28 Apr Monthly Commentary: April 2021

Value still holding up over growth

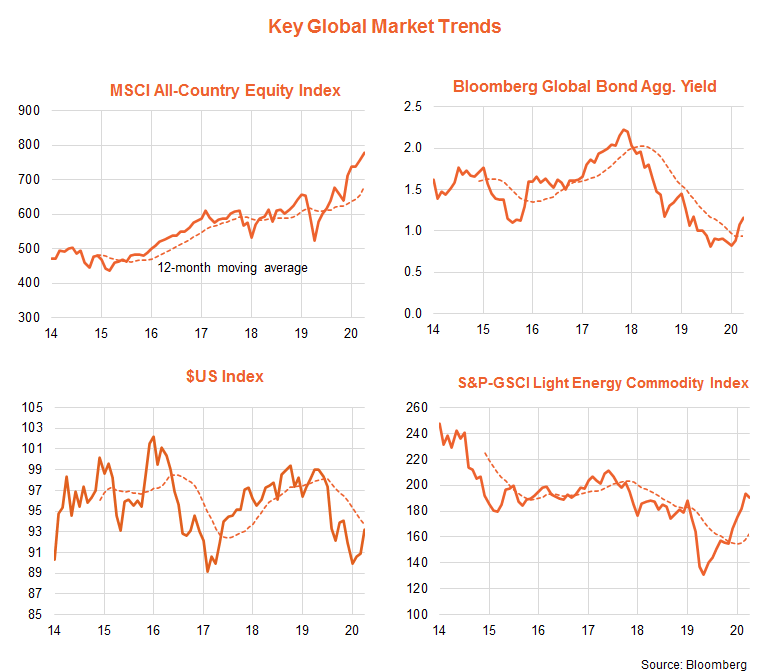

Reflecting the improving economic outlook, global equities continued to move higher in March, though so too did bond yields. Commodity prices, by contrast, corrected a little, which perhaps reflected a tightening in Chinese credit conditions. Despite the ‘risk-on’ sentiment, the $US continued its recovery so far this year, after weakening through the latter half of last year.

Relative to their 12-month moving average, the trend in equities, bond yields and commodity prices remains to the upside, while – at this stage at least – the trend in the $US is still down.

Looking forward, the outlook for equities remains favourable given rapidly recovering global economic growth and corporate earnings. The major near-term risk is any further untoward rise in bond yields as this could pressure still lofty outright price-to-earnings (PE) valuations. My view is that bond yields should remain relatively contained as any lift in inflation (especially in the U.S.) is likely to be short-lived and won’t change the dovish stance of central banks.

That said, it’s also possible that equities could withstand somewhat higher bond yields given strength in earnings and especially if the equity earnings-to-bond yield gap (which is still above 10 to 20-year average levels) narrowed further instead.

Also of interest is if the $US remains strong along with global equities, which could reflect a growing investor appreciation of the likely relative strength in the U.S. economy this year. I anticipate the $US will gather strength this year, which in turn should contain the $A to around the mid-low US70c range.

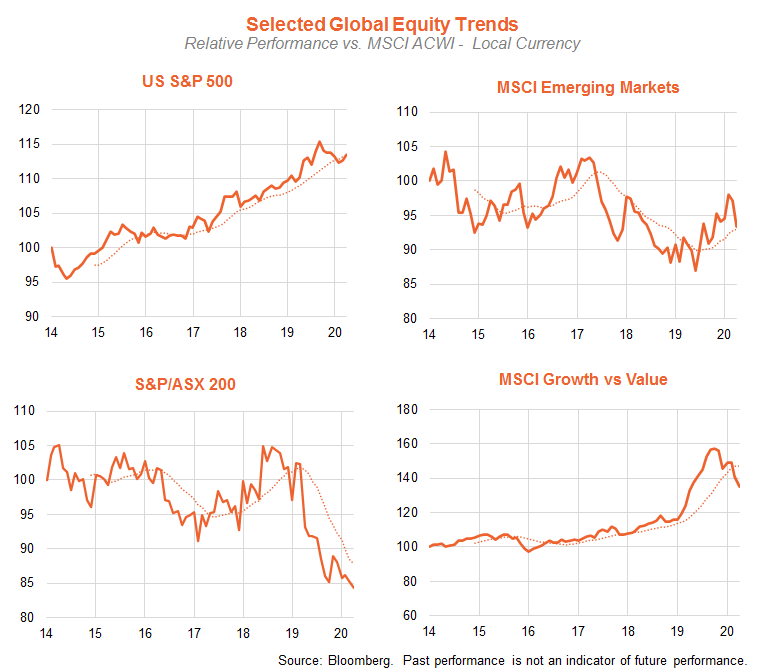

Major global equity trends

As seen in the chart set below, the COVID equity recovery so far has favoured non-U.S. themes, such as emerging markets and ‘value’ over ‘growth’. Relative to hedged global equities, Australian stocks have underperformed – though performance has been better against unhedged global equities due to (at least up until recently) strength in the $A. So far at least, however, the underperformance of U.S. stocks has been only modest, and the longer-term relative trend is still pointing up.

Within the ‘value’ part of the global market, one notable development in March was the strong performance in the ‘high yield’ thematic, which has been especially hurt by the weakness in utility and infrastructure stocks during the COVID crisis. This could reflect investors seeking value in areas of the market that have been left behind in the COVID recovery so far.

My base case is that value areas of the global market can continue to outperform over at least the next three to six months, though the ‘reflation/re-opening’ trade should then give way to a reassertion of the pre-COVID relative outperformance of growth sectors such as technology. Overall, the Australian market may also continue to underperform the global benchmark.

This article was originally produced by David Bassanese from BetaShares you can read the full article here.

Next Steps

To find out more about how a financial adviser can help, speak to us to get you moving in the right direction.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254 (a subsidiary of Spark FG ABN 15 621 553 786)

No Comments