25 Jan Five good reasons for seeking financial advice

Financial advice isn’t just for people with wealth. Whether you’ve set your sights on owning a home or retiring early, advice from a financial adviser can help you make it happen.

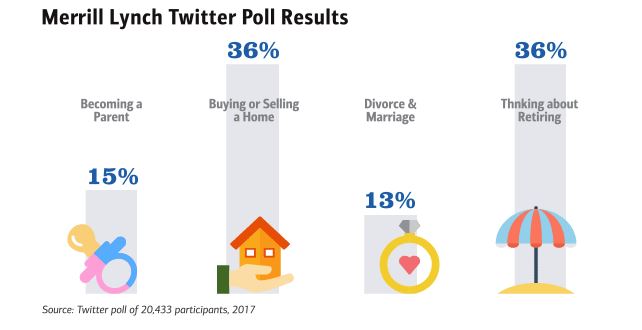

A poll that Merrill Lynch ran on its Twitter handle in 2017 asked the question, “In which situation would you most likely to turn to a financial advisor for help?” Here’s how 20,433 respondents responded:

Buying a home

Managing your budget and cash flow to save for a deposit are key to getting you into your first home. A financial adviser can help you simplify and prioritise your finances and manage existing debts so you can draw up a sensible budget and get saving. In July 2018, the FHSSS was launched to allow first time home buyers to redraw voluntary payments from their super savings to put towards a deposit. Given the potential tax advantages of saving in super, the scheme does offer some advantages for helping first home buyers to build their savings faster. There may be other government incentives such as the First Home Owner Grant scheme that you could potentially benefit from. And when you’re ready to buy, they can help you update your household budget and insurance arrangements to make sure life in your new home is secure and sustainable.

Starting a family

Money isn’t the only consideration when you’re getting ready to have children. But it’s an important one and taking the financial pressure off while you adapt to your new life as parents can help you enjoy this new chapter in your life even more.

A financial adviser can help you budget for taking time off work and managing all your expenses on a reduced income. They can help you understand how working part-time will affect your household income and superannuation savings so you can make lifestyle decisions that will work for your new family and your finances.

Providing for your family

When your kids are young, your financial goals might be around saving and investing for their education (see our previous post here). As they grow older, this might change to helping them buy a home or start a business. Through investment and debt management advice, a financial adviser can help you support them and continue to lead a comfortable life.

You’ll also want to make sure your family can still benefit from your wealth after your death. Your financial adviser can help with this by arranging life insurance and making sure your estate and will are well organised and kept up-to-date.

Getting rid of debts

With house prices rising year on year, the amount of debt we take on when we become home owners can seem overwhelming. But with the right strategy, saying owning your property outright can become a reality. And becoming debt-free doesn’t necessarily mean channelling most of your income into loan repayments. Sometimes it can make more sense to start an investment portfolio, particularly when there’s potential for earning more than you’re paying in loan interest. With a smart investment strategy and sound advice from a financial adviser, you can pay off your loans faster and enjoy better cash flow now, and in the long term.

Planning for and enjoying retirement

Whatever you plan to do in retirement, having a decent income can give you the freedom to make lifestyle choices without worrying about money. When you’re younger, getting financial advice about your super can be the trigger you need to make your retirement savings a priority when it still seems so far off. And if you’re approaching retirement, a good planner can help you maximise your super contributions and investment earnings, so you can really boost your savings as retirement becomes a reality.

Whether you’re buying your first home or downsizing, starting a family or retiring, a financial adviser can offer help with organising and planning your finances for a better future.

If you would like to know more, talk to Michael Sik at FinPeak Advisers on 0404 446 766 or 02 8003 6865.

Important information and disclaimer

The information provided in this document is general information only and does not constitute personal advice. It has been prepared without taking into account any of your individual objectives, financial solutions or needs. Before acting on this information you should consider its appropriateness, having regard to your own objectives, financial situation and needs. You should read the relevant Product Disclosure Statements and seek personal advice from a qualified financial adviser. From time to time we may send you informative updates and details of the range of services we can provide. If you no longer want to receive this information please contact our office to opt out.

FinPeak Advisers ABN 20 412 206 738 is a Corporate Authorised Representative No. 1249766 of Aura Wealth Pty Ltd ABN 34 122 486 935 AFSL No. 458254

No Comments