21 Jun The value of a mortgage offset account

Most major lenders offer mortgage packages which include a mortgage offset account. Although the benefits of a mortgage offset account may be attractive for some people, they may involve higher fees, requiring some cost-benefit analysis.

What is a mortgage offset account?

Its really very simple. A mortgage offset account is usually a transaction or everyday banking account that is linked to a mortgage debt account. You may contribute funds to the mortgage offset account at any time, but you must also meet your repayment obligations on your mortgage debt account.

The balance of a mortgage debt account is used to calculate how much interest is payable, usually on a monthly basis. If there are funds in a linked mortgage offset account which offers a 100 percent offset, the balance of the mortgage offset account reduces the mortgage debt account balance that is used to calculate the interest payable.

Example – Bill and Mary:

Bill and Mary are 33 and 34 respectively, and have a mortgage of $400,000 on their home. Their mortgage arrangements are as follows:

They have received a windfall of $50,000 and wish to use the funds to help pay down their mortgage as soon as possible.

Their options include:

- using the $50,000 to immediately reduce their loan debt

- depositing the amount into a separate bank account which pays interest of 2.0 per cent per annum, with the goal of using the balance later to reduce the mortgage debt

- depositing the amount into a linked mortgage offset account (the account incurs an extra $400 per annum in fees) with the goal of using the balance later to reduce the mortgage debt.

Option 1 – reduce loan principal

With option 1, Bill and Mary’s outstanding debt (that is, their ‘loan principal’) will be reduced to $350,000 by the payment of $50,000. Interest (at 4.0 per cent per annum) will be calculated on $350,000 rather than $400,000, so there is an immediate interest saving of $164 in the first month (assuming a 30 day month).

If Bill and Mary maintain the same level of repayments per month ($1,887.03) their mortgage term will be reduced by six years and three months, and their total repayments will be reduced by $92,717 (equivalent to $24,565 in today’s dollars assuming a consumer price index (CPI) rate of 2.5 per cent per annum).

However, it may be difficult for Bill and Mary to redraw the funds if they wished to access the funds due to some unforeseen circumstances. Some mortgage debt accounts allow extra repayments to be redrawn, but that is not always the case. Redrawing additional funds may require an application to the lender, with costs, and it may take some time before the necessary funds are available.

Option 2 – bank account deposit

Depending on the type of bank account used, Option 2 may involve access to the funds at call or at short notice, and potentially at no cost. This may be comforting for Bill and Mary, especially if their excess cash flow is limited after funding their existing lifestyle and mortgage repayments.

But this increased accessibility to the funds comes at a cost to Bill and Mary when compared with Option 1. The interest rate assumed to apply to the bank account (2.0 per cent per annum) is considerably lower than the mortgage debt account interest rate (4.0 per cent per annum). Furthermore, the interest earned on the bank account is taxable at Bill and Mary’s marginal tax rates (39 per cent), assuming the account is in joint names.

Option 2 reduces Bill and Mary’s loan term by three years and one month, assuming they maintain the same level of repayments per month ($1,887.03). Their total repayments would be reduced by $23,392.

Option 3 – using a mortgage offset account

Option 3 involves depositing $50,000 into a mortgage offset account, rather than a separate bank account. The facility costs $400 per annum.

The benefit is the reduced interest on the debt account the mortgage offset account is linked to. By offsetting the interest payable on the debt account, effectively the mortgage offset account generates an after-tax return of 4.0 per cent per annum for Bill and Mary. To achieve the same result, the separate bank account in Option 2 would have to pay interest at 6.56 per cent per annum (assuming Bill and Mary’s marginal tax rate is 39 per cent, including the Medicare Levy).

Option 3 reduces Bill and Mary’s loan term by five years and thee months, assuming they maintain the same level of repayments per month ($1,887.03). Their total repayments would be reduced by $71,654 (equivalent to $12,825 in today’s dollars assuming a CPI rate of 2.5 per cent per annum).

A key advantage of a mortgage offset account in this situation is Bill and Mary’s ability to re-draw the funds at short notice. With some offset accounts, access to the funds is immediate. So, if Bill and Mary encounter unforeseen expenses, such as major house repairs, they may be able to draw on the required funds from their mortgage offset account. The potential to immediately draw on funds can be very comforting.

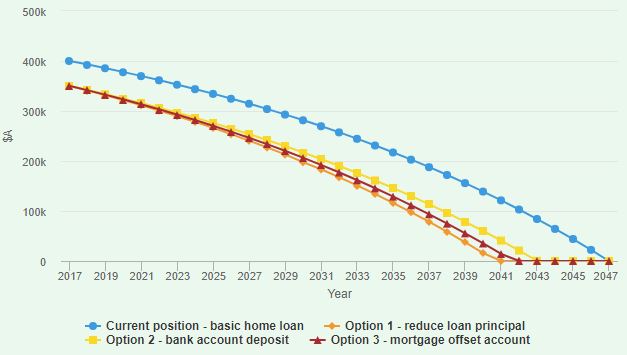

The impact of the three options is shown in Chart 1 below, compared to Bill and Mary’s position if there was no windfall and they repaid their loan over 30 years.

Chart 1: Options for use of $50,000 windfall

Option 1 would result in Bill and Mary paying off their home loan in 23 years and nine months but, as mentioned above, there may be difficulty for Bill and Mary accessing the extra funds if they were to require them.

With Option 2 Bill and Mary will not pay off for their loan for 26 years and 11 months, although they may have immediate access to the extra funds.

Option 3 allows Bill and Mary to pay of the loan after 24 years and nine months, and they may have immediate access to the extra funds.

The motivating impact of a mortgage offset account

Some people may be reluctant to make additional payments towards their mortgage debt where they feel they are losing access to those funds.

The generally immediate access to funds placed in a mortgage offset account can provide a strong incentive to further increase the flow of funds into a mortgage reduction arrangement. Motivated clients may be inclined to maximise the use of their mortgage offset account by directing all cash flow, including their salary, through their mortgage offset account, and making expense payments from it. This strategy will further reduce the amount of interest you pay over the term of your home loan.

Example – Bill and Mary (continued):

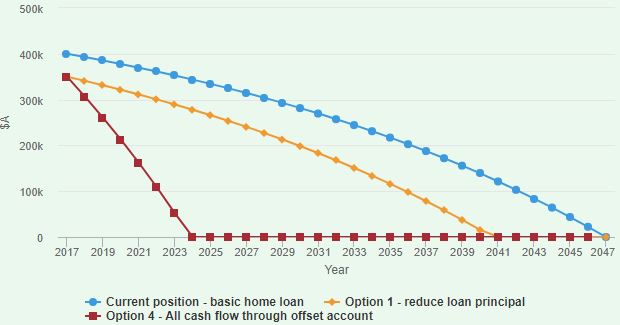

Bill and Mary decide to run all their excess cash flow through their mortgage offset account. They both earn $90,000 per annum before tax, and require $6,500 per month for their day-to-day living expenses.

Their excess cash flow (approximately $2,800 per month, increasing over time) accrues in the mortgage offset account, reducing the interest calculated on their home loan. As a result, Bill and Mary are able to pay off their home loan by October 2024, 23 years sooner than under their original loan term of 30 years. Their total repayments would be reduced by $226,851 (equivalent to $61,548 in today’s dollars assuming a CPI rate of 2.5 per cent per annum).

Chart 2: $50,000 windfall and excess cashflow in a mortgage offset account

Deductible mortgage arrangements

Mortgage offset accounts can also be beneficial for investment property loan arrangements, where the interest expenses are tax deductible.

Placing additional funds, such as a windfall lump sum, into a mortgage offset account will reduce the interest expense broadly to the same extent as paying down the loan principal.

The advantage of using a mortgage offset account is that if the funds in the mortgage offset account are withdrawn later, for an overseas vacation for example, the increased interest payable as a result of the withdrawal may be tax deductible if the income producing purpose of obtaining the loan still remains.

In contrast, if the windfall was used to reduce the loan principal, and subsequently re-drawn to fund the overseas vacation, the interest on the loan would be only partially tax deductible, as the redrawn funds would not be for income producing purposes.

Conclusions

Mortgage offset accounts are a useful strategy for both home loan borrowers and investment loan borrowers. Although they may involve additional fees, the long term benefits will often outweigh the additional cost.

This article was prepared by David Barret from Macquarie Bank on 29 November 2017 the full article can be found by clicking here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments