17 Jul Monthly Commentary: July 2020

Key global trends – equity rally continues

The global equity market recovery continued into June, reflecting a lift in some economic indicators as social distancing restrictions eased and investors remained confident that central banks will keep monetary conditions extremely easy. The influence of U.S. monetary stimulus is evident in other markets, with a further easing in the U.S. Dollar and bond yields, and further gains in gold.

Chief economist David Bessanese from BetaShares summarises the monthly trends in their video below.

The MSCI All-Country World Equity Return Index rose by 2.9% in local currency terms, after a gain of 4.3% in May. As seen in the chart set below, global bond yields remain in a strong downtrend, and gold prices in a strong uptrend*. Although relative to their 12-month moving average, global equities and the $US dollar are now defined as in an uptrend and downtrend respectively, from a broader perspective both remain in a choppy sideways range.

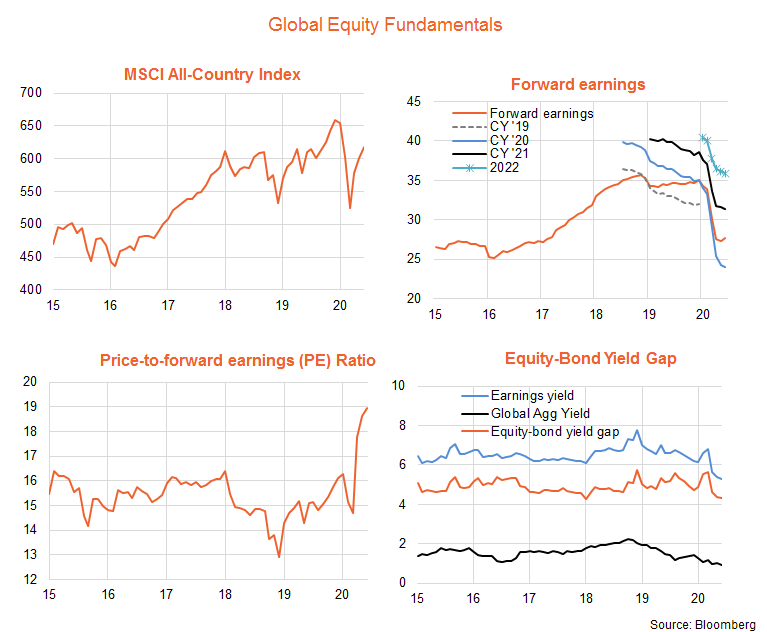

Global equity fundamentals – counting on low bond yields and stabilisation in earnings expectations

As seen in the chart pack below, the rebound in global equities of late has largely been driven by a strong rebound in PE valuations, with the forward PE rising from 14.7 at end-March to 19 at end-June.

By recent historic standards, equities also appear expensive relative to bond yields, with the equity-to-bond yield gap (EBYG) easing of late to 4.3% – at the lower end of its 5-year range, and below its 10-year average of 5.4%. That said, one upside risk for equities is if an expectation of ‘lower for longer’ bond yields causes equity PE valuations to re-rate even higher, given that the EBYG is still a little above its 20-year average (4.2%) and well above its 50-year average (2.1%).

A sharp fall in forward earnings over recent months, reflecting downgrades to earnings expectations, has also helped push up valuations. Effectively, investors are attempting to ‘look through’ recent earnings weakness on the grounds that it may prove only temporary.

One hopeful sign in this regard is that global forward earnings over June registered their first uptick for the year – as there was a slowing in the rate of earnings downgrades. If earnings expectations don’t fall further, the still-bullish outlook for CY’21 earnings (30% growth, returning earnings close to the level of 2019) will push up forward earnings further in coming months. That said, especially with the U.S. soon to commence its Q2 earnings reporting season, risk seems tilted towards more significant earnings downgrades in coming months.

Sector and regional equity trends

The strongest performers over recent months have been global gold miners, Australian technology and global health care.

June, however, also saw solid gains in European equities and local financials, perhaps reflecting investor interest to seek potentially better value opportunities in less strongly performing market areas.

The strongest performers over recent months have been technology thematics such as Asian technology, the NASDAQ 100 and global cyber security.

Cash and bonds – government yields drop, credit spreads widen

In the local bond market, overall bond yields plumbed new lows in June and credit spreads contracted further (though remained above their lows earlier this year). As a result, fixed-rate bonds continued to outperform cash, especially longer-duration corporate exposures. Narrowing credit spreads also supported hybrids and floating-rate bonds over cash.

Next Steps

To find out more about navigating current market trends speak to us to get you moving in the right direction.

This article was produced with the help of BetaShares, click here to view the full article.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. FinPeak Advisers does not provide personal tax, legal or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal or accounting advice. You should consult your own tax, legal and accounting advisors before engaging in any transaction. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments