20 Jul COVID-19 and the performance of responsible investments

In a time of massive market disruption brought on by the global COVID-19 pandemic, this article explores how responsible investment funds that integrate environmental, social and governance factors have performed compared to the rest of the market.

The evidence is overwhelming, showing that more sustainable companies are performing better and responsible investment funds are largely continuing to outperform the general market.

What does responsible investing have to do with COVID-19?

All businesses, and therefore all investments, have an impact on people and the planet, both positive and negative.

Companies or assets are unlikely to thrive if they ignore environmental issues (such as pollution, climate change, water and other resources scarcity), social issues (for example, their employees, local communities, health and safety), governance issues (such as corruption, strong boards and appropriate executive pay) or ethical issues.

Responsible investing, including the consideration of ESG factors such as these, helps investors identify a broad array of themes that are influencing markets and returns, and provides an important means for investors to navigate turbulent times; to avoid the most significant risks and to capture more opportunities.

In addition to its devastating death toll, the COVID-19 pandemic has resulted in significant economic turmoil, having wide-ranging and severe impacts on many people’s livelihoods and financial markets globally. These include substantial stock market declines and many countries entering into a recession.

Yet while there has been widespread market downturn, the various analysis by commentators including investment managers, research houses and rating agencies is consistently showing that more sustainable companies are performing better and responsible investment funds are outperforming the general market during this time.

What are investors and research houses saying?

1. MSCI

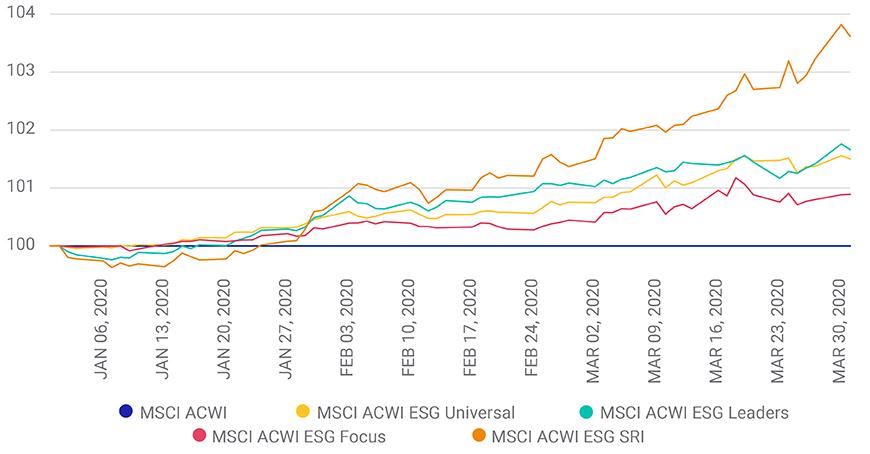

Research firm MSCI conducted a comparison of its ESG indexes compared to its parent indexes for the first quarter of 2020 highlighting that the COVID-19 pandemic “is the first real-world test since the 2008 global financial crisis of the resilience of companies with high MSCI ESG Ratings”.

As per the chart below, the four ESG indexes comprehensively outperformed their parent MSCI ACWI index from 1 January to 30 March 2020 with MSCI concluding this was largely “attributable to the systematic tilt of these indexes toward higher ESG-rated stocks.”

2. Blackrock

New research by BlackRock argues that COVID-19 presents a test to their conviction that companies managed with a focus on sustainability should be better positioned versus their less sustainable peers to weather adverse conditions while still benefiting from positive market environments.

Encouragingly, their analysis concludes that in the first quarter of 2020, they have observed better risk-adjusted performance across sustainable products globally, with 94% of a globally-representative selection of widely-analysed sustainable indices outperforming their parent benchmarks.

BlackRock’s research highlights that in similar notable market downturns in recent years, the findings have been consistent: that is that sustainable indices outperform their non-sustainable counterparts. The message is getting through – in this downturn, where outflows accelerated across many funds, sustainable funds continued to see strong inflows with BlackRock finding record inflows to sustainable funds in the first quarter of 2020.

BlackRock states “we believe these inflows during a period of extraordinary market drawdown suggests a persistence in investor preferences toward sustainability”.

3. Morningstar

Longitudinal research by Morningstar measures the performance of sustainable open-end and exchange-traded funds versus traditional peers, spanning nearly 4,900 funds domiciled in Europe, including 745 sustainable open-end and exchange-traded funds.

Morningstar says that the average returns and success rates for sustainable funds suggest that there is no performance trade-off associated with sustainable funds. In fact, a majority of sustainable funds have outperformed their traditional peers over multiple time horizons. Notably, the outperformance continued during the COVID-19 pandemic, finding “in all but one category considered in the study, sustainable funds outperformed, with average excess returns in Q1, 2020 ranging between 0.09% and 1.83% across categories”.

3. AXA IM

AXA Investment Managers undertook an analysis of how leading ESG companies (issuers) had performed in the first quarter of 2020 compared to laggards, applying their research across equities and bond markets.

AXA IM concluded unequivocally that “Companies with the highest ESG ratings have proven more resilient in the coronavirus market crash than those with the lowest.” Their findings highlight that ESG leaders not only outperformed the benchmark MSCI ACWI index (>5% outperformance), but left the ESG laggards for dead with a staggering outperformance of 16.8% points in Q1 2020.

However responsible investment is not all just about ESG integration, with many leading responsible investors also employing strong exclusion policies to screen out sectors. A frequently argued point is that this could risk limiting the universe of stocks available to fund managers and so leave them more exposed to market changes. AXA IM’s analysis on this point finds that when assessing the impact of their company-wide exclusion policies, that a portfolio of stocks that apply their exclusion lists outperformed the parent benchmark index by 47 basis points.

Responsible investing is central to avoiding or mitigating future crises

The thesis that responsible investing supports stronger outcomes for society and the environment, alongside delivering superior financial returns, has been put to one of its toughest market tests with the COVID-19 pandemic.

While the social and economic fallout from the crisis is still playing out, and most responsible investors are guided by a longer time horizon, initial analysis and results are emphatic. The research reinforces that responsible investment supports the achievement of better investment outcomes, and is central to navigating our way towards a more sustainable and resilient world that can mitigate or avoid such crises in the future.

We continuously strive to be at the forefront of changes within the financial industry and investment needs of Australians as a whole. This is why responsible investing is an area we specialise in and hold highly at FinPeak.

Next Steps

If you want to start an ethical investment strategy or find out more, speak to us to get you moving in the right direction.

This article was produced with the help of RIAA, click here to view the full article.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. FinPeak Advisers does not provide personal tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments