13 Apr Monthly Commentary: April 2022

Global Equities – March rebound

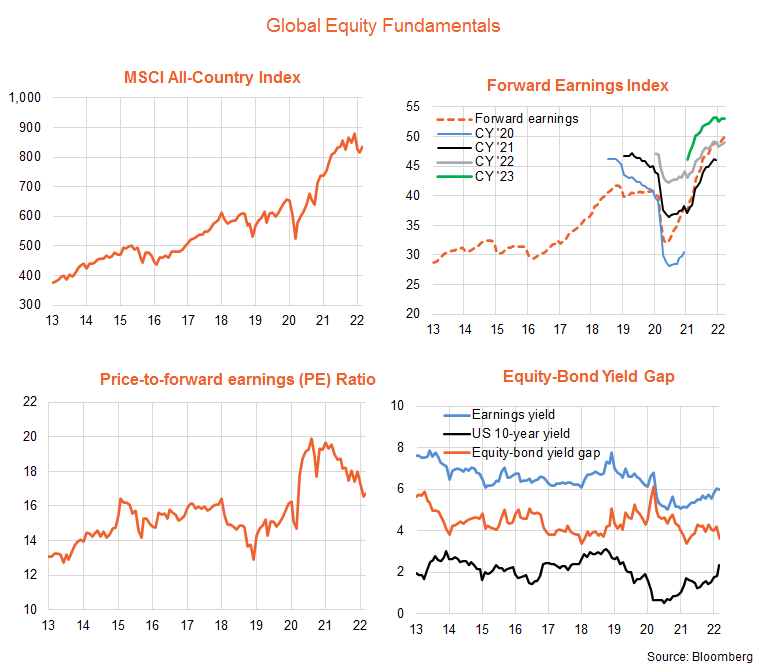

Global equity returns enjoyed a modest 2.6% rebound in March, after a decline of 1.0% in February and a larger 6.1% decline in January. The rebound appears to reflect optimism that prospective U.S. interest rate increases should not unduly slow global economic growth anytime soon, given good current underlying momentum in activity. Hopes of a peace deal between Russia and Ukraine also sporadically buoyed investor sentiment.

Reflecting continued expectations for around 6 to 8% earnings growth this year and next, forward earnings rose a further 1.1% in the month, although the expected level of earnings in 2022 and 2023 are no longer being revised up in the way evident through much of last year. Current expectations are consistent with 6% growth in global forward earnings by year-end. The stronger gain in equity prices – relative to earnings – saw the forward PE ratio edge back up to 16.7 from 16.5 at end-February.

The rebound in equities came despite a further notable lift in bond yields, with the yield on U.S. 10-year bonds rising from 1.83% to 2.34%. As a result, the earnings yield-to-bond yield gap (EBYG) fell to 3.6% from 4.2% – or the lower end of its range of recent years.

In terms of broad trends, the relative performance of the U.S. market remains upward, despite the pull back in technology performance over recent months. Emerging markets also remain in a relative performance downtrend, with defensive sectors (consumer staples, energy, health care and utilities) beating cyclical sectors and value still largely beating growth.

Global equity trends

Reflecting commodity price gains associated with the Russian invasion of Ukraine, energy and food producers enjoyed the strongest gains among hedged global equity ETFs in the month. That said, there were solid gains among most other exposures also, though global banks and European stocks were relatively weaker, likely reflecting concerns of the impact of Russian sanctions on the global financial sector and the war-related pressures on Europe.

Australian Trends

There were good gains across most Australian equity exposures last month, with the overall market returning a solid 6.9%. Resources and technology enjoyed especially strong returns. The strongest relative performers at present are resources and the fundamentally-weighted large-cap index. Despite last month’s strong bounce back, the longer-run outright and relative trends for local technology remain negative.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Spark Advisers Australia Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments