24 Oct Market Commentary – October 2019

Key Global Trends – bond yields snapback

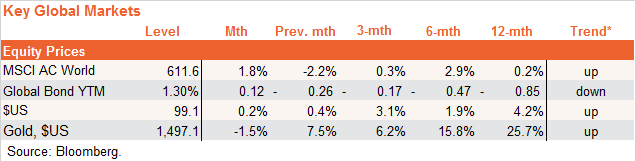

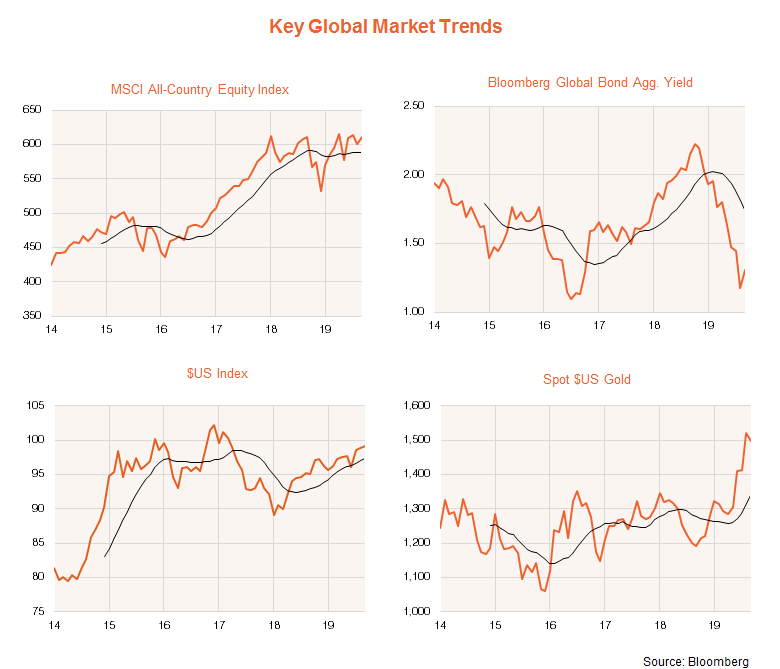

Trend signals for major markets remained unchanged last month. Though they remain in a sharp downtrend, global bonds yield finally bounced last month as the US and China agreed to resume trade talks and the US Federal Reserve indicated it might not need to cut interest rates as aggressively as the markets had thought.

Equities are still trending up, and withstood the rise in bond yields, but the uptrend has flattened in recent months as markets approach previous record highs. The $US continues to grind higher, supported by ongoing relative strength in the US economy. Risk-on sentiment saw gold prices edge back last month, but the trend remains firmly up for now.

Global Equities – Fundamentals Update

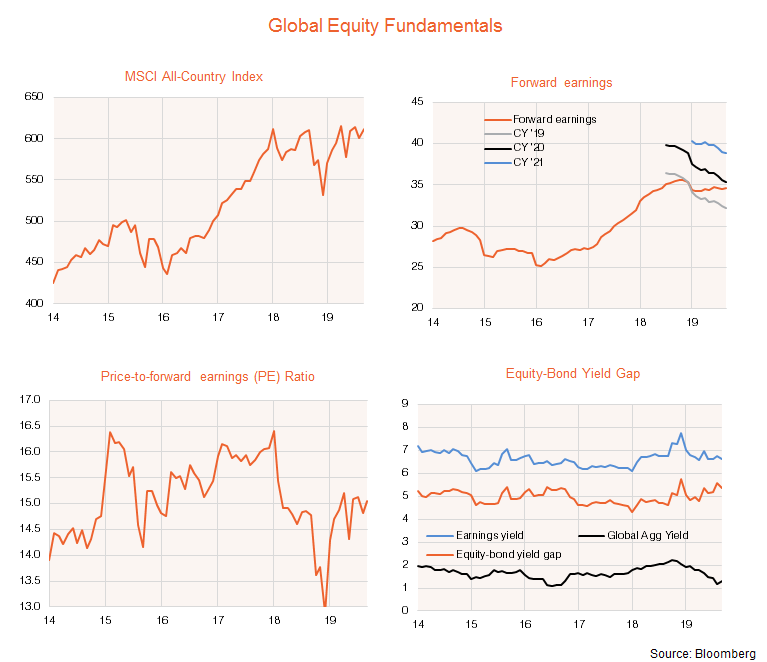

As seen in the chart pack below, the uptrend in global equities so far this year has been led by PE valuations rather than earnings, with the latter in turn supported by the decline in bond yields.

Forward earnings have flattened out this year, reflecting ongoing downgrades to the expected pace of earnings growth this year and next. Until such time as earnings expectations begin to level out, further gains in equities will be reliant on further gains in the PE ratio – which at 15 times forward earnings as at end-September is at least still below the previous highs of around 16 last seen in 2017.

Can the PE ratio rise further? Current low bond yields remain valuation-supportive, so the degree to which bond yields potentially rebound further in coming months will be important. That said, to the extent bond yields do rise somewhat, this might presumably be associated with an improved outlook for the global economy and earnings expectations.

The original article was produced by BetaShares, to see the full article please click here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

[/vc_column_text][/vc_column][/vc_row]

No Comments