24 Oct Why is Asset Allocation so Important?

What is Asset Allocation?

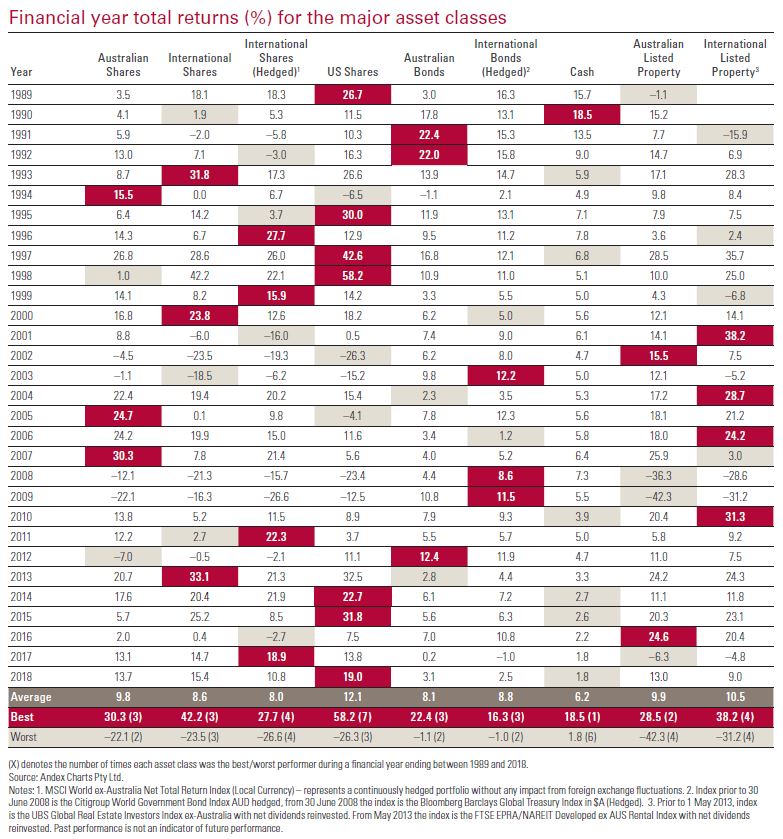

If you were given a dollar and were asked to invest that dollar where would you invest it? Would your answer still be the same today as it was last year? Or even five or ten years ago? Since 1989, no single asset class has outperformed on a consistent basis. It is clearly evident in the table below that yesterday’s winner is often tomorrow’s loser, and vice versa.

How you allocate your money to each asset class is one of the most important decisions you can make when it comes to investing your money and building an investment portfolio. Asset Allocation is the practice of investing not just in one asset class (eg. Australian shares), but in several such as cash, international shares, bonds, currencies, commodities, properties and alternative assets such as infrastructure and hedge funds. The simplest way to generate returns through asset allocation is to be in the right asset class at the right point in the economic and business cycle.

Which is all well and good if you have a crystal ball – unfortunately no-one does. Given current levels of overall share market volatility, low-interest rates, property market cooling and a weakening Australian Dollar, we think it’s worth taking a look at the fundamental aspects of asset allocation, as you assess the appropriate mix that is right for you across your portfolio.

There are two ways you can decide on how you are going set your asset allocation strategy – strategic or tactical.

Strategic – Strategic asset allocation is where you set a long-term target for each asset class and stick to it. This type of asset allocation is set according to the investment objective, risk/return profile and investment timeframe.

Tactical – changes are made in the short-term based on your view of the performance relativities of each asset class. Those who use this approach analyse economic and financial factors to predict the performance outlook for each sector. Some investors set minimum and maximum ranges for each asset class. Usually, they set a target within this range which is regularly reviewed based on their view of market conditions.

No two asset classes are equal

Many asset classes move inversely or in a non-correlated manner to each other. The key is picking the right asset class for the current (or approaching) economic environment. After sustained periods of rising prices, investors are often lulled into taking risk for ever-diminishing reward within a given asset class.

Conversely, after sustained pullbacks, assets can become cheap and priced to deliver strong future rewards.

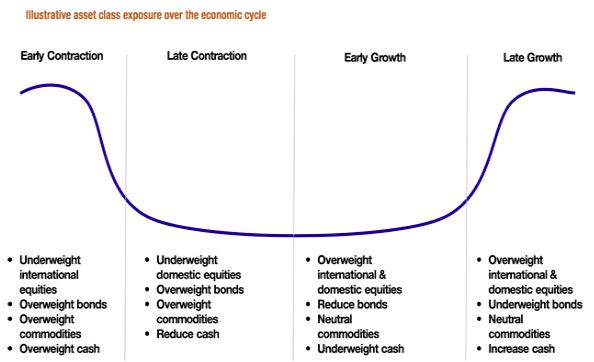

Here is a broad idea of which asset classes tend to suit particular stages of business cycles:

If you decide that to go down path of tactical asset allocation then the on-going assessment of asset class values and resulting portfolio adjustments is the key tenet of asset allocation.

How we can help?

We will be able to help you determine the optimal asset allocation for your individual needs. You need to be active between asset classes to capture excess returns over and above market expectations. We work with Farrelly’s who is the first independent specialist asset allocation research service for investment advisory firms in Australia and New Zealand. They have been providing specialist consulting services since 2004.

By avoiding overpriced assets and buying underpriced assets you can potentially achieve higher returns and lower risk over the course of a full business cycle. This is surely an outcome that all investors are looking at achieve.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments