutilisation to 13.9%. With job vacancies and other forward labour market indicators pointing to a slowdown in job growth below the 20,000 a month needed to absorb new entrants to the workforce unemployment is likely to drift up. The CBA’s business conditions PMIs also weakened sharply in February consistent with the coronavirus outbreak weighing on economic activity this quarter.

With Australia stuck a long way from full employment (which is probably well below 4% for the headline unemployment rate), wages growth which was just 2.2% through last year is likely to remain weak and underlying inflation is likely to remain well below target. The bottom line is that more policy stimulus is required. Ideally, this should come in the form of more fiscal stimulus but in the absence of that, the pressure falls back on the RBA, which is likely to have to act on the easing bias that it again reiterated in its February board meeting minutes despite the risks associated with further easing. So, we continue to see another rate cut in either March or April and the cash rate falling to 0.25% by mid-year.

The December half profit reporting season is now two-thirds done and while the results have improved a bit compared to a week ago, they are still mixed. 55% of companies have seen their profits rise from a year ago, which is below the long-term norm of 65%. And while downside surprise has fallen to 40% of companies its above upside surprise of 38%. There were some strong dividend increases including from BHP and Fortescue, but only 53% of companies have now raised dividends and this is below the long-term norm of 62%. Several companies also issued profit downgrades related to the impact of coronavirus, but investors seemed prepared to look through this given that underlying results were generally better than feared. Reflecting the mixed results overall, the proportion of companies seeing their shares outperform the market versus underperform on the day they reported is running at 51% to 49% which is the same as in the August reporting season. Earnings growth expectations for 2019-20 are coming in at around 2.8% which is in line with expectations at the start of the reporting season. Earnings growth is strongest in tech, telcos, gaming and healthcare stocks with good growth from resources stocks and weakest amongst utilities, media, and insurers.

Outlook for investment markets

Improving global growth and still easy monetary conditions should drive reasonable investment returns through 2020, providing the coronavirus is contained in the next month or so. But returns are likely to be more modest than the double-digit gains of 2019 as the starting point of higher valuations for shares and geopolitical risks are likely to constrain gains and create some volatility:

- Shares are at risk of further short-term volatility, particularly with uncertainty around the coronavirus remaining high both in terms of the outbreak’s duration and its economic impact even if it’s soon contained.

- But for the year as a whole, global shares are expected to see total returns around 9.5% helped by better growth and easy monetary policy.

- Cyclical, non-US and emerging market shares are likely to outperform, particularly if the US dollar declines and trade threat recedes as we expect.

- Australian shares are likely to do okay this year but with total returns also constrained to around 9% given sub-par economic & profit growth.

- Low starting point yields and a slight rise in yields through the year are likely to result in low returns from bonds.

- Unlisted commercial property and infrastructure are likely to continue benefitting from the search for yield but the decline in retail property values will still weigh on property returns.

- National capital city house prices are expected to see continued strong gains in the months ahead on the back of pent up demand, rate cuts and the fear of missing out. However, poor affordability, the weak economy and still-tight lending standards are expected to see the pace of gains slow leaving property prices up 10% for the year as a whole. The coronavirus outbreak could be a bit of a short-term dampener though, particularly in terms of keeping Chinese buyers away.

- Cash & bank deposits are likely to provide very poor returns, with the RBA expected to cut the cash rate to 0.25%.

- The A$ is likely to fall to around US$0.65 as the coronavirus outbreak depresses Australia’s exports and the RBA eases further but then drift up a bit as global growth improves to end 2020 little changed.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

This article was originally produced by Beta Shares (click here to view the full article and) and AMP (click here to view).

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments