03 May Market Commentary – Apr 2019

Property gains on lower rates

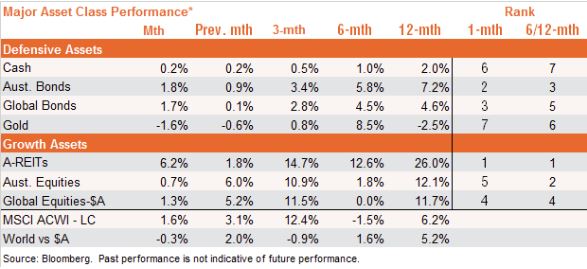

Australian listed property was the best performing of our seven major asset classes* in March, benefiting from a steep drop in global bond yields as central banks moved back to a more neutral policy stance. Indeed, Australian bonds were the second best performing asset class as expectations grew that the Reserve Bank would eventually cut interest rates, which contributed to a decline in local 10-year bonds yields from 2.1% to 1.8%. Australian equities posted solid gains, albeit somewhat weaker than in February as financial stocks gave back some of their strong gains following the Hayne Royal Commission. Global stocks rose, helped by gains in the technology, property and consumer staples sectors. The risk-on environment saw gold prices retreat further even though the $US remained soft over the month.

Across the seven benchmark asset classes, Australian listed property (A-REITs) retains the strongest return momentum rank**, followed by Australian equities. Cash retained the worst return momentum rank, followed by gold.

Market Outlook

Provided global inflation remains contained, there remains a good chance that global equity markets can continue to grind higher due to modest earnings growth and favourable valuations, relative to the still low level of bond yields. Although global growth has slowed, few recession indicators are at this stage flashing red, and sentiment could improve if the US and China finally negotiate a trade deal. The key risk remains an acceleration in US wage inflation given the apparent tightness of the US labour market. If wage inflation takes off, the Fed would have little choice but to continue raising rates – potentially to recession-inducing levels later this year. Another concern is that US earnings expectations for 2019 have been downgraded somewhat in recent months, and earnings growth this year is expected to be muted. If earnings flatten out, equity markets could soon run into price-to-earnings valuation headwinds. All this suggests a growing level of caution around equities may be required this year, with increasing focus on defensive thematics such as quality, and areas of the market such as health care and property/utilities. In Australia, a weaker $A and an improving outlook for China, however, might still favour the resources sector.

*Asset Benchmarks Cash: UBS Bank Bill Index; Australian Equities: S&P/ASX 200 Index; Australia Bonds: Bloomberg Composite Bond Index; Australian Property: S&P/ASX 200 A-REITs; International Equities: MSCI All-Country World Index, unhedged $A terms; Gold, Spot gold price per tonne in $US.

** Momentum rank based on equally-weighted average of 6 & 12 month return performance.

***Outright trend is up if the relevant NAV return index is above its 12-month moving average and the slope of the moving average is positive. Relative trend is based on the ratio of the relevant return index to its broader Australian or global benchmark index.

This article was written by David Bassanese from BetaShares, you can read the full article here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments