30 Nov What if ‘Working From Home’ saved you $300k

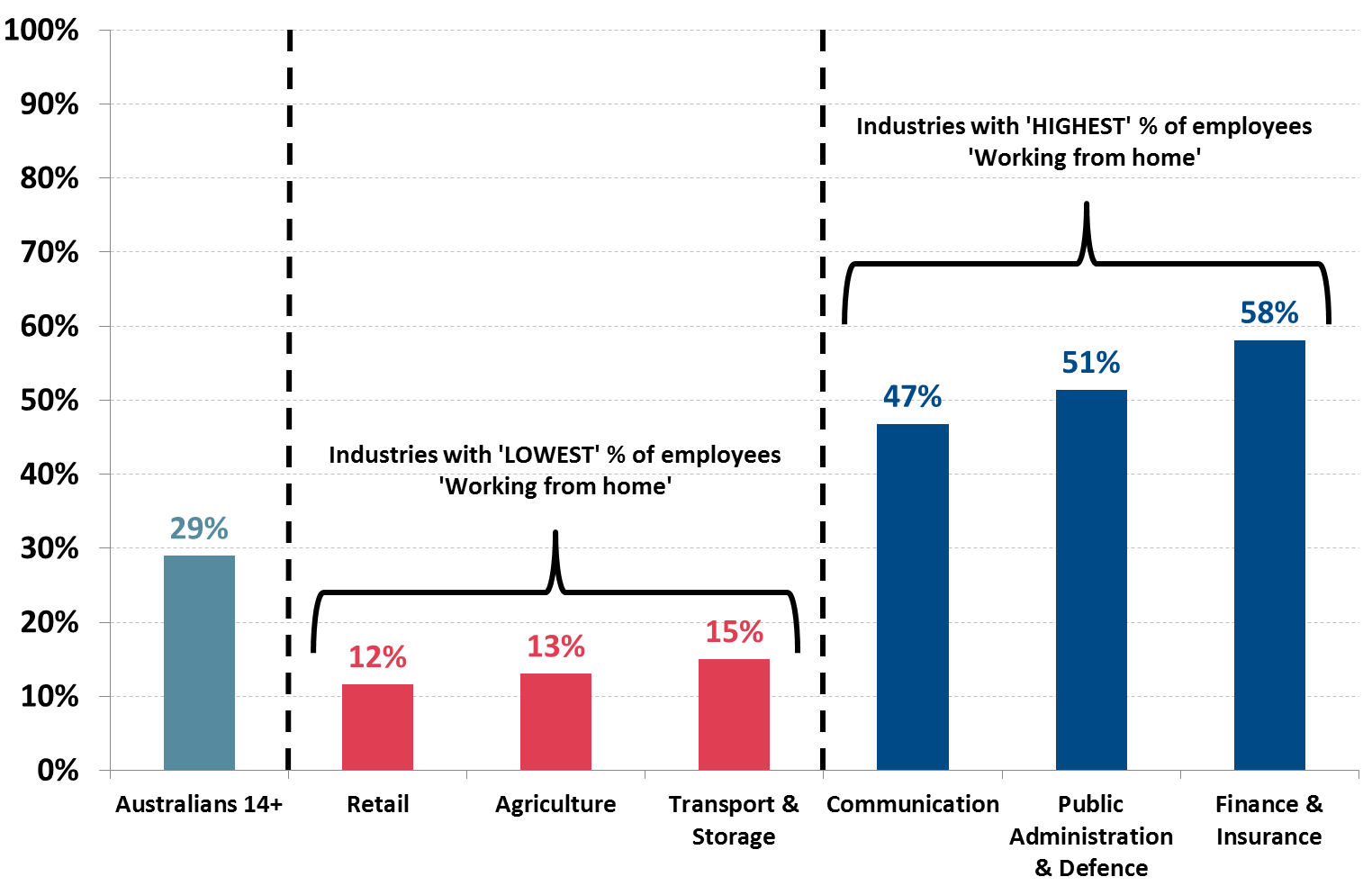

Covid-19 has certainly changed a few aspects of our daily lives and non more so than how we work. According to a study from Roy Morgan, over 4.3 million (32% of working Australians) have been ‘working from home’ (WFH) since the start of the pandemic which sent many of us packing our laptops and monitors and retreating to the confines of dining room tables and makeshift homeoffices.

People aged 35-49 (38%) are more likely to be WFH followed by those aged 25-34 (36%) and 50-64 (33%) with workers aged under 25 representing only 17% of the people in the study (possibly coinciding the demographic of workers in the retail/service and hospitality industries).

Source: Roy Morgan multi-mode survey of Australians conducted from the weekend of April 17-19, 2020 through to May 29-31, 2020, n=9,905 including 6,637 working Australians. Base: Australians aged 14+.

There are more than a million commuters absent from the CBDs across Australia’s capital cities as WFH emerges as one of the largest social shifts caused by the pandemic. There are some firms that are fully embracing this new way of working, like the major banks, financial services and tech companies. Why not? If on the most part, the productivity hasn’t slowed down and you’re able to save some money by not having as many permanent desks. From an employees lens, it may mean a better work-life balance, less travel (including domestic and international) which further enhances productivity and potentially increases job satisfaction. Pre-pandemic WFH according to the national census was about 5% and hadn’t really changed until now. It won’t be until sometime during 2021 before we will probably see some sort of retreat to those levels. According to some businesses, there may be a hybrid model that emerges where work time is split between the home and office.

The disruption caused by this pandemic could potentially trigger long lasting changes to the housing market as homeowners reconsider how they want to live, Citi’s annual investment conference heard earlier in October. Companies such as Dropbox are looking to repurpose its offices solely for collaboration and teamwork as it moves to become a virtual-first company where staff will WFH permanently. This may mean living in close proximity to the city is taking a back seat to lifestyle for some home buyers. In fact, according to some agents in regional towns, like Bowral, this is already happening.

Case Study

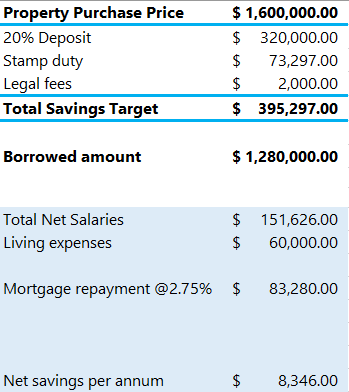

Let’s look at this a bit further with a case study. They say the average house price in Sydney is just shy of $1 million dollars, but in reality, if you’re a couple with a young family and want to live within 20km of the CBD then the houses you’re looking at are around $1.6m. Let’s assume for this case study you’re aged 40 and earning $100,000 pa each and have modest living expenses of $60,000 and you were hoping to pay off this mortgage by the time you both turn 60. The table below illustrates what your yearly cashflow might look like.

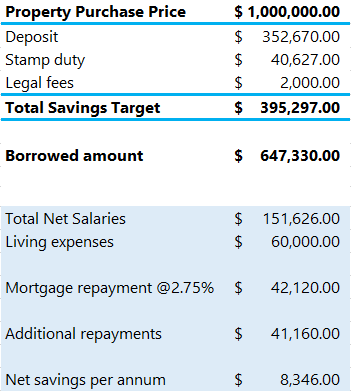

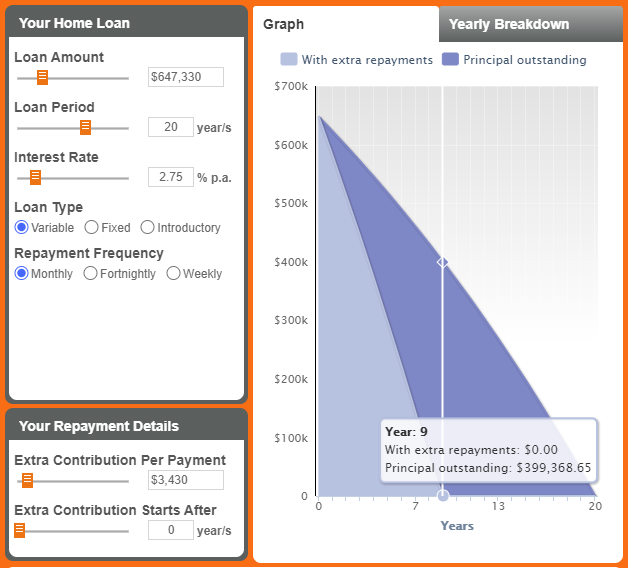

Now, what if you were fortunate enough to have an employer that allows you to work primarily from home and the longer commute a few days a week was very bearable? The same sized house you were looking at in the above scenario might only cost $1m if you opened your options to move up and down the coast. The below table shows you what your cashflow might look like if you used the same sized deposit and made extra repayments to your mortgage whilst keeping the same living expenses and net annual savings.

Under the first scenario, you would have paid around $385,534 in total interest over those 20 years, under the second scenario you would have paid $81,794. This represents a difference in $303,740 in interest and have the mortgage paid off by about 11 years sooner!

Why now?

It’s clear that having a smaller mortgage and making the same repayments will lead to paying off your home sooner. So why now? The game changer has been because of a few things, firstly the rollout of a national 5G network which could provide speeds of up 3Gbps (that’s roughly 30 times faster than the maximum speed of an NBN 100 connection). Perfect for all your Zoom and Microsoft Teams meetings you’ll be having.

Secondly, Australia has been through a few ‘booms’ over the years. We had the mining boom that kept our economy out of recession during the GFC, then we had a housing and construction boom and now we have the infrastructure boom. Projects announced during this infrastructure spending include provisions for better roads and faster rail which not only will provide more jobs for our economy but allow people outside of major capital cities to commute more efficiently.

What can you do with your excess savings?

By not being tied to a large mortgage you have the option to invest your money in other goals like securing your retirement or paying for your children’s education. If you started making additional contributions to your super equal to the extra mortgage repayments at the age of 40, then by the time you are 60 you would have approximately $470,000 more super each. Or if you put a small amount away each month for your child into an education fund you would have enough money to help pay for private school fees or even have a small gift when they finish school to help them get into their own property.

In conclusion, the WFM phenomenon in some form is here to stay and the decision for where you live is much more than a mortgage contract. Speaking to a financial adviser can help quantify your options and highlight what’s really important to you and the trade-offs it may involve.

Please note that the opinions in this article and projections do not constitute any personal advice and you should seek the help of a professional adviser before making any decisions.

Next Steps

To find out more about this, speak to us to get you moving in the right direction.

References

https://www.afr.com/property/residential/pandemic-to-change-how-we-live-citi-summit-20201015-p565cx

https://www.afr.com/work-and-careers/careers/dropbox-kills-the-9-to-5-workday-20201014-p564zy

https://www.afr.com/property/residential/sydneysiders-head-for-the-hills-20201113-p56ee2

https://moneysmart.gov.au/how-super-works/superannuation-calculator

https://investment.infrastructure.gov.au/about/budget.aspx

https://www.nsw.gov.au/projects/a-fast-rail-future-for-nsw

https://www.afr.com/property/residential/sydneysiders-head-for-the-hills-20201113-p56ee2

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments