08 Mar Why women need a unique focus on their finances

For many reasons, women face additional hurdles when it comes to achieving financial freedom. So it’s important to take control of your finances now, and be proactive when it comes to planning your financial future.

The unfortunate truth is that women experience low-income and poverty at a much higher rate than men. In fact, up to 40 per cent of older, single, retired women now live in poverty, according to not-for-profit foundation Women In Super.

There are many reasons why women end up with less later in life, but it largely comes down to structural and systemic issues. The so called gender pay gap, super gap, wealth gap, investing gap, time spent on unpaid work and the ‘pink tax’ all play a role. The good news is with a little knowhow, women can take control of their finances and overcome some of the well-known financial traps.

Here are the stats

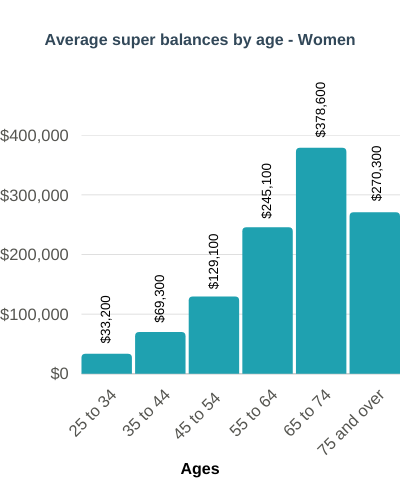

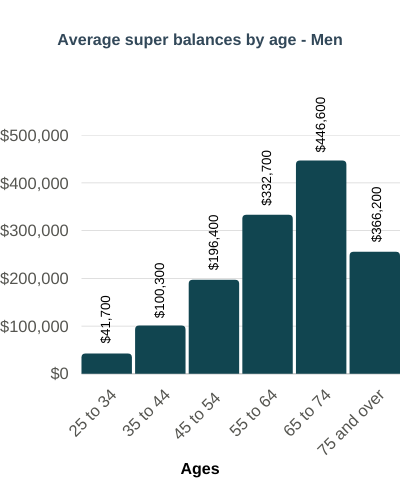

In case you’re in any doubt about the seriousness of the issue, consider that women retire with 47 per cent less superannuation than men, yet live five years longer on average. Below are the average super balances by age according to the Australian Bureau of Statistics (ABS)>

Why is that the case? Here are some of the key drivers behind the gap[1]:

- Women spend an average five-years out of the workforce to care for children and other family members, missing out on income, promotions and superannuation payments.

- They’re more likely to work part time (43%), spending five-hours more per day caring for children than men.

- Even when women do work full-time, they earn 18 per cent less than men. Sometimes for the same job.

- Female graduates earn $5,000 less than their male counterparts, again, sometimes for the same job.

- Yet the ‘pink tax’ means that women pay seven per cent more across the board, on items ranging from clothing and personal care products to pens and kid’s toys.

- Finally, women are more likely to dip into their own savings when things go wrong in a relationship, choosing to provide for their family while neglecting their own retirement.

It’s little wonder that women over 55 are considered the fastest-growing homeless demographic in Australia.

So what can you do about it?

Plenty! Start with an action plan and be consistent over time. Here a few simple tips below.

1. Supercharge your super

One of the best ways to save for the future is through your superannuation fund, due to the associated tax benefits. But not just any strategy will do. Women need a tailored approach to ensure their money lasts as long as possible.

One of the biggest contributors to the super gap is career breaks, whether it’s for family or other reasons, such as returning to study, change careers or travel.

- Consider making voluntary super contributions. In the 2021 financial year, you can contribute up to $25,000 as a concessional contribution (CC), such as employer contributions including salary sacrificing and personal deductible contributions, which could potentially reduce your overall tax obligations this year meaning more in your back pocket.

- Another form of voluntary contributions are (after-tax) non-concessional contributions (NCC). You can contribute up to $100,000 in FY21 (if your total super balance is under $1.6m as at 30 June 2020). The growth and income on these funds would be taxed at a maximum of 15% inside super and could be zero once you convert your fund into pension phase. The catch is that you won’t be able to access these funds until you satisfy a condition of release such as retirement.

If your income has dropped due to unpaid leave or part-time work, you may qualify for the government super co-contribution. Or, if you have a spouse, they may qualify for a tax offset if they contribute to your super while your income is low. Another option is contribution splitting, where up to 85 per cent of your spouse’s super is transferred to you each year to even up your balances. Speak with a financial adviser to find out what’s the best option for you.

2. Invest with purpose

While having a strong savings plan is important, you may also need to take a proactive approach to investment to reach your goals.

Educate yourself on how your money is invested, investing too conservatively and the investment outcomes may not meet your expectations, investing too aggressively may lead to volatility in the short term which might have you feeling a little uncomfortable but if you hold the course will outperform in the long run. Pay attention to the fees because this may erode balances in the long run if you are not careful.

Lastly, it’s never too early, or too late, to start.

The strategies you adopt and the areas you focus on are likely to differ depending on your age, but the end goal will be the same. To increase your financial freedom and security.

3. Insurance

Once you’re on track to building your financial nest egg, it’s important to have the right protection strategies in place. That includes adequate insurance and an emergency fund of at least three month’s living expenses. Illness and injury can totally derail your financial plans, so it’s really important to consider what you and your family will need to stay afloat should the worse occur. Insurance can be structured to be relatively cheap depending on your circumstances. It can be similar to the cost of your mobile phone bill each month depending on a number of factors.

4. Starting young

Creating a better financial future for all women means we need to start early, by teaching our girls money management tools and techniques that will help them overcome these hurdles.

Start a savings plan early and look into online investment platforms offering ‘children’s accounts’. It’s a great way to start teaching children the value of money and saving. The money they get for their birthdays, doing household chores or from that summer holiday job could one day help them buy something big like their first car or even a down payment for their first property. Starting early could give our girls a serious head start in life.

Make sure to do your research thoroughly before signing up, as fees can quickly eat into low account balances. Look for accounts that are fee-free for those under-18.

Perhaps the most important thing women can do to reach their financial goals is to get expert financial advice. A financial planning professional can give you advice on the best superannuation and investment strategies, as well as which insurance/s you’ll need, to reach your financial goals sooner.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

This article was produced in conjunction with Money & Life, to read the full article you can click here.

[1] Figures supplied by Women in Super, The facts about women and super

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments