21 Dec Negative Gearing: Explained

There has been quite a bit of media around the proposed changes to negative gearing if Labor wins the election next year. In this article, we will explain how negative gearing works and what may change going forward.

What is Negative Gearing?

An investment is negatively geared if it is purchased using borrowed funds and expenses related to owning the investment (for example interest on the borrowings) exceed the income it produces. Expenses that exceed income produced by the investment may be able to be claimed as a deduction against other assessable income (like income such as wages). In relation to property, other expenses could include the ongoing costs such as rates or strata and depreciation (with a few specific conditions announced in the budget on 9th May 2017, click here to read more) on the property itself.

While negative gearing is commonly used for investment properties, it can also be applied to other investments such as shares.

Case Study

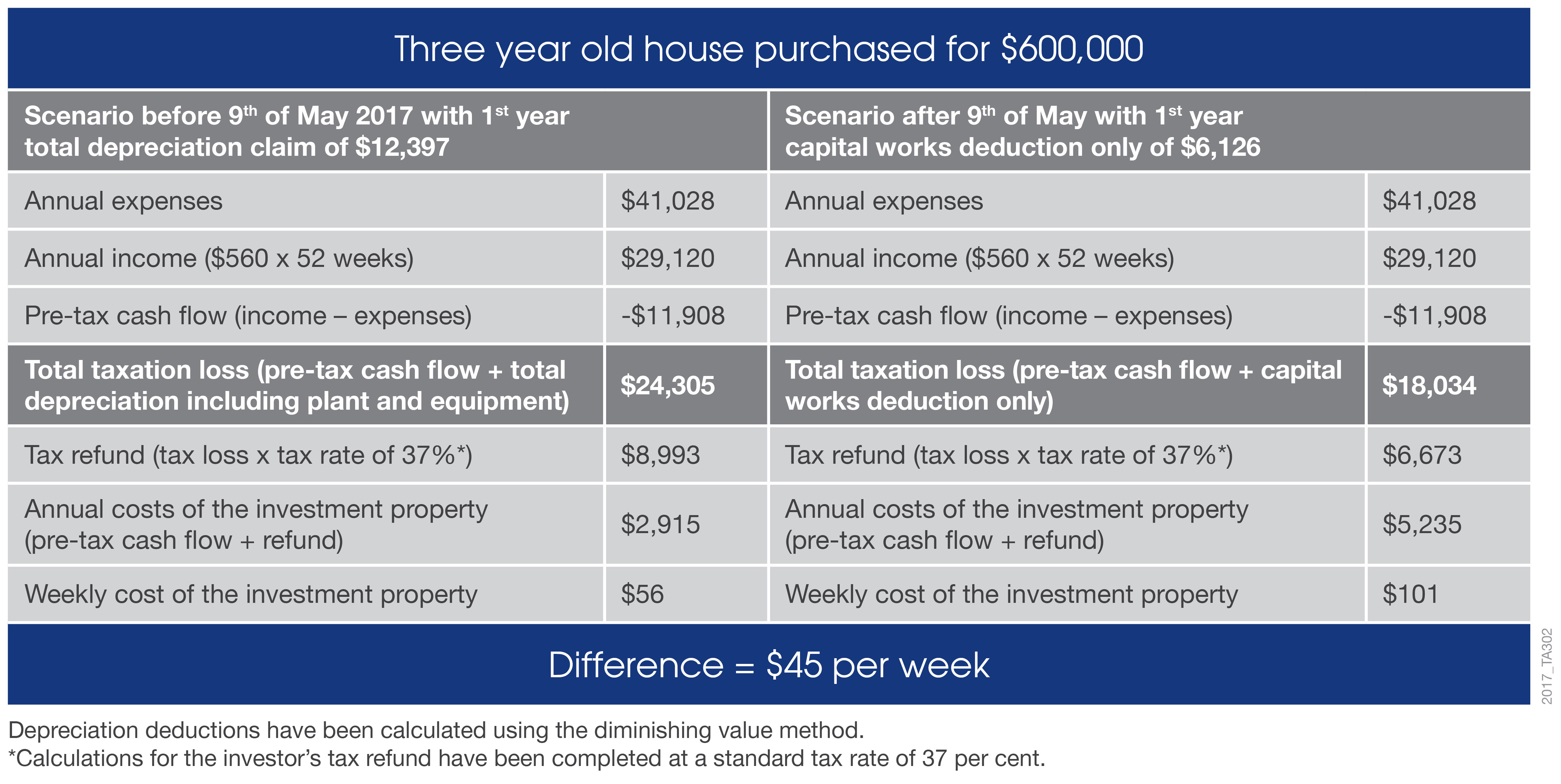

Take for example, John purchased a three year old house for $600,000. He receives rental income of $560 per week and all the expenses relating to the property (interest, council rates, property management, insurance and repairs and maintenance) total $41,028.

Under the current scenario, it also depends on when he bought the property as the main difference is the ability to claim plant and equipment as a depreciation expense. As you can see from the above this equated to a difference of $6,267 in deductions and resulted in an increased holding cost of $2,320. If this was a brand new property then John would still be able to claim plant and equipment regardless of the date he purchased the property.

Labor’s proposed changes

Here is a summary of the proposed changes:

- Limit negative gearing to new housing (which means that you will still be able to use this loss to offset non-investment income)

- Any losses on established properties will need to be used to offset other investment income (like shares or positively geared properties) or carried forward to offset future investment income or capital gains

- Reduction in capital gains discount from 50% to 25%

In the above example, the annual cost of holding the property would be $11,908 and would carry forward a paper loss of $24,305 and $18,034 respectively. This may reduce the ability to maintain the cashflow across any future property purchases and potentially your borrowing or refinancing ability. It also means that a gain of $200k on the sale of an investment property, the taxable income would increase by $50k.

Note: these changes are not law and should not be relied on to make future investment decisions, you should consult a financial adviser before making any investment decisions.

How we can help?

Like all investment portfolios, diversification is the key. Given the current lending environment and proposed changes to negative gearing, investing in property as an asset class may not be ideal. Another option could be to invest in another growth asset class such as shares. Any losses on established properties could be used to offset dividend income and gains from holding shares, however, we do recommend speaking to a financial adviser before making any investment decisions.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments