21 Dec Investing in property vs shares

If you’re thinking of buying an investment property in Australia, you may have the nagging feeling you’ve arrived at the party a little too late.

You possibly have.

With property prices at near all-time highs, we ask: is this still a good strategy to use to build your wealth? And how does it stack up against a diversified share portfolio when it comes to providing capital growth and a reliable income stream?

Key points

- Over the long term, returns have been similar for shares and property.

- What’s not remotely similar is access and hassle – directly owning property is way more difficult, costly and time consuming than owning shares.

- Residential property price growth is unlikely to be as spectacular in the future as it was in the past.

A boom no longer

As they say, past performance is not a reliable indicator of future performance. But it is instructive to look back. What we find is that shares and property have both provided wonderful returns over the long term.

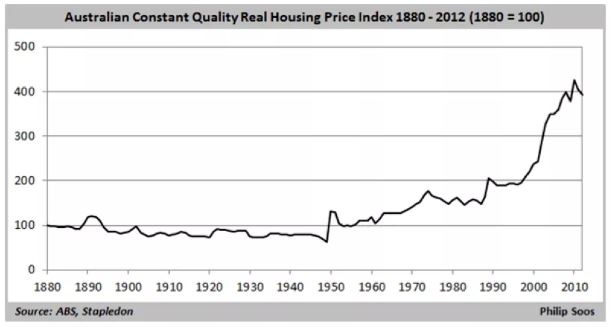

The following chart¹ gives a great snapshot of housing returns over more than a century. It shows how house prices have soared since around 1990.

Shares have also provided excellent returns. According to Vanguard, over the 30 years to 30 June 2015 – despite a number of market ‘crashes’ – Australian shares achieved an average annual return of over 10%. $10,000 invested in the Australian share market during that time, with all income reinvested in the market, would have turned into $215,685.

Brilliant.

Though, if we look more recently – over the 10 years to December 2016 – we find that Australian residential property was the best-performing asset class.²

Over this period, property produced an average annual compound return of 8.1%, ahead of Australian shares at 4.3%. However, it’s worth remembering that the GFC occurred in this period, and savaged the stock prices of most companies and, therefore, the index as a whole.

Is it too late to invest in residential property?

Probably. Sorry. High returns from investment property are increasingly less likely. Last year the Reserve Bank of Australia said there had been a “build up of risks” associated with the housing market. And a 2017 Russell Investments / ASX report said:

“…we believe [residential property] carries significant stock-specific risk for people seeking stable, positive returns. While residential property overall has achieved strong positive returns over the last 10 and 20 years, it would be a mistake to blindly rely on the upward trend continuing across the board.”³

In addition, the boom in house prices has been a double-edged sword for investors, as it has outpaced rental increases, and therefore cut the return on new investments.˜ This has squeezed rental yields. In Sydney, for example, rental yields on apartments have dropped to a 12-year low. It’s better in the rest of the country, where apartments in capital cities yield, for example, around 4%.

Let me give a practical example.

The property my wife and I rent yields the owner <2.8% per year, based on its current valuation, about equal to a term deposit. However, that’s before most of the costs they incur, such as body corporate fees, maintenance, real estate agent fees, etc. I’d estimate our owner is lucky if they earn 1.5% per year after costs, which with inflation (the rate prices change year to year), running at around 1.9% per year the owner of the apartment that I rent is losing 0.4% year in real terms. Many, many property investors are in the same boat.

For ownership of the apartment to be a successful investment they need significant capital growth. Growth that may never happen.

A question I like to ask of any investment, is what has to happen for this to work out well? And how might I lose my shirt?

Let’s start with a couple of assumptions.

With cash returning ~2.8% a year, it’s safe to say we want any investment to return more than cash. How much more? 3% above cash is a modest aim. So, the owner of my apartment needs the value of the property to rise least 4.3% a year (cash rate (2.8%) + investment return (3%) = 5.8%, 5.8% less property income (1.5%) = 4.3%) per year.

How likely is that?

Not very. Even property bulls are conceding that prices will likely fall this year, and that they are unlikely to rise swiftly any time soon.

Unpacking the drivers of property prices is complex and deserves to be explored in another post.

Here, I leave it to a couple of comments.

First, most who argue prices will continue to rise focus on immigration and lack of supply. They’re mostly right: immigration and lack of supply, especially in tricky cities such as Sydney, will help buoy prices.

However, what is often ignored are the impacts that falling interest rates (which makes financing houses cheaper), falling unemployment (which creates more people with money) and increasing participation by women in the workforce (which boosts household income) have had on property prices over the past few decades. Not to mention the impact of falling household sizes (which creates demand for more houses). Each of these factors simply can’t continue forever: interest rates realistically can’t fall much below zero (and if they do we’ll have other problems to worry about!), unemployment tends not to fall below 5% and women can only join the workforce once. Household size can’t shrink below one. So from providing a strong tailwind for property prices they’ll become more of a gentle breeze.

Direct property comes with direct costs

Buying, owning and maintaining direct property is expensive and time consuming.

Let’s start with entry costs. When you buy a property, you’ll be slapped with stamp duty, conveyancing and bank fees. Often, there are also some repairs you’ll need to do before you can rent it out.

And then there are the ongoing costs:

- Council rates

- State government taxes

- Federal income tax (if your property is positively geared)

- Body corporate fees (if you purchased some form of shared land or title)

- Utility bills

- Building, landlord and tenant protection insurance

- Maintenance and repair bills

- Renovations and improvements

- Property management fees (if you don’t manage it yourself).

All this adds up. Not to mention loan/mortgage costs. If you’ve never looked into it before, check out the full cost of buying, owning and selling a home.

Which means that shares are easier to buy and own

Comparatively, buying and managing shares, ETFs or managed investments is much simpler and less costly. It’s never been easier or cheaper to trade shares, with CMC Markets, IG Markets, Commsec, ANZ Share Investing, NAB Trade, Bell Direct and Desktop Broker all offering great broking rates.

Other ways to invest in property

If you want to own property, you have other options beside direct housing.

For example, you can invest in a real estate investment trusts (REITs), which own collections of various properties, such as shopping centres, pubs, office towers and warehouses. Dexus, GPT, Scentre (Westfield’s Australian centres), Charter Hall, Cromwell and Goodman are some of the bigger players. ‘REITs’ remove some of the hassle of owning property directly while giving you access to the asset class. Of course, they charge management fees in return.

The verdict?

Investing in shares and property has been a smart move—far superior to leaving your cash in the bank getting whittled away by inflation. But what matters in investing is what tomorrow is going to look like. If you already own an investment property or your own home, consider broadening your investment base via direct shares, ETFs or a managed investment portfolio.

For those considering making the leap into property, pause and consider whether you’d be better served investing your money somewhere that’s likely to achieve higher returns.\

Resources

- https://www.macrobusiness.com.au/2013/02/the-history-of-australian-property-values

- Australian shares only fifthbest performing asset class over 10 years. and Russell asx long term investing report

- ABS

- Ongoing costs of an investment property

This article was produced by Jason Prowd from Morningstar Next, you can read the full article here.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments