21 Aug Tech Talk: Thinking about downsizing?

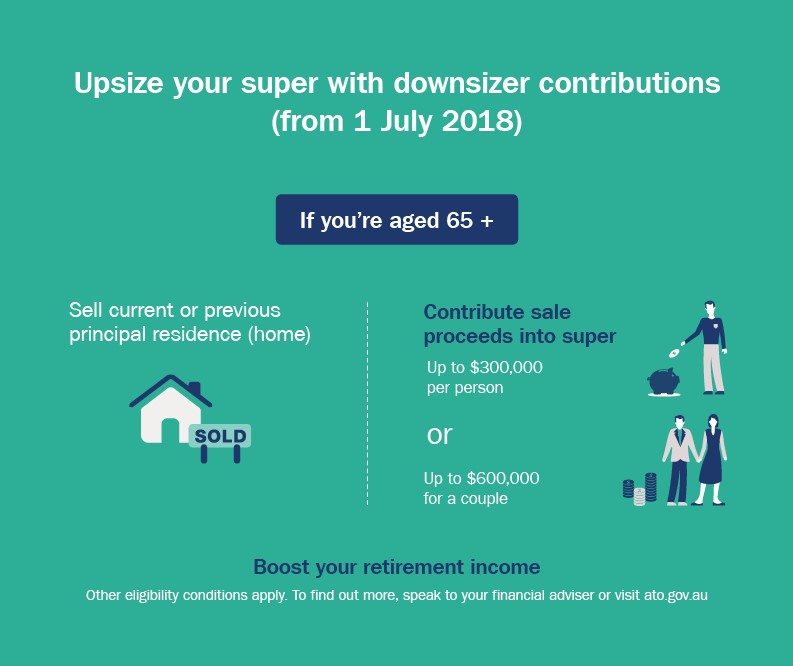

Upsize your super with downsizer contributions

People aged 65 or over may be eligible to make additional super contributions of up to $300,000 per person from the proceeds of the sale of their home from 1 July 2018. These are known as ‘downsizer contributions’ and they can be made on top of the existing contribution caps, without having to meet certain contribution rules and restrictions.

The opportunity

The downsizer contribution rules have removed some of the existing barriers that prevent or restrict your ability to make super contributions at age 65 or over. Provided certain other conditions are met (see below) it may be possible to contribute up to $300,000 per person (or $600,000 per couple) from the proceeds of selling your home on or after 1 July 2018. The contributions won’t count towards your concessional (pre-tax) or non-concessional (after-tax) contribution caps and there is no maximum age limit. Also, the ‘work test’ (for people aged 65 to 74) and the ‘total super balance’ test won’t apply.

Case Study

Bi`nh and Sui-Lee are 77 and 70 and retired. They sell their home on 20 August 2018 after owning it for 12 years and receive $1.2 million. They can both make a non-concessional super contribution of $300,000 ($600,000 in total). They can do this even though Sui-Lee doesn’t meet the contribution ‘work test’ and Bi`nh is over 75. They can make these contributions regardless of how much they already have in their super accounts and the contributions won’t count towards the non-concessional contribution cap. Also, it wouldn’t matter if the house was only owned by one of them.

Key requirements

There are a number of conditions you’ll need to meet to be eligible to make downsizer contributions, including:

- You must be aged 65 or over at the time you make the contribution.

- The property must have been owned by you or your spouse (but not necessarily both) for at least 10 years prior to the disposal.

- The contract for sale must be entered into on or after 1 July 2018.

- The property must qualify for the main residence capital gains tax exemption in whole or part, so properties held purely for investment purposes won’t qualify.

- You must make the contribution within 90 days of the change of ownership.

- You need to make an election to treat the contribution as a downsizer contribution.

- You cannot claim the contribution as a tax deduction.

Other conditions may also apply. For more information, please visit the ATO website at www.ato.gov.au

Key considerations

There are some key issues that should be considered when assessing whether making downsizer contributions could be a suitable strategy, including:

- The property being sold to fund the contributions doesn’t have to be your current home. It can be a former home which meets the requirements. Also, you don’t need to purchase another home.

- Once contributed, downsizer contributions will count towards your ‘total super balance’ which could impact your capacity to make future contributions.

- Downsizer contributions can’t be transferred into a tax-free ‘retirement phase income stream’ if you have used up your ‘transfer balance cap’. The transfer balance cap is $1.6 million in 2018/19.

- If you have used up your transfer balance cap, the contribution must remain in the ‘accumulation phase’ of super, where investment earnings are taxed at a maximum rate of 15%.

- Money held in the accumulation or retirement phase of super is assessed for both social security and aged care purposes.

Could you benefit from downsizer contributions?

If you are thinking about selling your home, we can help you decide whether making downsizer super contributions is a suitable strategy for you and assess other options.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments