09 Sep When should you start saving for retirement?

The answer is: as soon as you begin working.

Too late for that? Remember that saving will be easiest if you start now. Saving for retirement is effectively a balance between your quality of life today and living your best life tomorrow.

Let’s work backwards, how much do you need each year when you retire?

There is no simple answer to this and will depend on various factors such as:

- How much do you spend on everyday living expenses?

- What your holidays or leisure activities will look like?

- How healthy you are at retirement and whether there are potential future medical issues.

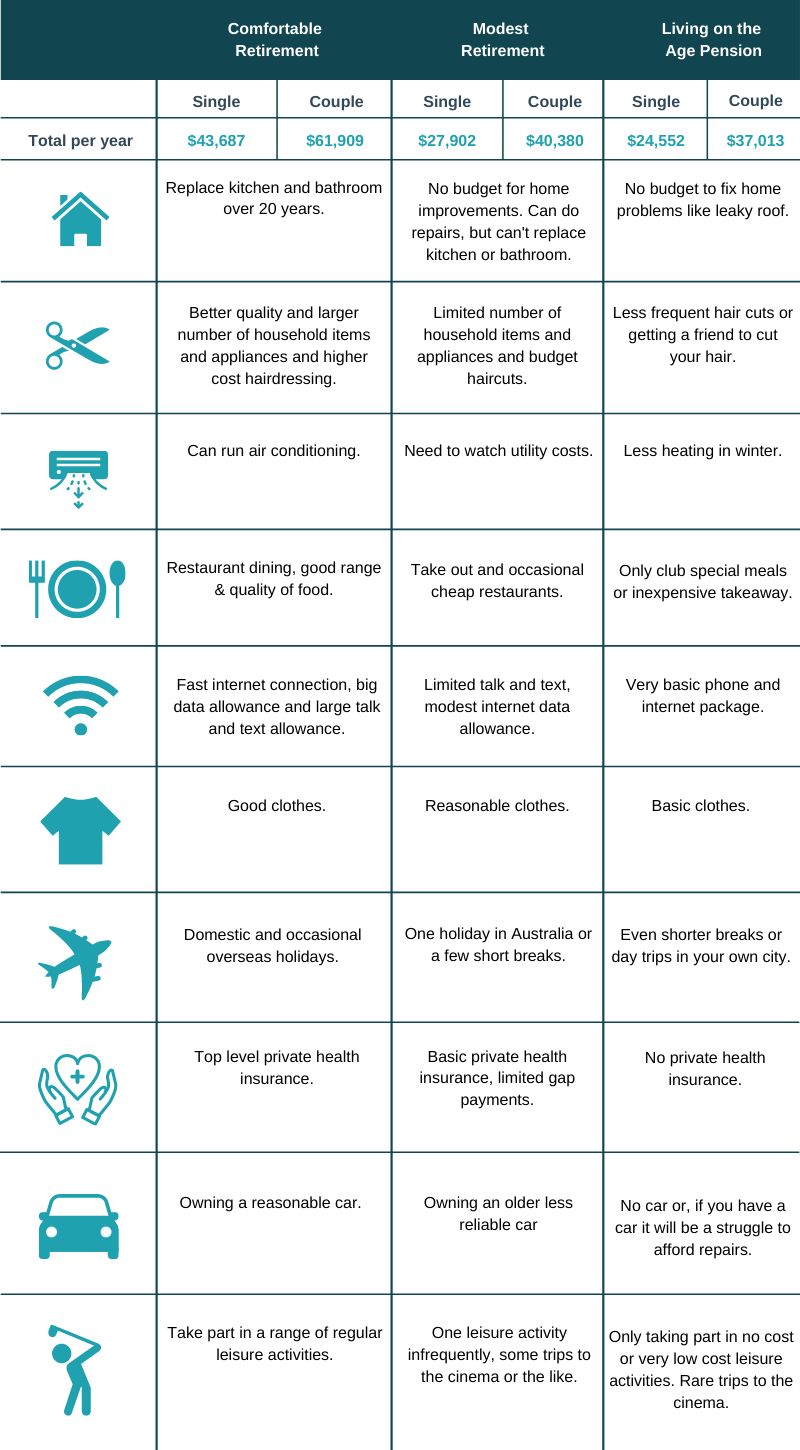

According to research from the Association of Superannuation Funds of Australia (ASFA) a single will spend $43,687 pa to have a ‘comfortable’ lifestyle, whereas a couple will spend about $61,909 (report as at June 2020). Given that maximum Age Pension (as at March 2020) is $24,554 for a single and $37,014 for a couple, there is a significant difference between being able to afford the basic minimums and living the life you want. So what do these amounts look like in practical terms? See the table below to illustrate these three different scenarios (note this assumes that you have paid off your own home at retirement).

The next question would be, how much superannuation do I need in order to live the life I want?

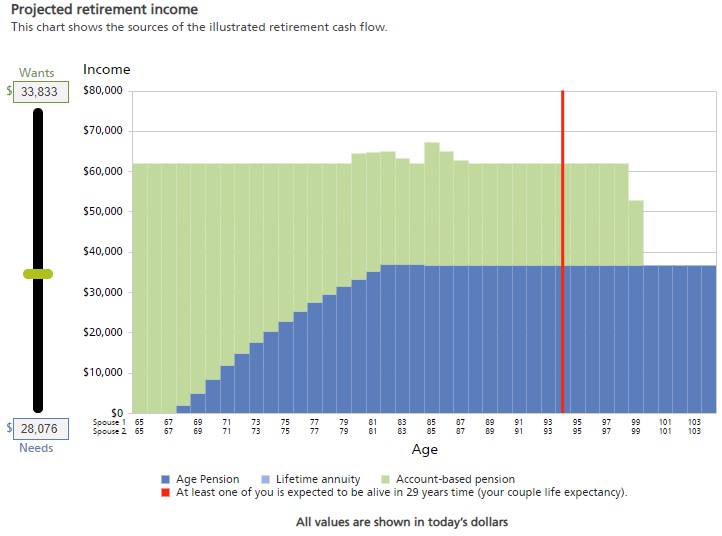

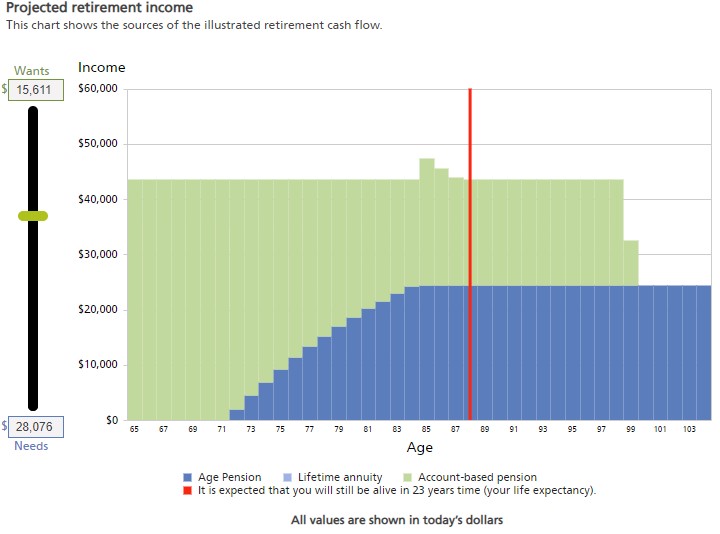

According to financial modelling produced by Challenger if a couple was aged 65 today and invested the funds in a 50/50 balanced investment strategy, you would need approximately $1,000,000 (in today’s dollars) in order to fund a ‘Comfortable’ lifestyle to the age of 99. Similarly, you would need approximately $800,000 if you were a single household. This is illustrated in the graphs below (these assume you do not have any other income or assets that may affect your government Age Pension requirements).

Couple Household

Single Household

Of course, not all of us will live to the age of 99 but what if we just aimed for our average expected life expectancy? This certainly changes the goalposts somewhat, based on the same above assumptions a couple would need approximately $760,000 combined and a single would need approximately $500,000.

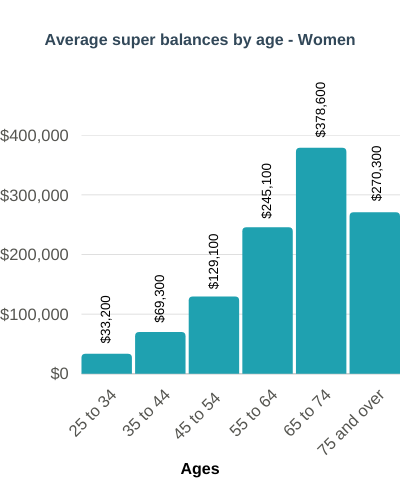

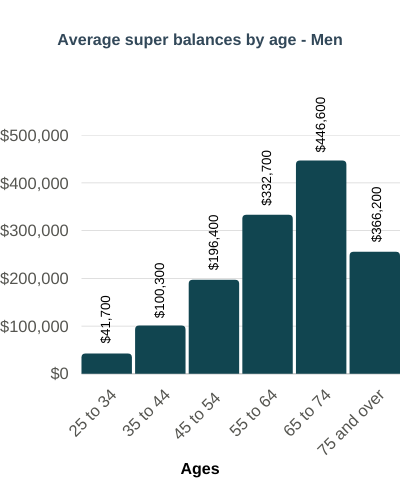

Super Balances by age

According to the Australian Bureau of Statistics (ABS)* the average super balance for Australians aged between 55 to 64 is $245,100 for women and $332,700 for men.

This is quite concerning as it falls well short of what a ‘comfortable’ lifestyle looks like, also alarming is the disparity between the super balances between men and women. If it doesn’t seem like you are on track then you can either choose to work longer and build up your super balance, adjust your retirement expectations or start putting away money now.

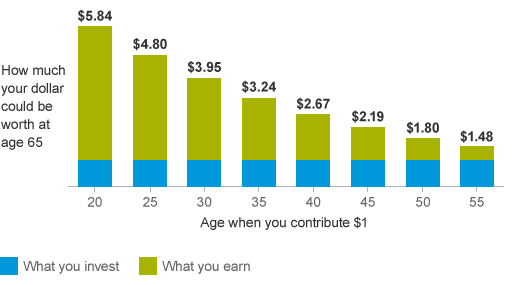

The power of compounding returns

The power of compound returns is startling and the mathematics in favour of starting to save early in life is undeniable.

According to Vanguard, at a 4 per cent annual return, $100,000 invested today will grow to around $580,000 over the course of a regular 45 year working life.

Vanguard’s retirement planning team has a worked example online. A person starting at age 20 and saving $4,500 a year has a good chance of having $1 million in retirement. At 30, they would need to save $9,000 a year. And if they wait until 40, they need to save $18,000 a year to hit the same goal.

$1 could grow to much more by retirement—but it depends what age you contribute it.

This hypothetical illustration assumes an annual 4% return after inflation.

Figures are in today’s dollars. The illustration doesn’t represent any particular investment.

This Covid-19 pandemic has produced a whole host of challenges and opportunities. For those that have been forced to access some of their superannuation, it is important to consider putting a plan together to replenish those withdrawn funds as failure to do so may mean falling short of your retirement objectives. Depending on your situation you may be entitled to future tax deductions or government support through the Co-contribution scheme.

Also conversely, some people may find that due to lockdown restrictions and reduced transport costs the household budget may be slightly more in surplus than normal. This may be an opportunity to top up your super balances and possibly reduce your taxable income at the same time. In both cases, you should seek the help of your financial adviser to put together an appropriate plan.

This article was produced in conjunction with Vanguard, to read the full article you can click here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. FinPeak Advisers does not provide personal tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark Financial Group ABN 15 621 553 786)

No Comments