25 Aug Inflation and It’s Impact on Your Retirement

The Effects of Inflation on Retirees

Inflation denotes the overall price surge of goods and services in an economy, diminishing the purchasing power of money. Thus, while planning for retirement, it’s crucial to gauge the future impact of inflation. In essence, the steeper the inflation during retirement, the heftier the savings needed beforehand.

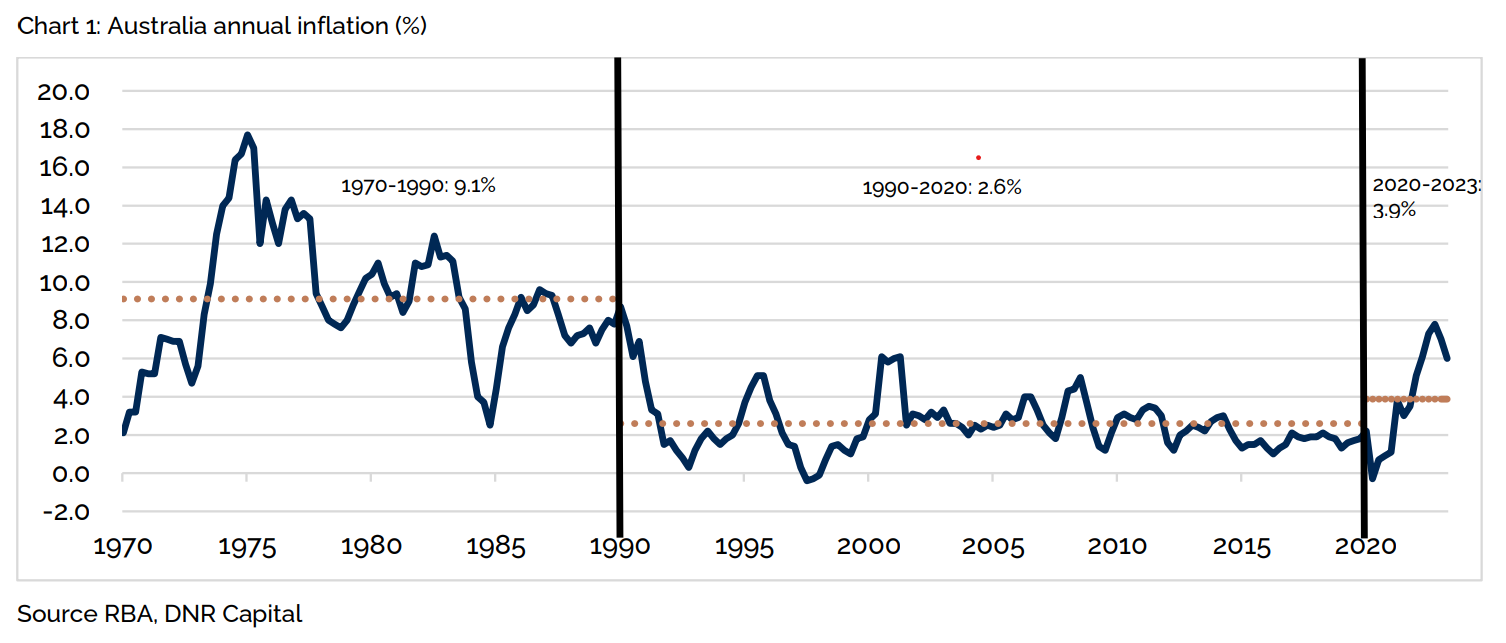

From 1990 to 2020, inflation remained largely within the RBA’s objective, hovering around 3% annually. However, between 1970 and 1990, it escalated to an average of 9% per annum, and in the current decade, it’s around 4%.

Several factors have recently intensified inflation:

1. Disruptions from the Covid-19 pandemic caused imbalances in demand and supply.

2. The conflict in Ukraine elevated essential commodity prices, like food and energy.

3. Constricted labor markets pushed up wages, indirectly boosting inflation.

Even though inflation might have hit its zenith, challenges arise if it’s not reined in swiftly and if high prices become the norm. Evaluating this scenario, we highlight the repercussions of escalating inflation on retirees. Furthermore, we advocate for retirees to diversify, particularly with more emphasis on Australian stocks, as they can offer a counterbalance to inflation in the long run.

Moreover, we’re convinced that strategies focusing on Australian equity income can yield superior results for retirees. Such strategies not only combat inflation but also aid in ensuring retirees can maintain their desired lifestyles.

The Retirement Horizon: Growing Longer

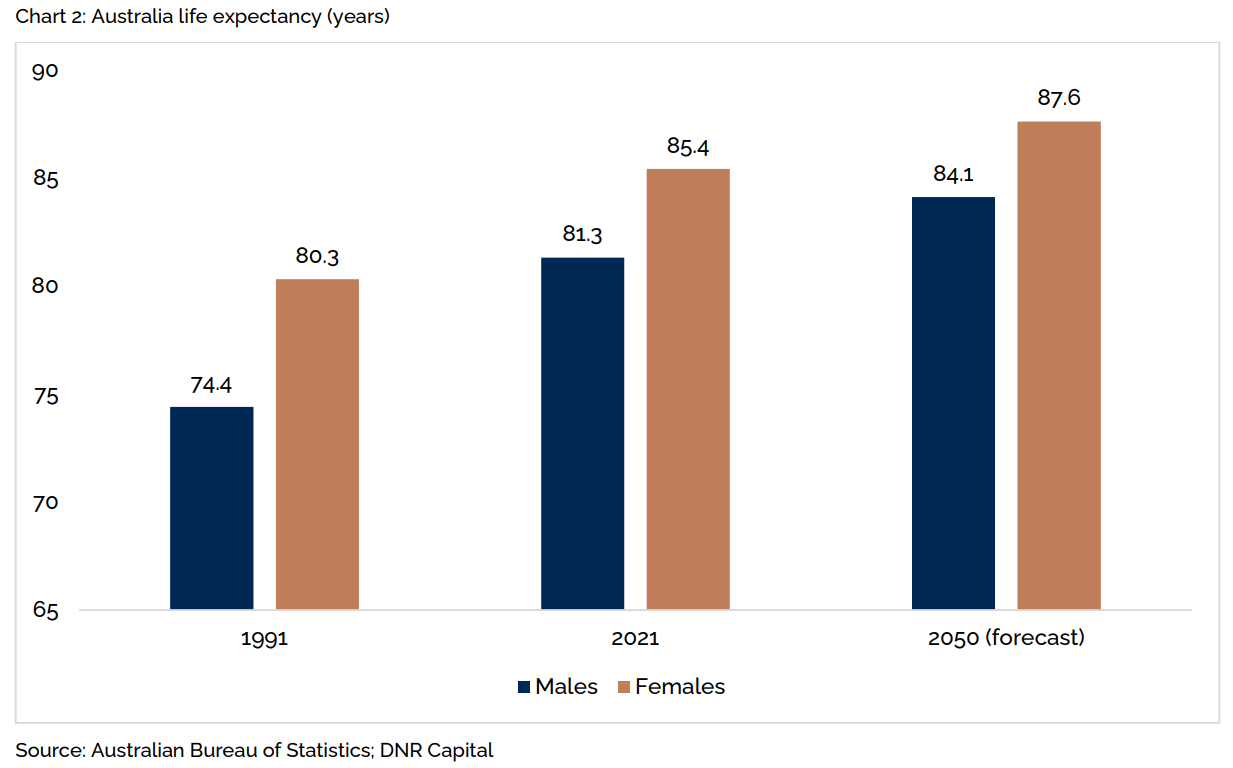

Advancements in healthcare and better living standards mean people are living lengthier lives. Since 1990, life expectancy for Australian men has risen by seven years and for women by five years. Presently, Australian men and women can expect to live up to 81 and 85 years, respectively, ranking third globally.

While Australia doesn’t have a fixed retirement age, pension eligibility age matters for those relying on it for post-retirement earnings. As of 1 July 2023, this age shifted to 67 for those born post-31 December 1956. Consequently, retirees now spend 14-18 years on average in retirement, expected to extend to 21-25 years by 2050, assuming no further shifts in pension age.

Financial Planning for Retirement

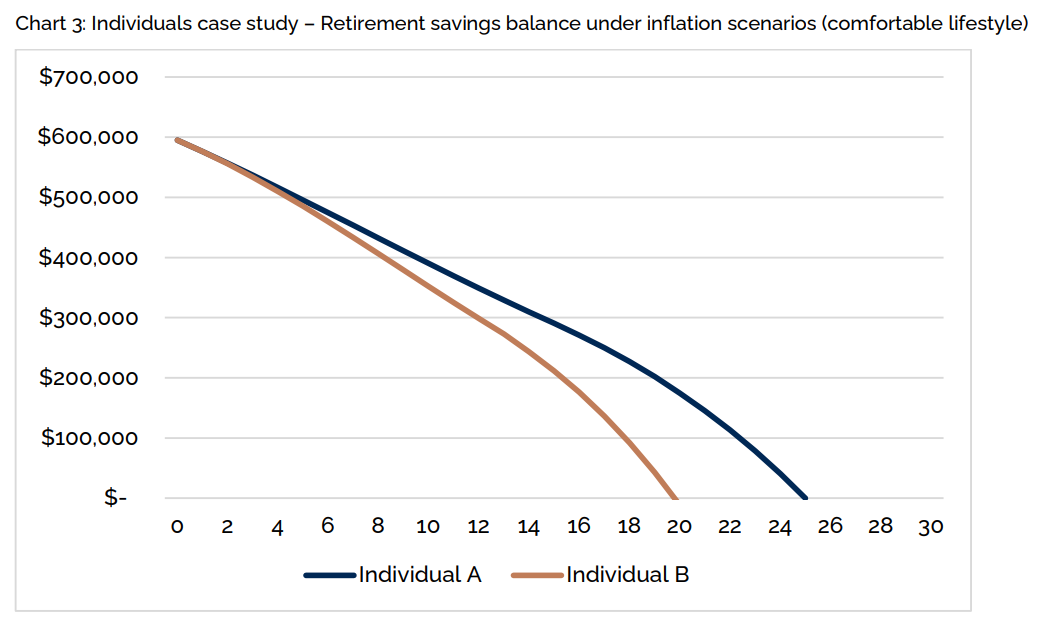

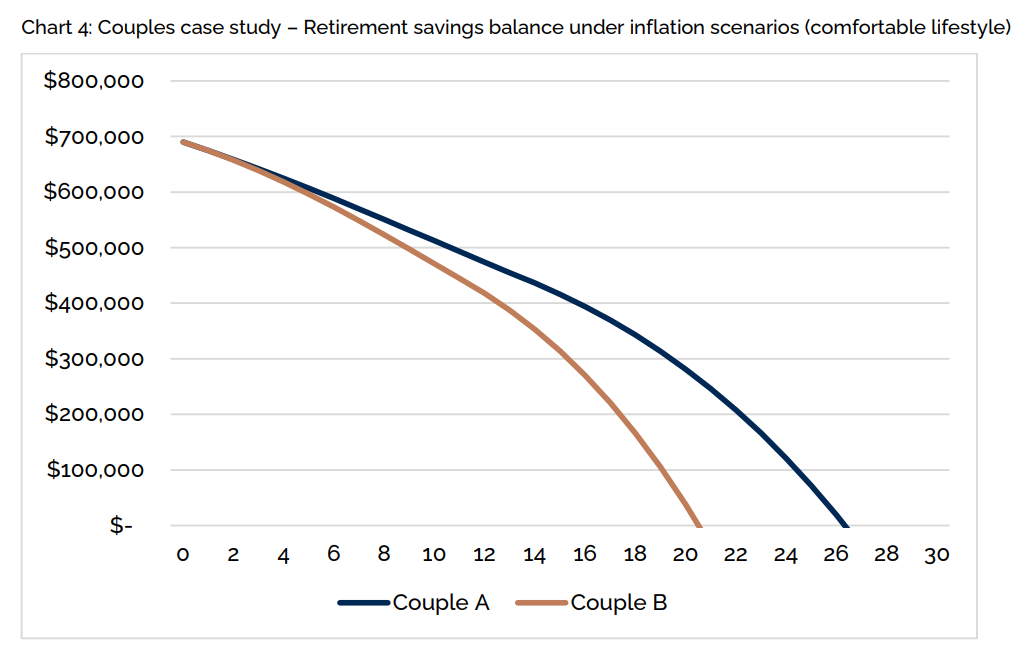

The Association of Superannuation Funds of Australia (ASFA) provides guidelines on retirement savings. For a comfortable retirement, individuals should aim for an annual income of about $50k, while couples should aim for $70k. The government’s Age Pension offers between $21k and $28k per year. Therefore, to ensure this comfortable lifestyle, a single person should save up to $595k, and a couple should save about $690k. These estimates are based on retiring at 67, with a projected inflation of 2.75% and a 6% investment return. There’s also a consideration on how a higher 5% inflation rate might impact these savings, detailed in specific charts.

Individuals: Based on ASFA estimates for a comfortable lifestyle for individuals, a higher inflation scenario (i.e. 5% pa) results in Individual B’s savings expire ~5 years before Individual A (i.e. 20 years v 25 years).

Individual A: 1) Expenses of $50k pa; 2) Superannuation savings of $595k; 3) Investment return of 6% pa; and 4) Inflation of 3% pa.

Individual B: 1) Expenses of $50k pa; 2) Superannuation savings of $595k; 3) Investment return of 6% pa; and 4) Inflation of 5% pa.

NB. Calculations take into account the receipt of the Age Pension.

Source: ASFA; DNR Capital

Couples: Based on ASFA estimates for a comfortable lifestyle for couples, a higher inflation scenario (i.e. 5% pa) results in Couple B’s savings expire ~6 years before Couple A (i.e. 20 years v 26 years).

Couple A: 1) Expenses of $70k pa; 2) Superannuation savings of $690k; 3) Investment return of 6% pa; and 4) Inflation of 3% pa.

Couple B: 1) Expenses of $70k pa; 2) Superannuation savings of $690k; 3) Investment return of 6% pa; and 4) Inflation of 5% pa.

NB. Calculations take into account the receipt of the Age Pension.

Source: ASFA; DNR Capital

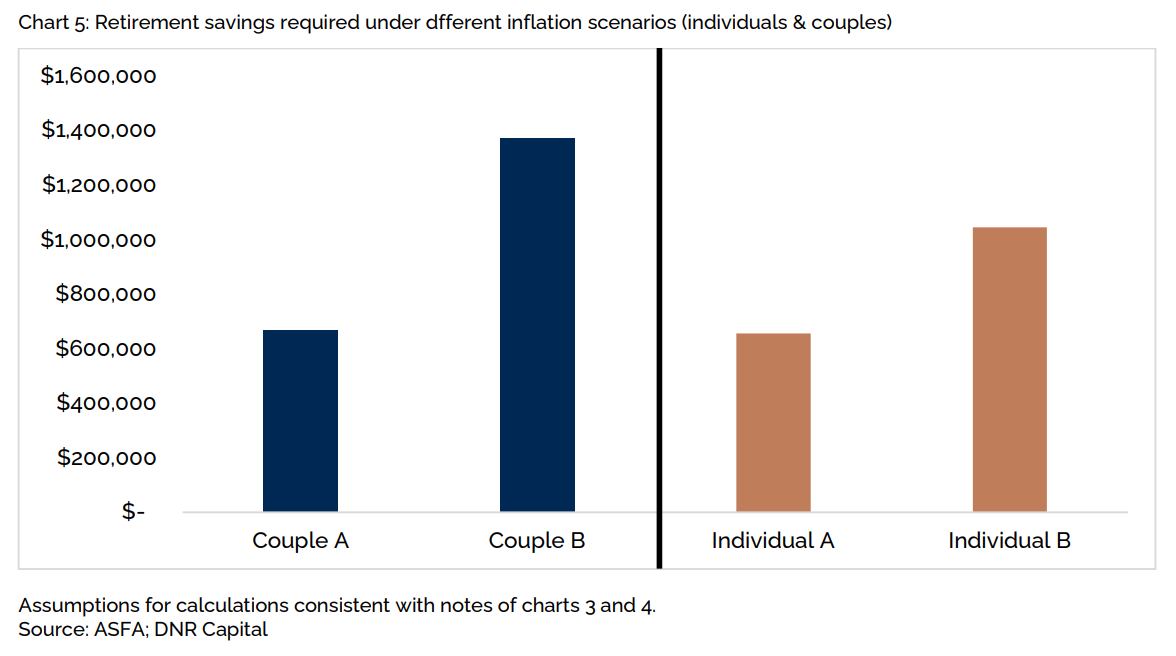

Another way to look at the impact of inflation on retirees is to calculate the savings or superannuation balance required to achieve a desired lifestyle, under different inflation scenarios.

The chart below demonstrates that if inflation is 5% pa, rather than the 2.75% pa assumed by the ASFA, then individuals would need closer to ~$1m (compared to the ~$595k ASFA currently estimates), whilst couples would need almost ~$1.3m (compared to the ~$690k ASFA currently estimates).

Forecast for various asset classes

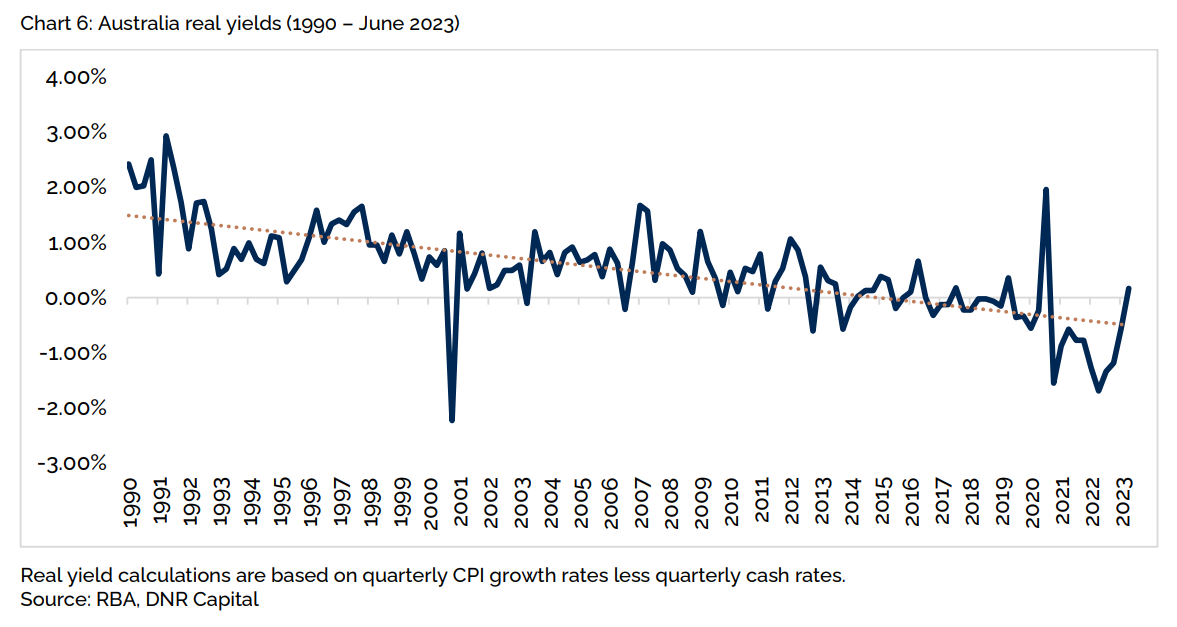

Real yields have been heading toward negative territory over the previous few years as a result of lower interest rates and have spent the previous seven years in negative territory during the past thirty years.

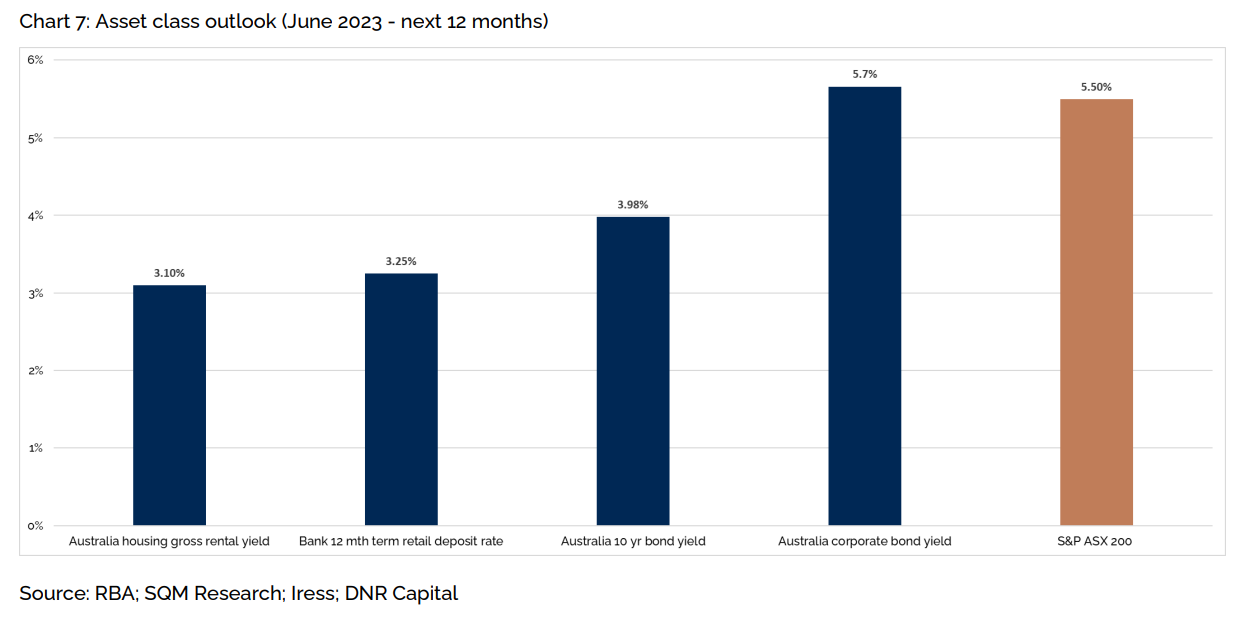

Whilst investment yields on cash, bonds and housing are now at decade highs, many of these are still eroding purchasing power after considering inflation (i.e. the amount invested today will be worth less tomorrow) Conversely, Australian equity dividends (including the benefit of franking) still remain appealing to retirees, with projections to deliver a gross dividend yield of ~5.5% over the next 12 months.

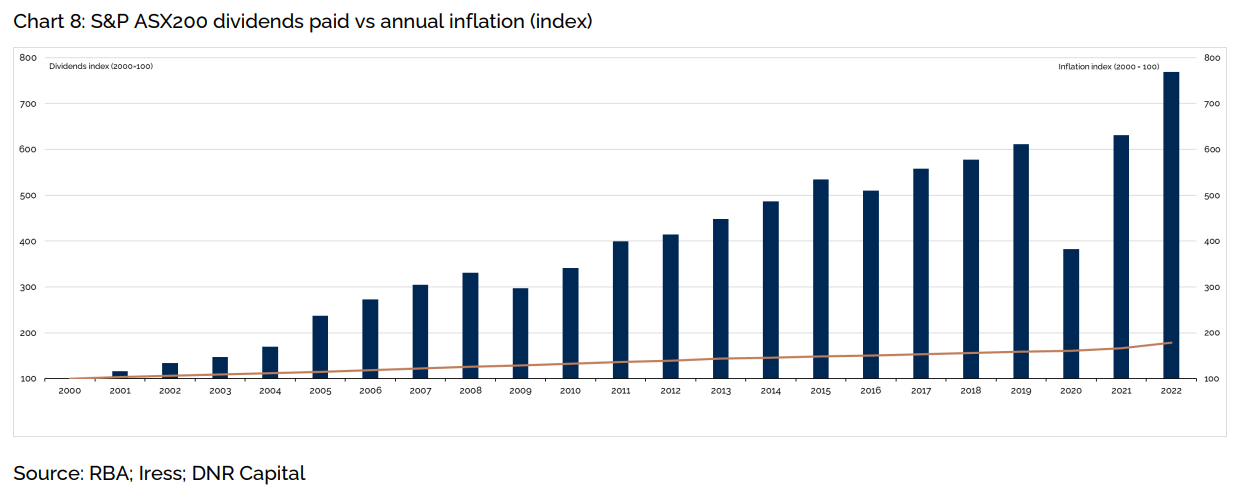

Over the last two decades, total dollar dividends paid by Australian equities have substantially outpaced inflation, providing retirees a generous buffer against cost-of-living pressures.

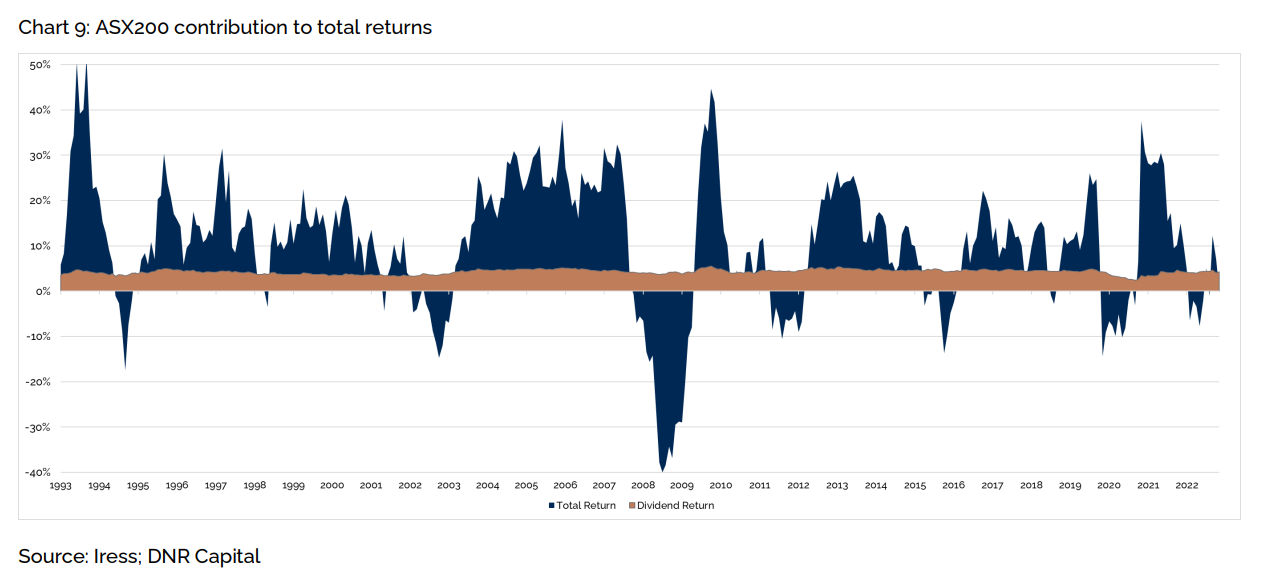

We expect dividends will continue to be a large contributor to market returns, having contributed approximately half the ASX200 index returns since 1950. Franking benefits are also unique to the Australian market and provide a source of upside for domestic investors – particularly for retirees. Each year the Australian market (ASX200) typically receives dividends with ~75-80% franking attached. This will remain a defensive investment feature in Australia’s investment case, relative to other markets.

Final Thoughts

Inflation plays a pivotal role in determining the nest egg retirees need. With current inflation trends, there’s a looming threat to the real value of retirees’ savings. Diversification, especially in Australian equities, might offer a shield against this threat. The DNR Capital Australian Equities Income Strategy, focusing on both income and capital growth, is tailor-made to address both short-term and long-term requirements of retirees, ensuring a robust foundation for income-driven portfolios.

This article is related to the DNR Capital piece by Scott Kelly, the portfolio manager.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments