12 Nov Observations from the US Midterm Elections

The US midterm elections on November 6th resulted in a divided government—the widely expected outcome—with the Democratic Party gaining control of the House of Representatives while the Republican Party maintained their majority in the Senate. We believe the markets were largely priced for this outcome and therefore expect limited effect on market volatility.

Fundamentals and policy matter more than politics

Financial markets care more about fundamentals and policies than politics, with markets showing greater resilience towards political events or rhetoric that produce little action. We believe the midterm result is no exception with a divided government likely to have a larger impact on political sentiment than market performance.

From a fundamental perspective, US growth remains on solid footing and the third quarter US corporate earnings season has been robust so far, characterized by strong earnings growth and earnings “beats” relative to consensus expectations running above the historical average. However, the market has sharply punished earning misses and failed to appropriately reward beats—even before the midterm election outcome—as investors’ attention has shifted to 2019 when the fiscal tailwinds are expected to become less powerful and the impact from tariffs is expected to intensify pressure on corporate profit margins.

We think the election outcome is likely to produce few changes in US economic policy relative to what is already reflected in market pricing.

- Fiscal policy: With Democrats gaining control of the House, we see limited potential for significant changes in fiscal policy. A divided government is likely to create political gridlock, lowering the probability of further US fiscal stimulus such as a middle class tax cut, while also making it difficult for Democrats to change existing policy. Without additional fiscal stimulus, we think markets could remain focused on the potential for a US slowdown in 2019. We think markets have already gone a long way to price in this scenario, creating upside potential for risk assets if incoming economic data remain strong.

- Trade policy: The focus of the Trump Administration is now likely to shift towards securing re-election in 2020. Trade is an area where President Trump can continue to pursue his agenda through executive power. However, with limited potential for fiscal stimulus, the administration could look to de-escalate trade tensions as a way to support economic growth.

What we are watching?

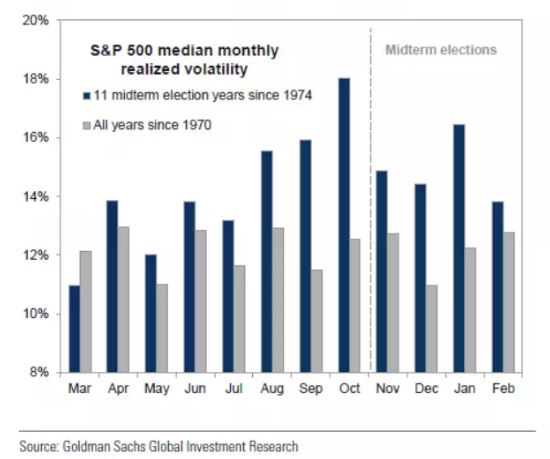

From a political perspective, we think two upcoming events could provide some insight on the potential for policy shifts. In the near term, the November G20 Summit could provide more clarity on the Trump Administration’s post-election approach to trade policy. Following that, the US debt ceiling could become an issue again beginning in March 2019, when prior legislation suspending the debt ceiling is set to expire. Historically, divided government has raised the risk of government shutdowns, with 2011 and 2013 serving as recent examples. This period, post midterm elections, has typically been favourable to US equities in the past but Goldman Sachs expects uncertainty to linger for longer than usual this year.

How can we help?

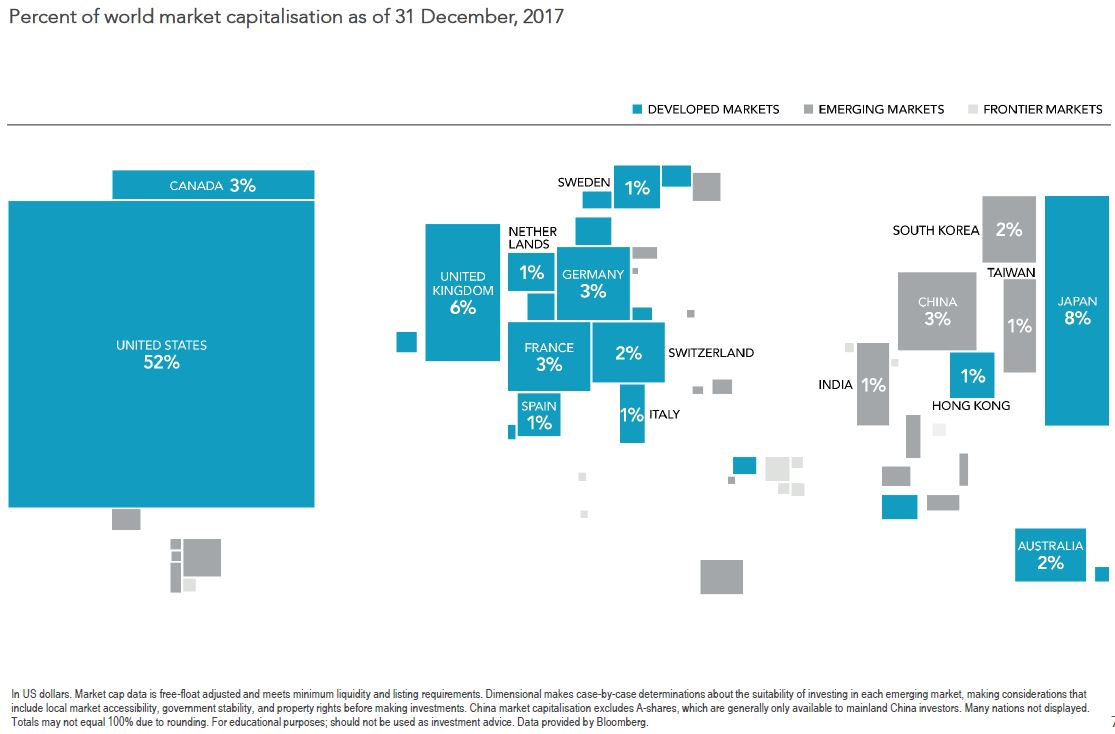

As shown in the image below the US, although significantly important to our portfolios, make up about 52% of the world’s equity markets. With all this uncertainty in place, it could be time for investors to broaden their horizons and diversify their portfolios by looking further outside of the U.S. for international equities exposure.

The full extract of the article from Goldman Sachs “Observations on the US Midterm Elections” can be found here.

The full extract of the article from Alex Cook of BetaShares “U.S. Midterms: The Importance of a Globally Diversified Portfolio” can be found here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments